Here's an article addressing the topic "How much does BTC cost? What is the worth of Keepbit Platform?" designed for SEO optimization and reader engagement.

Understanding the Current Market Value of Bitcoin: Factors at Play

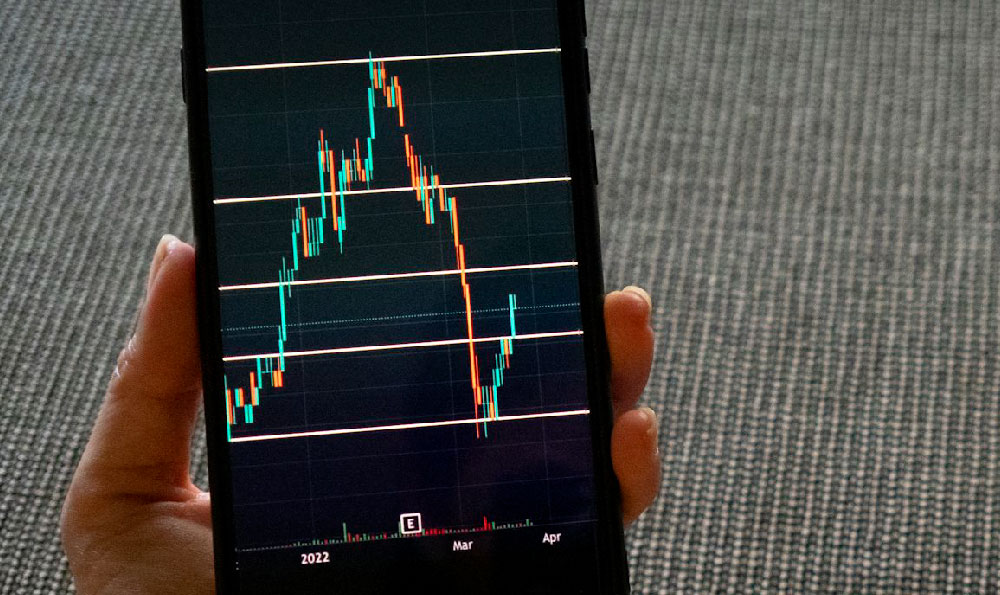

Bitcoin, the pioneering cryptocurrency, is renowned for its volatility. Determining its exact cost at any given moment is a dynamic exercise, influenced by a complex interplay of factors. To accurately gauge its current market value, it's crucial to consult reputable cryptocurrency exchanges like Coinbase, Binance, Kraken, or Gemini. These platforms offer real-time pricing data reflecting the constant flux of buying and selling activity.

However, simply knowing the present price is insufficient for informed decision-making. Understanding the driving forces behind these price fluctuations is paramount. Several key elements contribute to Bitcoin's price movements:

-

Supply and Demand: This is the fundamental economic principle. Bitcoin has a finite supply of 21 million coins, creating inherent scarcity. Increased demand, driven by institutional adoption, mainstream acceptance, or speculative investment, typically pushes the price upwards. Conversely, decreased demand, often triggered by negative news, regulatory concerns, or market corrections, can lead to price declines.

-

Market Sentiment: The overall mood and attitude of investors significantly impact Bitcoin's price. Positive sentiment, fueled by optimistic news, endorsements from influential figures, or widespread belief in Bitcoin's long-term potential, can lead to buying frenzies. Conversely, negative sentiment, stemming from security breaches, regulatory crackdowns, or economic uncertainty, can spark panic selling.

-

Regulatory Landscape: Government regulations and policies surrounding cryptocurrency play a crucial role. Clear and supportive regulations, such as those establishing legal frameworks for Bitcoin use and trading, can foster confidence and attract institutional investment. On the other hand, restrictive or ambiguous regulations can create uncertainty and dampen investor enthusiasm.

-

Technological Advancements: Developments in Bitcoin's underlying technology, such as improvements to the Bitcoin network's scalability, security, or privacy, can positively impact its price. Conversely, concerns about technological vulnerabilities or the emergence of competing cryptocurrencies can exert downward pressure.

-

Macroeconomic Factors: Broader economic trends and events, such as inflation rates, interest rate changes, and geopolitical instability, can influence Bitcoin's price. Bitcoin is sometimes viewed as a hedge against inflation, and its price may rise during periods of economic uncertainty.

Therefore, before making any investment decisions, one should research using credible resources to get an understanding of these current factors.

Keepbit Platform: Assessing its Worth and Potential

Keepbit is a cryptocurrency platform that is designed for trading cryptocurrencies with perpetual futures. Assessing the worth and potential of Keepbit Platform requires a multi-faceted approach, considering its features, functionality, user base, competitive landscape, and the overall market conditions.

Key Features and Functionality:

The worth of Keepbit is closely linked to the uniqueness and effectiveness of its features:

- Trading Platform: A user-friendly interface is vital. The ease of navigation, charting tools, order placement mechanisms, and overall trading experience are important indicators. A robust and reliable platform that can handle high trading volumes without glitches is essential.

- Security Measures: Security is paramount in the cryptocurrency world. Keepbit's security infrastructure, including cold storage of funds, two-factor authentication, and regular security audits, must be robust and reliable. A history of security breaches can severely damage a platform's reputation and value.

- Liquidity: High liquidity, meaning a large volume of buying and selling activity, ensures that traders can execute orders quickly and efficiently without significantly impacting prices. Keepbit needs to demonstrate sufficient liquidity to attract and retain users.

- Range of Supported Cryptocurrencies: The diversity of cryptocurrencies available for trading is a factor. A broader selection can attract a wider range of users.

- Fee Structure: Competitive trading fees are crucial. Keepbit's fee structure should be transparent and competitive compared to other platforms in the market.

- Customer Support: Responsive and helpful customer support is essential for addressing user inquiries and resolving issues promptly.

User Base and Community:

The size and engagement of Keepbit's user base are important indicators of its value. A growing user base suggests that the platform is attracting new users and that existing users are satisfied with its services. A strong and active community can provide valuable feedback and support for the platform.

Competitive Landscape:

The cryptocurrency exchange market is highly competitive. Keepbit faces competition from established exchanges like Binance, Coinbase, and Kraken, as well as from newer and more specialized platforms. To succeed, Keepbit must differentiate itself by offering unique features, superior service, or a more competitive fee structure.

Market Conditions:

The overall health of the cryptocurrency market can impact the value of Keepbit. During bull markets, when cryptocurrency prices are rising, trading activity tends to increase, which can benefit Keepbit. Conversely, during bear markets, when cryptocurrency prices are falling, trading activity may decline, which can negatively impact Keepbit.

Conclusion:

Determining the precise worth of Keepbit Platform requires a thorough understanding of its features, user base, competitive landscape, and market conditions. Prospective investors should conduct their own due diligence and carefully consider the risks involved before investing in Keepbit or any other cryptocurrency platform. The cryptocurrency market is inherently volatile, and investment decisions should be made with caution and a clear understanding of the potential risks and rewards. Ultimately, the perceived value of Keepbit, like any investment, lies in its ability to deliver on its promises and adapt to the evolving landscape of the cryptocurrency world.