Earning money through cryptocurrency has become a highly discussed topic in recent years, driven by the dramatic volatility and potential for high returns that digital assets can offer. However, the path to profitability is not straightforward and requires a strategic approach. Unlike traditional investments, where risk and reward are often more predictable, the cryptocurrency market is shaped by complex forces, including technological advancements, regulatory changes, and global economic trends. For those seeking to navigate this space effectively, it's essential to understand not only the mechanisms of different investment strategies but also the underlying risks that can influence outcomes. The key to success lies in balancing research, risk management, and patience, while avoiding the pitfalls of speculative behavior and overconfidence.

One of the most enduring strategies in the crypto world is long-term holding, commonly referred to as "HODLing." This approach emphasizes buying and holding digital assets for an extended period, anticipating their value appreciation over time. The appeal of HODLing lies in its simplicity—investors focus on fundamental analysis, such as a project's technological innovation, community support, and real-world use cases—rather than short-term price fluctuations. For example, the early investment in Bitcoin during its 2017 bull run, when prices surged from around $1,000 to nearly $20,000, exemplifies the power of long-term commitment. However, HODLing is not without challenges. Market cycles can lead to prolonged bear markets, and the risk of losing value due to technological obsolescence or regulatory crackdowns requires careful consideration. Investors adopting this strategy should diversify their portfolios, allocate funds to projects with strong fundamentals, and remain patient, as digital assets may take years to reach their full potential.

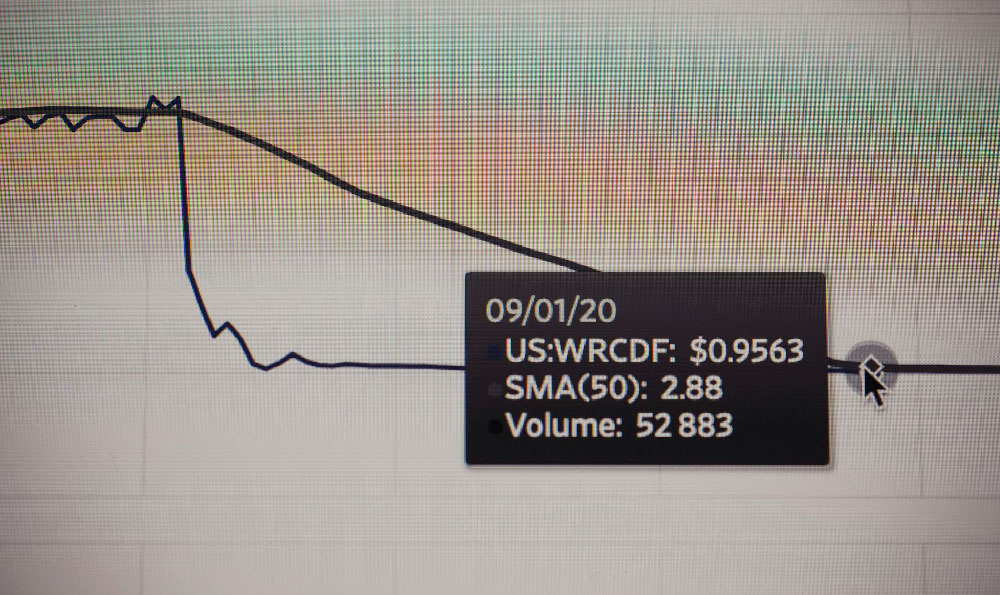

Another popular avenue is algorithmic trading, which leverages technical analysis and market data to make rapid decisions. This strategy often involves using automated platforms, trading bots, or quantitative models to identify short-term price patterns. While algorithmic trading can capitalize on market volatility, it demands a high level of expertise and consistent monitoring. For instance, the use of candlestick charts and moving averages helps traders determine entry and exit points, but misinterpretation of these tools can result in significant losses. Moreover, the rise of decentralized finance (DeFi) has introduced new opportunities, such as liquidity mining, where investors earn rewards by providing funds to decentralized platforms. However, this approach carries its own risks, including smart contract vulnerabilities and the potential for rug pulls by unscrupulous projects. Those interested in DeFi should thoroughly research protocols, assess risks associated with impermanent loss, and consider using yield aggregators to optimize returns across multiple platforms.

For those with a higher risk tolerance, staking and yield farming offer alternative avenues. Staking involves locking up cryptocurrencies to support the operations of a blockchain network, earning rewards in return. This is particularly common with proof-of-stake (PoS) blockchains like Ethereum and Cardano, where validators are compensated for maintaining network security. Yield farming, on the other hand, requires depositing assets into liquidity pools to generate returns. While these methods can provide passive income, they are not without drawbacks. The fluctuating value of staked or farmed assets, the risk of slashing penalties for irregular participation, and the potential for liquidity fragmentation in DeFi platforms all contribute to uncertainty. To mitigate these risks, investors should focus on stablecoins for short-term staking, diversify their staking positions across multiple networks, and stay informed about protocol updates.

Beyond these primary strategies, non-fungible tokens (NFTs) have emerged as a unique investment category. NFTs represent digital ownership of assets, from artwork to virtual real estate, and their market has grown rapidly. However, the NFT space is highly speculative, with prices often driven by factors beyond intrinsic value, such as social media trends and hype. Investors should approach NFTs with caution, evaluating the rarity, utility, and market demand of digital assets before purchasing. It's also crucial to recognize that NFTs may not be suitable for all risk profiles, as their value can decline sharply without clear fundamentals.

Despite the allure of these opportunities, the cryptocurrency market remains fraught with risks. The extreme volatility of prices, for instance, can lead to rapid gains or catastrophic losses. A single day's market movement can erase months of growth, as seen with Bitcoin's 2022 crash, where prices dropped by over 60% in a short period. Regulatory uncertainties further complicate the landscape, as governments around the world continue to grapple with how to oversee digital assets. In 2023, the U.S. Securities and Exchange Commission (SEC) and other regulators have intensified scrutiny of crypto exchanges and projects, creating potential market disruptions. Additionally, security breaches and hacks have underscored the importance of safeguarding digital assets. High-profile incidents, such as the Poly Network hack in 2022, highlight the vulnerabilities of decentralized systems and the need for robust risk management practices.

To navigate these challenges, investors must prioritize education, diversification, and vigilance. Understanding the fundamentals of different cryptocurrencies, including their team, technology, and adoption rates, is critical for making informed decisions. Diversifying across asset classes—such as combining long-term holdings with short-term trading or staking—can help balance risk and reward. Furthermore, adopting a disciplined approach to risk management, such as using stop-loss orders, limiting exposure to volatile assets, and maintaining a liquidity buffer, can protect against sudden market downturns. Building a solid financial foundation, including an emergency fund and a diversified investment portfolio, also ensures that crypto investments do not consume all available capital.

In conclusion, earning money through cryptocurrency is neither a guaranteed path nor a purely random one. It demands a combination of research, strategic planning, and mindfulness of risks. While the potential for high returns is undeniable, success in this market requires a long-term perspective, technical knowledge, and emotional resilience. By combining these elements, investors can navigate the complexities of cryptocurrency and position themselves for sustainable wealth growth.