The allure of day trading often lies in its promise of quick returns and the ability to capitalize on short-term market movements. However, the reality is far more complex, as profitability in this high-stakes environment depends on a cocktail of factors ranging from market conditions to individual discipline. While some traders consistently generate income through strategic execution, others find themselves entangled in losses that test their resilience and financial stability. The question of whether day traders can truly make a profit is not a simple “yes” or “no” but a nuanced exploration of opportunity, skill, and systemic challenges.

Profitability in day trading is often tied to the ability to identify fleeting market inefficiencies. Sharp-eyed traders may exploit gaps between asset prices, such as when a stock jumps in value due to sudden news or earnings announcements. These opportunities, however, demand swift decision-making and strict adherence to predefined strategies. For instance, a trader specializing in high-frequency trading leverages automated systems to detect and act on micro-movements in real time, but even this method is subject to rapidly changing conditions. Similarly, those who rely on technical indicators like the RSI or MACD must constantly refine their approach to avoid false signals, which can lead to costly mistakes. The key lies in the trader's capacity to adapt and extract value from these volatile dynamics without succumbing to emotional biases.

The psychological dimension cannot be overstated. Day trading imposes an immense mental toll, as every trade carries the weight of immediate consequences. Successful traders often exhibit traits like patience, emotional control, and the ability to withstand pressure. A seasoned trader might remain unfazed by a string of losses, attributing them to market noise rather than personal failure. Conversely, novice traders may struggle with overtrading or chasing losing positions, which can erode profits and increase risk exposure. The challenge is not merely technical but also cognitive, requiring traders to separate their ego from their strategy and prioritize long-term consistency over temporary gains.

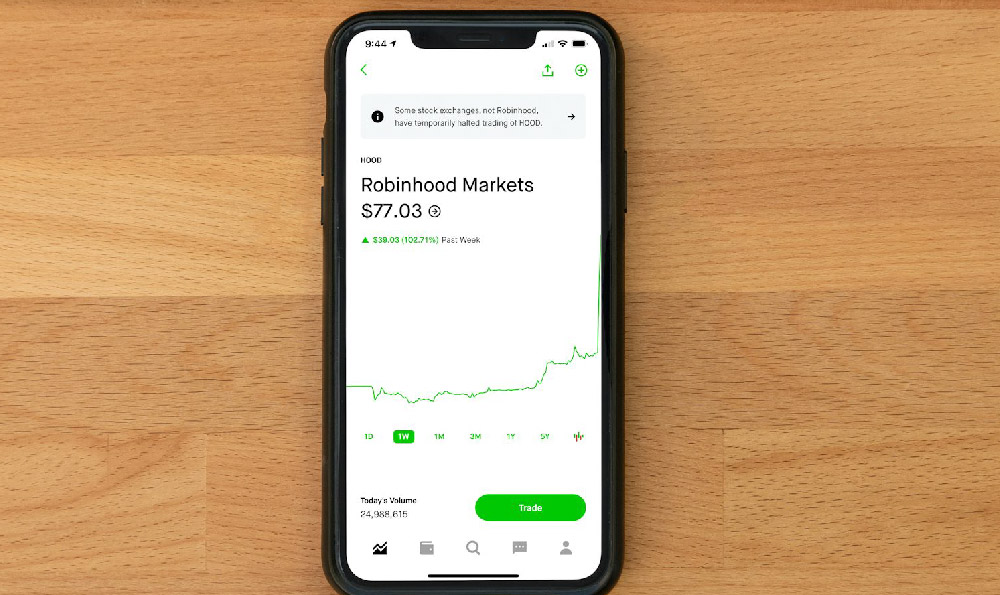

Market conditions play a pivotal role in determining profitability. During periods of high volatility, such as economic downturns or geopolitical crises, day traders can benefit from exaggerated price swings. For example, during the 2020 market crash triggered by the pandemic, those who traded with a strong grasp of liquidity dynamics managed to turn significant losses into gains. However, in low-volatility environments, the same strategies may falter, as smaller price movements are harder to identify and exploit. A trader who relies on intraday gaps may find themselves in a precarious position during a sustained consolidation phase, where market momentum is absent and trends are elusive. The ability to navigate these conditions is essential for sustained profitability, as markets are inherently unpredictable.

Moreover, the risk-reward ratio is a critical factor. Day traders who focus on high-risk, high-reward opportunities may experience outsized gains, but this comes with an increased probability of substantial losses. A trader might take a $10,000 position in anticipation of a 5% move, only to face a 10% dip that triggers a stop-loss. In contrast, those who employ conservative sizing and strict risk management often achieve modest but consistent returns. This highlights the importance of balancing ambition with caution, as even the most advanced strategies can be undermined by poor risk control.

The role of capital cannot be ignored either. A trader with access to substantial funds may weather losses more effectively, allowing them to maintain positions through market fluctuations. However, those with limited capital may feel the pressure of margin calls or account drawdowns, which can force premature exits. A disciplined trader might allocate funds across multiple positions to diversify risk, while others may concentrate their capital in a single trade, increasing the stakes. The psychological impact of capital constraints often shapes trading behavior, making it imperative to build a sustainable trading plan that accounts for both income and expenses.

Ultimately, the path to profitability for day traders is a delicate balance between skill, strategy, and self-discipline. While the market offers opportunities for profit, it also demands that traders navigate a labyrinth of challenges. Success is not guaranteed, even for those with advanced knowledge, as market conditions and psychological factors can create turmoil. The key to long-term viability lies in continuous learning, adaptability, and a commitment to robust risk management. As technology continues to evolve, offering new tools and platforms, traders must remain vigilant against the seductive promises of easy gains, focusing instead on the fundamentals of a disciplined approach. The answer to whether day traders can make a profit is not a fixed outcome but a reflection of their ability to master the intricacies of this dynamic field.