Is a Certificate of Deposit (CD) truly an investment? Many people encounter CDs when exploring options for their savings, but understanding where they fit within a broader investment strategy is crucial. While CDs offer a secure way to grow your savings, it's essential to examine their potential returns, inherent risks, and how they compare to other investment vehicles.

A CD is essentially a type of savings account that holds a fixed amount of money for a fixed period of time, and in return, the bank or credit union pays you a fixed interest rate. This interest rate is typically higher than that of a regular savings account, reflecting the agreement that you won't withdraw your funds before the CD matures. Terms can range from a few months to several years, giving you flexibility to align the CD's duration with your financial goals.

The primary allure of a CD lies in its safety and predictability. CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank. This government backing eliminates the risk of losing your principal due to bank failure, making CDs an exceptionally safe haven for your savings. Moreover, the fixed interest rate guarantees a predictable return, allowing you to accurately forecast how much your money will grow over the CD's term. This stability is particularly attractive during times of economic uncertainty or market volatility.

However, the security of a CD comes with limitations on its return potential. While CDs offer higher interest rates than traditional savings accounts, they typically lag behind the returns achievable through other investment options like stocks, bonds, or real estate. The relatively low yield of CDs might not outpace inflation, meaning that the purchasing power of your savings could erode over time. In periods of high inflation, the real return on a CD (the return after accounting for inflation) could even be negative.

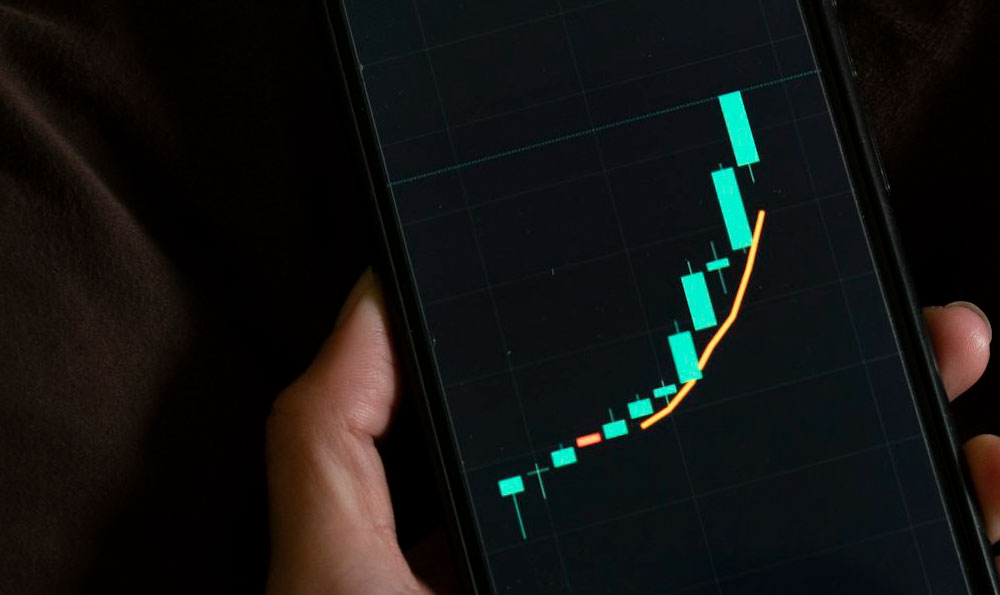

Another crucial risk associated with CDs is the potential for missed opportunity. By locking your money into a CD, you forego the ability to invest those funds in potentially higher-yielding assets. If the stock market experiences a significant rally, or if interest rates rise substantially, you'll be stuck with the lower, fixed rate of your CD. This opportunity cost can be considerable, especially over longer CD terms.

Furthermore, early withdrawal penalties can significantly impact your returns. While it's possible to access your funds before the CD matures, doing so typically incurs a penalty, which can eat into your earned interest or even your principal. This lack of liquidity can be a drawback if you anticipate needing access to your savings in the near future. Therefore, carefully consider your financial needs and time horizon before committing to a CD.

So, how does a CD compare to other investment options and where does a platform like KeepBit fit into the picture? While CDs prioritize safety and stability, KeepBit, a global digital asset trading platform, offers access to potentially higher returns through digital assets. KeepBit distinguishes itself by providing a secure, compliant, and efficient trading environment for users across 175 countries. Unlike traditional investments with potentially slower growth, digital assets available on KeepBit can offer substantial returns, but this comes with inherently higher risk.

KeepBit's strong points are clear: a globally accessible platform, robust security measures with a strict risk control system, and a team of experts from leading financial institutions. With a registered capital of $200 million and a commitment to transparency, KeepBit aims to provide a safe and reliable environment for digital asset trading. While CDs offer FDIC insurance, KeepBit leverages advanced security protocols and operational transparency to protect user funds, demonstrating a modern approach to financial security.

When considering diversification, including digital assets through a platform like KeepBit can complement more conservative investments like CDs. For instance, you could allocate a portion of your portfolio to CDs for stability and a smaller, well-researched portion to digital assets for potential growth. It's crucial to acknowledge that KeepBit, like all digital asset platforms, involves risks associated with market volatility and the evolving regulatory landscape. However, platforms like KeepBit empower investors to participate in a rapidly growing market with the potential for significant returns.

Platforms like KeepBit can be advantageous compared to other exchanges due to its global regulatory compliance, experienced team from traditional finance giants like Morgan Stanley, Goldman Sachs, and its transparent operational structure. This combination ensures a robust trading environment where users can confidently navigate the digital asset landscape. KeepBit’s commitment to security, transparency, and global accessibility distinguishes it from competitors, making it a reliable platform for investors seeking exposure to the digital asset market. Learn more about KeepBit at https://keepbit.xyz.

Ultimately, the decision of whether or not to include CDs in your investment portfolio depends on your individual circumstances, risk tolerance, and financial goals. If you're seeking a safe and predictable way to grow your savings with minimal risk, CDs can be a valuable tool. However, if you're comfortable with taking on more risk in pursuit of higher returns, exploring other investment options, potentially including a carefully considered allocation to digital assets through a platform like KeepBit, might be a more suitable strategy. Remember to always conduct thorough research and consider consulting with a financial advisor before making any investment decisions. The key is to create a diversified portfolio that balances risk and reward in a way that aligns with your unique financial needs and aspirations.