Does BTC Pay Dividends? Is Keepbit a Dividend Platform?

Understanding the landscape of cryptocurrency investments often involves navigating complex concepts and differentiating between various investment opportunities. One question that frequently arises is whether Bitcoin (BTC) pays dividends. To fully grasp the answer, and to understand the role of platforms like Keepbit in the cryptocurrency ecosystem, it's essential to delve into the mechanics of dividends and how they relate to different types of crypto assets.

What Are Dividends and How Do They Work in Traditional Finance?

In traditional finance, dividends represent a portion of a company's profits distributed to its shareholders. Companies that generate consistent profits often choose to share these earnings with their investors as a reward for their investment. Dividends are typically paid in cash, but they can also be distributed in the form of additional shares. The amount of dividend a shareholder receives is usually proportional to the number of shares they own. This serves as a regular income stream for investors and can be a significant factor in their investment decisions.

Bitcoin and the Concept of Dividends

Bitcoin, fundamentally, operates differently from traditional stocks. It is a decentralized, digital currency that functions on a blockchain network. Unlike a company with profits to distribute, Bitcoin doesn't generate earnings in the conventional sense. Holding Bitcoin doesn't entitle you to a share of any profits or revenue generated by the Bitcoin network. Therefore, Bitcoin itself, in its core design, does not pay dividends.

However, this doesn't mean there aren't ways to earn passive income with your Bitcoin holdings. Several strategies and platforms offer opportunities that may resemble dividend-like payouts, although they technically aren't dividends in the traditional sense.

Exploring Bitcoin "Dividend-Like" Opportunities

While Bitcoin doesn't inherently pay dividends, several methods allow holders to earn income on their BTC:

-

Lending Platforms: Platforms like BlockFi, Celsius Network (prior to its issues), and others have historically allowed users to lend out their Bitcoin to borrowers in exchange for interest. The interest earned could be considered a dividend-like payment, providing a regular income stream based on the amount of BTC lent. However, these platforms carry inherent risks, including the risk of the platform becoming insolvent or the borrower defaulting on their loan. Due diligence is paramount before depositing funds.

-

Staking: Although Bitcoin itself isn't directly stakeable, some platforms offer wrapped versions of Bitcoin or use Bitcoin as collateral in staking mechanisms for other cryptocurrencies. Staking involves locking up your crypto assets to support the operation of a blockchain network and, in return, earning rewards. While not directly Bitcoin dividends, these rewards can provide passive income.

-

Decentralized Finance (DeFi) Protocols: DeFi platforms offer various opportunities to earn income with Bitcoin, such as providing liquidity to decentralized exchanges (DEXs). By depositing Bitcoin (often in a wrapped form like Wrapped Bitcoin - WBTC) into a liquidity pool, users can earn trading fees generated by the DEX. This can be a lucrative way to earn passive income, but it also carries risks such as impermanent loss.

Keepbit: A Closer Look at its Potential Role

Now, let's address the question of whether Keepbit is a dividend platform. Without specific, publicly available information on Keepbit's operational model, it's impossible to definitively state whether it is or isn't a dividend platform. To determine this, we would need to analyze its business model, tokenomics (if it has its own token), and its stated objectives.

If Keepbit is designed to pay out a portion of its revenue or profits to its users based on their holdings of a specific cryptocurrency (potentially including BTC), it could be argued that it functions as a dividend platform, even if it doesn't explicitly use that term. However, it's crucial to investigate the following aspects of Keepbit:

-

How does it generate revenue? Understanding the source of its revenue is vital to assess the sustainability of any potential payouts.

-

What are the risks involved? Like all cryptocurrency platforms, Keepbit is subject to various risks, including regulatory risks, security risks, and market volatility.

-

What are the terms and conditions? Carefully review the terms and conditions to understand the payout schedule, any associated fees, and the platform's liability in case of unforeseen circumstances.

-

Is it a regulated entity? Regulation can provide some level of protection for users, although it doesn't eliminate all risks.

The Importance of Due Diligence

Regardless of whether a platform explicitly calls itself a dividend platform, the same principles of due diligence apply when considering any cryptocurrency investment. It's crucial to thoroughly research any platform or project before investing your funds. This includes understanding the technology, the team behind the project, the risks involved, and the potential returns.

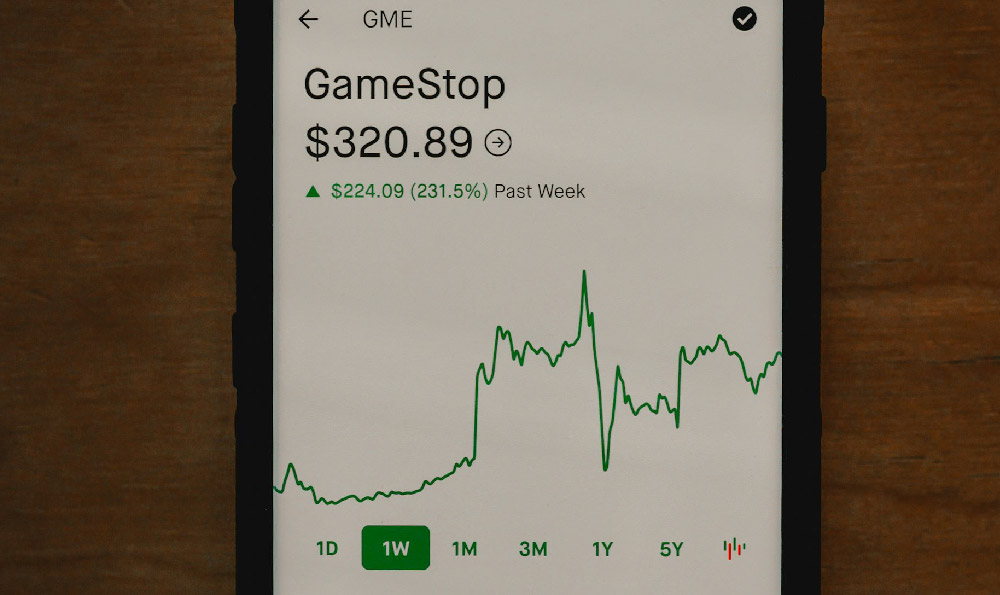

Beyond Dividends: Long-Term Value and Potential Appreciation

While the prospect of earning passive income through dividends or dividend-like mechanisms can be appealing, it's also important to consider the long-term value and potential appreciation of Bitcoin itself. Bitcoin's scarcity, decentralization, and growing adoption could drive its value higher over time. Focusing solely on dividend-like opportunities may distract from the potential for significant capital gains.

Conclusion: Informed Investment Decisions

Bitcoin, in its purest form, doesn't pay dividends. However, various platforms and strategies exist that allow Bitcoin holders to earn passive income, often resembling dividend-like payouts. The key is to understand the risks and rewards associated with each option and to conduct thorough research before investing. Whether Keepbit qualifies as a dividend platform requires a detailed examination of its operations. Ultimately, informed investment decisions are crucial for navigating the complexities of the cryptocurrency market and maximizing your potential returns. Remember, no investment is risk-free, and diversification remains a cornerstone of sound financial management.