The allure of the gig economy, particularly driving for ride-sharing services like Uber, is strong. The promise of flexible hours and being your own boss, coupled with the potential to supplement or even replace traditional income, makes it a tempting option for many. However, the question of whether driving for Uber is “worth it” is complex and depends heavily on individual circumstances, financial goals, and a realistic understanding of the associated costs and benefits.

At its core, the profitability of driving for Uber hinges on a simple equation: income generated minus expenses incurred. The income side is relatively straightforward. Uber drivers are typically paid based on a combination of base fares, distance traveled, and time spent in the trip. Surge pricing, which increases fares during periods of high demand, can significantly boost earnings. However, reliance on surge pricing as a consistent source of income is risky, as its availability is unpredictable and subject to market fluctuations. Drivers need to carefully analyze their local market and understand peak hours and surge patterns to maximize their earning potential. Ignoring this aspect leads to wasted time and fuel costs while waiting for profitable rides. Furthermore, incentives and bonuses offered by Uber can provide an additional boost to earnings, but these are often tied to specific performance metrics or time commitments, requiring drivers to adjust their schedules and driving strategies accordingly.

The expense side of the equation is where many potential Uber drivers underestimate the true cost of operating. The most significant expense is undoubtedly the cost of vehicle operation. This includes fuel, maintenance, repairs, insurance, and depreciation. Fuel costs can fluctuate widely depending on gas prices and driving style. Regular maintenance, such as oil changes, tire rotations, and brake inspections, is essential to keep the vehicle in good working order and prevent costly repairs down the line. Repairs, both routine and unexpected, can quickly eat into profits. Insurance costs are also a significant factor. While Uber provides some liability coverage while the driver is actively engaged in a ride, drivers are typically responsible for their own insurance coverage during idle periods. Furthermore, standard personal auto insurance policies often exclude coverage for commercial activities like ride-sharing, requiring drivers to obtain specialized and more expensive ride-sharing insurance.

Depreciation, the loss of value of the vehicle over time, is often overlooked but represents a very real expense. The more miles a vehicle is driven, the faster it depreciates. Since Uber drivers put significant mileage on their vehicles, they should factor depreciation into their calculations to accurately assess their profitability. Using a newer vehicle might seem advantageous due to its reliability and fuel efficiency, but the higher initial purchase price and faster depreciation can negate those benefits. Conversely, an older vehicle may have a lower purchase price but could require more frequent and costly repairs, ultimately making it a less economical choice.

Beyond vehicle-related expenses, other costs to consider include self-employment taxes, which are higher than taxes for traditional employees, and the cost of health insurance. Uber drivers are typically classified as independent contractors, meaning they are responsible for paying their own self-employment taxes, which cover both Social Security and Medicare. They are also responsible for obtaining their own health insurance, which can be a significant expense, particularly for those without access to employer-sponsored healthcare plans.

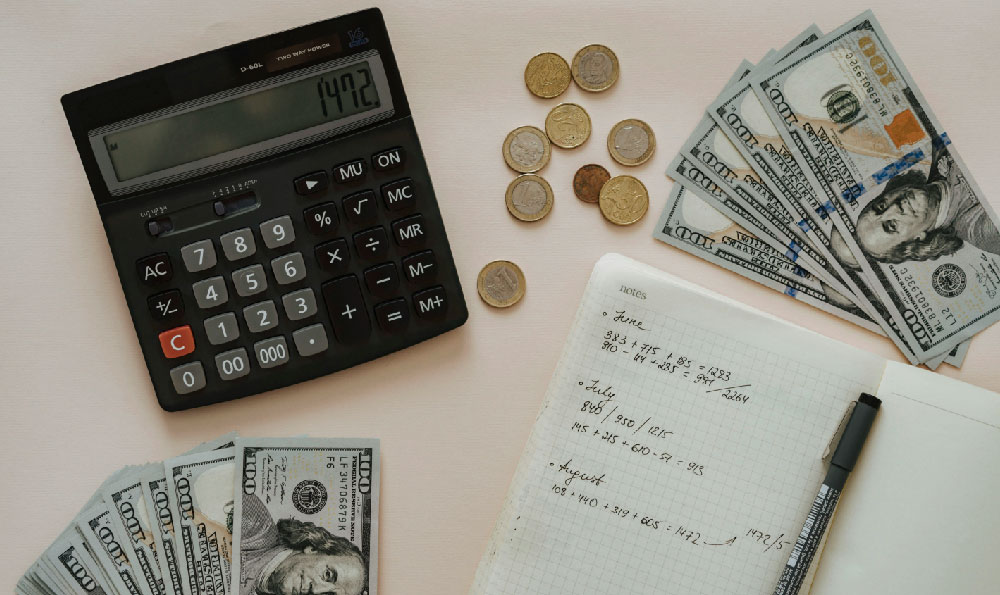

Successfully navigating the financial aspects of driving for Uber requires diligent record-keeping and meticulous expense tracking. Drivers should track all income and expenses, including mileage, fuel costs, maintenance costs, and insurance premiums. This information is crucial for accurately calculating profits and for claiming deductions on taxes. Utilizing expense tracking apps and consulting with a tax professional can help drivers stay organized and ensure they are maximizing their deductions.

Beyond the financial considerations, the non-financial aspects of driving for Uber also play a significant role in determining whether it's "worth it." The flexible hours can be a major advantage for those seeking work-life balance or needing to accommodate other commitments. However, the lack of job security and benefits, such as paid time off and health insurance, can be a disadvantage compared to traditional employment. The work itself can also be physically and emotionally demanding. Spending long hours behind the wheel can lead to fatigue and stress. Dealing with difficult or demanding passengers can also be challenging. Drivers need to develop strong communication and problem-solving skills to handle these situations effectively. Safety is another important consideration. While Uber has implemented safety features and protocols, drivers are still exposed to the risks associated with driving strangers, particularly at night or in unfamiliar areas.

Ultimately, deciding whether driving for Uber is "worth it" requires a careful and realistic assessment of one's individual circumstances and goals. It's crucial to conduct thorough research, analyze the local market, and understand the true costs and benefits involved. A spreadsheet detailing potential income versus expenses is a must. Those who are disciplined, organized, and able to manage their time and finances effectively are more likely to find success driving for Uber. However, those who underestimate the expenses or lack the necessary skills may find themselves working long hours for little or no profit. It's a venture that requires careful planning and a proactive approach to risk management to truly determine its long-term value. Before jumping in, consider talking to current Uber drivers in your area to gain firsthand insights into the realities of the job. Their experiences can provide valuable information and help you make an informed decision.