Cryptocurrency, initially conceived as a decentralized digital currency, has evolved into a multifaceted asset class offering a diverse range of income-generating opportunities beyond simple trading. Understanding these mechanisms and implementing effective strategies is crucial for anyone seeking to leverage the potential of the crypto market for financial gain.

One fundamental approach to generating income with cryptocurrency is through staking. Staking involves holding specific cryptocurrencies in a designated wallet to support the operation of a blockchain network. In return for contributing to network security and validation, stakers receive rewards, typically in the form of additional coins of the staked cryptocurrency. The annual percentage yield (APY) offered through staking varies depending on the cryptocurrency, the staking platform, and the lock-up period. Different proof-of-stake (PoS) blockchains have varying mechanisms and reward structures. Researching the underlying consensus algorithm and the specific staking parameters is essential. Platforms like Binance, Kraken, and Coinbase offer staking services for a wide array of cryptocurrencies, simplifying the process for users.

Another prevalent method is lending. Crypto lending platforms connect borrowers and lenders, allowing individuals to earn interest on their cryptocurrency holdings. Borrowers typically use cryptocurrency as collateral to secure loans, while lenders receive interest payments for providing the funds. The interest rates offered on crypto loans are often higher than those available through traditional financial institutions, reflecting the inherent risks associated with the volatile crypto market. Platforms like Aave and Compound are decentralized lending protocols that operate on blockchain networks, eliminating intermediaries and offering greater transparency. Evaluating the credibility and security of lending platforms is paramount, as hacks and scams can result in the loss of deposited funds. Understanding the collateralization ratios and liquidation risks is also crucial for lenders.

Yield farming represents a more sophisticated income-generating strategy within the decentralized finance (DeFi) space. It involves providing liquidity to decentralized exchanges (DEXs) and other DeFi protocols. Liquidity providers deposit their cryptocurrency pairs into liquidity pools, enabling users to trade assets on the DEX. In return for providing liquidity, farmers receive liquidity provider (LP) tokens, which represent their share of the pool. These LP tokens can then be staked or used in other DeFi protocols to earn additional rewards, such as governance tokens or a share of the trading fees generated by the DEX. Yield farming can be highly profitable, but it also carries significant risks, including impermanent loss, smart contract vulnerabilities, and rug pulls. Impermanent loss occurs when the price ratio of the deposited cryptocurrency pair changes significantly, resulting in a decrease in the value of the LP tokens compared to simply holding the individual assets. Thoroughly researching the DeFi protocols, understanding the risks involved, and diversifying across multiple platforms are essential for mitigating potential losses.

Masternodes offer another avenue for generating passive income, although they require a substantial initial investment. Masternodes are servers that support the operation of a blockchain network by performing specific tasks, such as validating transactions and storing blockchain data. In return for their services, masternode operators receive rewards in the form of cryptocurrency. Running a masternode typically requires holding a significant amount of the cryptocurrency associated with the network, as well as technical expertise to set up and maintain the server. While masternodes can be profitable, they also require ongoing monitoring and maintenance, and the value of the underlying cryptocurrency can fluctuate significantly.

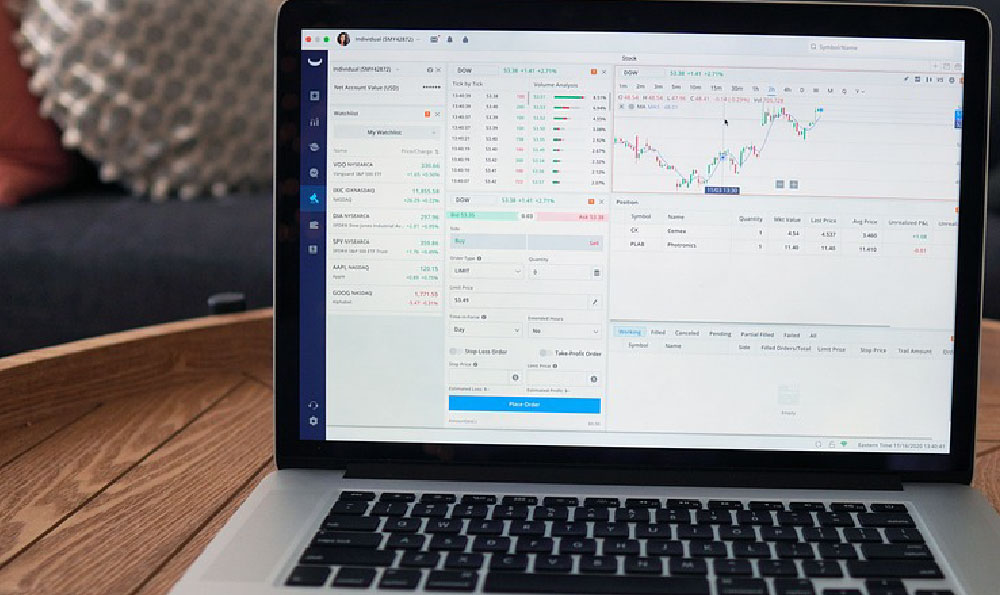

Beyond passive income strategies, active participation in the crypto ecosystem can also generate income. Crypto trading, including spot trading, futures trading, and options trading, involves buying and selling cryptocurrencies with the goal of profiting from price fluctuations. Successful trading requires a deep understanding of technical analysis, fundamental analysis, and risk management. The crypto market is highly volatile, and traders can experience significant losses if they are not careful. Developing a trading strategy, setting stop-loss orders, and managing position sizes are crucial for protecting capital.

Participating in Initial Coin Offerings (ICOs) or Initial DEX Offerings (IDOs) can also be lucrative, but it is also highly risky. ICOs and IDOs are crowdfunding events in which new cryptocurrency projects sell tokens to raise capital. If the project is successful, the value of the tokens can increase significantly, generating substantial returns for early investors. However, many ICOs and IDOs are scams, and investors can lose their entire investment. Thoroughly researching the project, the team behind it, and the underlying technology is essential before investing in an ICO or IDO. Look for projects with a clear use case, a strong team, and a well-defined roadmap.

Creating and selling Non-Fungible Tokens (NFTs) is a relatively new but rapidly growing way to generate income in the crypto space. NFTs are unique digital assets that represent ownership of various items, such as artwork, music, and collectibles. Creators can sell their NFTs on online marketplaces, such as OpenSea and Rarible, and earn royalties on future sales. Creating and selling NFTs requires artistic skills, marketing expertise, and a good understanding of the NFT market.

Crypto mining, while historically significant, has become increasingly specialized and competitive. It involves using powerful computers to solve complex mathematical problems and validate transactions on a blockchain network. Miners receive rewards in the form of cryptocurrency for their efforts. However, mining requires significant investment in hardware and electricity, and it is becoming increasingly difficult for individual miners to compete with large-scale mining operations. Mining profitability depends on the price of the cryptocurrency, the difficulty of the mining algorithm, and the cost of electricity.

Effectively managing the risks associated with cryptocurrency investments is paramount. Diversifying across multiple cryptocurrencies and income-generating strategies can help mitigate the impact of any single investment performing poorly. Staying informed about the latest developments in the crypto market and understanding the regulatory landscape is also essential. Utilizing cold storage wallets to store cryptocurrencies offline can protect against hacking and theft. Finally, consulting with a qualified financial advisor can help individuals develop a comprehensive financial plan that incorporates cryptocurrency investments in a responsible and sustainable manner. The world of crypto is constantly evolving, continuous learning and adaptation are key to successfully generating income and navigating the inherent risks.