Okay, I'm ready to put on my financial advisor hat and help this hypothetical 14-year-old navigate the world of earning and potentially investing. Here's an article aimed at answering that question comprehensively and responsibly.

Earning money at 14 might seem like a far-off concept to some, but it's an incredibly valuable experience that can lay the foundation for financial literacy and independence later in life. The best options available depend heavily on location, local labor laws, and individual skills and interests. However, several avenues are generally accessible and beneficial.

One of the most traditional routes for a 14-year-old is part-time employment. While restrictions often apply regarding the number of hours and types of work permitted, certain jobs are commonly available. Consider options like working at a local grocery store, assisting with stocking shelves or bagging groceries. Retail positions, especially during peak seasons like holidays, can also be a good fit. Restaurants sometimes hire bussers or hosts, but the availability of these positions can vary. It's crucial to research the specific labor laws in your area to ensure compliance and protect your rights as a young worker. Furthermore, talking to the school counselor can often provide insight into local employers known for hiring young individuals.

Beyond formal employment, numerous freelance opportunities are available, especially in the digital realm. The key here is to leverage existing skills or develop new ones. For example, if the teenager is proficient in a particular subject, tutoring younger students, whether in person or online, can be a lucrative option. Many parents are seeking academic support for their children, and a responsible and knowledgeable 14-year-old can fill that need effectively. Similarly, if creative, graphic design skills, even at a basic level, can be monetized. Creating simple logos, social media graphics, or presentations for small businesses or individuals can be a good starting point. Numerous online resources, both free and paid, offer courses and tutorials to improve design skills.

Another rapidly growing area is content creation. While directly monetizing platforms like YouTube or TikTok often requires a certain age and follower count, there are still ways to participate and potentially earn money. For example, the teenager could create content for other businesses or individuals, such as editing videos or managing social media accounts. Building a portfolio of work, even on a small scale, is essential to demonstrate capabilities to potential clients. The teenager should be aware of online safety and privacy while engaging in these activities. Parents should supervise the online activities to ensure the child is not engaging in risky behavior.

The gig economy offers diverse opportunities that align with different interests and skills. For the tech-savvy teenager, providing basic tech support to family, friends, or neighbors can be a viable option. Many people struggle with everyday technology issues, and a patient and knowledgeable young person can offer valuable assistance. Similarly, if the teenager enjoys writing, they could offer writing services, such as creating blog posts or website content, for local businesses. Platforms like Fiverr and Upwork are options to explore, though parental guidance is recommended, especially initially, to navigate these platforms safely and effectively.

Traditional odd jobs remain relevant and provide a good introduction to earning money. Lawn mowing, gardening, pet sitting, or dog walking are all possibilities, especially within the local neighborhood. These activities often require minimal start-up costs and can be a reliable source of income. Word-of-mouth referrals are crucial for building a client base in this area.

Once income is generated, the teenager should think strategically about how to manage it. While spending some on desired items is perfectly acceptable, prioritizing saving and even early investment is crucial. Opening a savings account is a fundamental step. Researching different banks and comparing interest rates is essential. Many banks offer specialized accounts for minors, often requiring parental co-ownership. Understanding the concept of compound interest is also important, as it highlights the power of saving early and allowing money to grow over time.

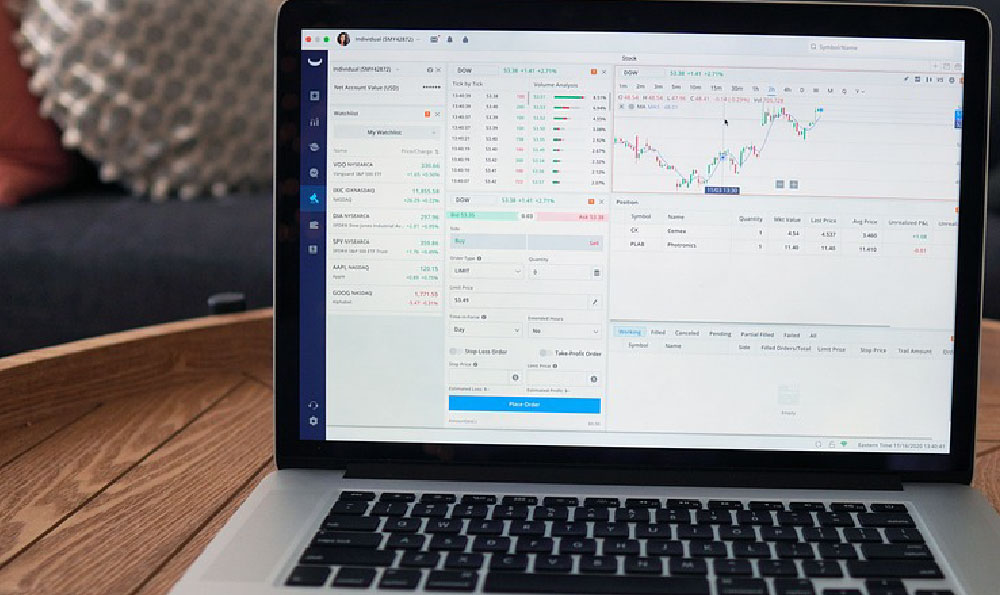

Exploring basic investment options, even with small amounts of money, can be a valuable learning experience. Investing in a certificate of deposit (CD) could provide a safe and predictable return. Another avenue, under parental guidance, could be investing in stocks. With a custodial account, the teenager can begin investing in small amounts of stock. They must research companies and understand the risks involved. Focus on established companies with a proven track record. Mutual funds and Exchange Traded Funds (ETFs) offer a more diversified approach, potentially reducing risk. Remember that investment is not without risk, and it is important to only invest money you can afford to lose.

Finally, prioritize financial education. Reading books, articles, and websites about personal finance is essential. Engaging in conversations with parents, teachers, or other trusted adults about money management can provide valuable insights. Consider taking online courses or workshops that focus on financial literacy. The more the teenager understands about money, the better equipped they will be to make sound financial decisions throughout their life. Earning money at 14 is not just about acquiring spending power; it’s about developing crucial life skills, fostering responsibility, and setting the stage for a financially secure future. By exploring different earning opportunities, learning to manage money effectively, and investing wisely, this young person can gain a significant advantage in the years to come.