Understanding the market dynamics is crucial for anyone looking to profit from cryptocurrency trading, as this volatile asset class is influenced by a wide range of factors from macroeconomic indicators to geopolitical events. Unlike traditional financial markets, crypto trading operates 24/7, allowing traders to respond to news cycles, price fluctuations, and technological advancements in real-time. To capitalize on these opportunities, investors must develop a nuanced approach that combines analytical rigor with strategic thinking. The first step in mastering this process involves identifying fundamental drivers behind price movements and utilizing advanced analytical tools to interpret data effectively. For instance, monitoring blockchain activity, such as transaction volumes and network congestion, can provide early signals about market sentiment. Additionally, investors should pay close attention to regulatory updates and technological milestones, as both can significantly impact the direction of the market. A well-informed trader might leverage these insights to anticipate short-term volatility or long-term value appreciation. However, it's important to note that no single factor can reliably predict market behavior, and a holistic understanding of multiple variables is often necessary to make accurate decisions.

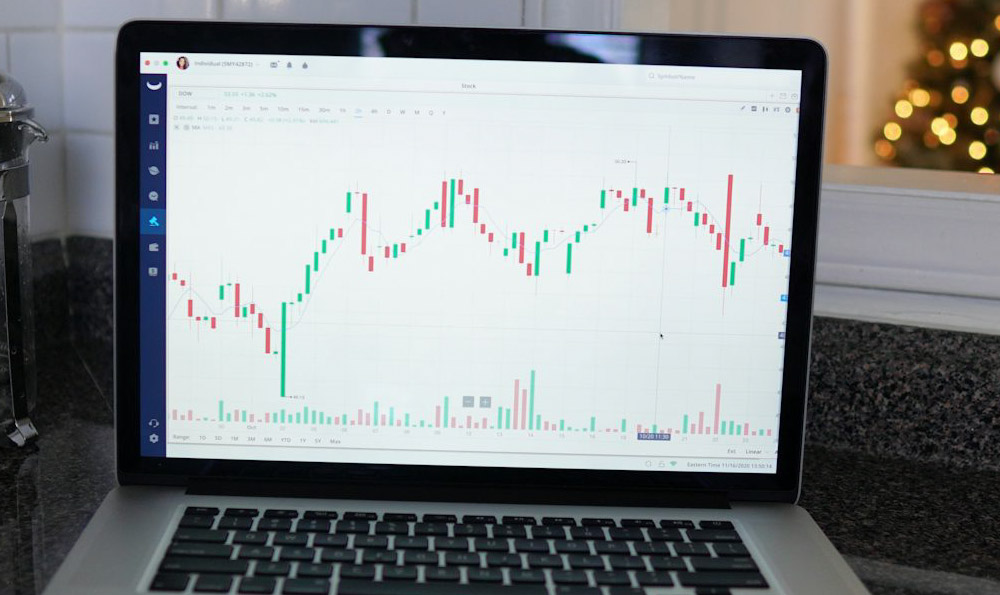

Profiting from cryptocurrency trading requires a combination of technical expertise and psychological discipline, as the fast-paced nature of this market often leads to emotional decision-making. Traders who remain calm under pressure and stick to their predefined strategies are more likely to achieve consistent returns. One key technique is the use of limit orders and stop-loss orders to automate trades. Limit orders allow investors to set a specific price at which they want to buy or sell a cryptocurrency, ensuring they enter or exit positions based on their calculations rather than impulsive actions. Stop-loss orders, on the other hand, help mitigate potential losses by triggering a sale when a cryptocurrency's price drops below a certain threshold. These tools can be particularly useful for managing risk in a market known for sharp price swings. Beyond automation, traders should also adopt risk management practices such as diversifying their portfolio across multiple assets and avoiding over-leveraging. By maintaining a balance between capital exposure and liquidity, investors can protect their portfolios from sudden market downturns. Moreover, staying updated on market trends through real-time charts and technical indicators can help traders identify potential entry and exit points. For example, recognizing patterns such as head and shoulders or double bottom formations can provide valuable clues about future price movements.

In addition to analytical and technical skills, mastering cryptocurrency trading demands a long-term perspective and a commitment to continuous learning. The market is constantly evolving, with new technologies, regulations, and trading strategies emerging on a regular basis. Investors who invest in education, such as following expert analyses, reading market reports, and learning from case studies, are better equipped to adapt to these changes. One effective way to stay informed is to analyze historical data and identify trends that have repeated over time. For example, studying the behavior of major cryptocurrencies during quarterly earnings reports can help traders anticipate market reactions. Furthermore, investors should be prepared to adjust their strategies based on changing market conditions. A successful trader might shift from短线交易 (short-term trading) to long-term holding during periods of extreme volatility, or vice versa. The ability to remain flexible and responsive to new information is often the difference between a thriving crypto portfolio and one that consistently underperforms.

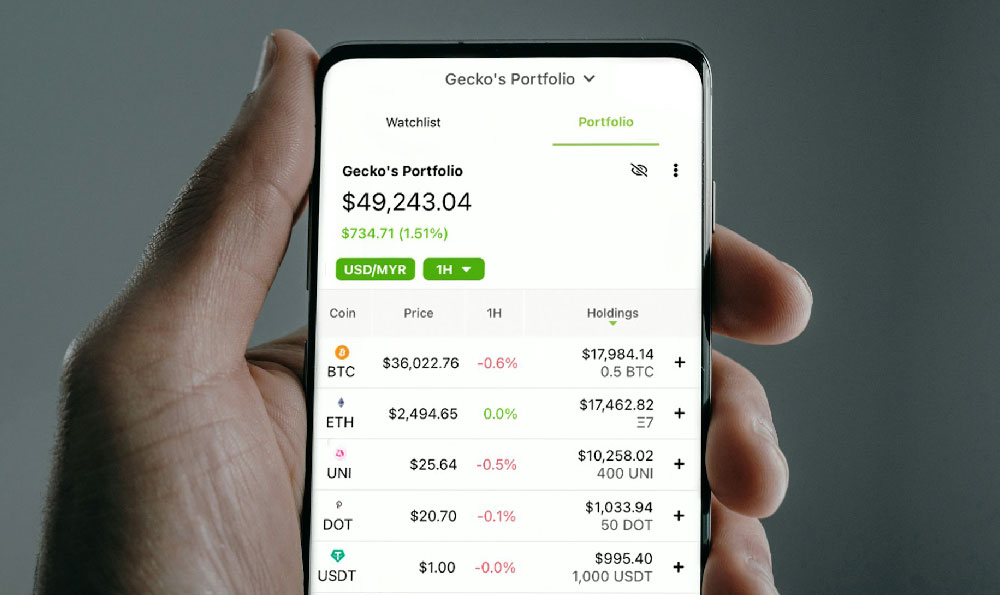

Another critical aspect of cryptocurrency trading is the importance of building a reliable trading environment. Traders should ensure they have access to accurate data, advanced analytical tools, and a secure trading platform. The choice of exchange can significantly impact the efficiency of trades, as different platforms offer varying levels of liquidity and fees. For instance, larger exchanges such as Binance or Coinbase typically have lower spreads and higher trade volumes, making them more suitable for active traders. Additionally, investors should consider the reliability and security of their trading tools, as fraudulent software or unreliable brokerage services can lead to significant losses. Setting up a trading plan with clear objectives, risk parameters, and exit strategies also helps traders maintain consistency and avoid impulsive decisions. The market is inherently unpredictable, but a well-structured trading plan can provide a framework for making rational choices.

Ultimately, the success of cryptocurrency trading hinges on the integration of knowledge, strategy, and discipline. Markets are driven by complex interactions between supply and demand, market sentiment, and external factors, making it essential for traders to develop a comprehensive understanding of these elements. By combining technical analysis with a clear trading strategy, managing risk effectively, and maintaining a long-term perspective, investors can increase their chances of generating sustainable returns. However, the journey to proficiency in crypto trading is not without its challenges, and traders must be prepared to adapt to changing conditions while staying grounded in fundamental principles. The key to making money in this space is to approach it with a combination of analytical skill, emotional control, and a commitment to continuous learning.