Investing in stocks can be a powerful tool for generating wealth, yet it demands a strategic approach that balances thorough research, discipline, and adaptability. Whether you're a novice or an experienced investor, the stock market offers opportunities for growth, but only for those who understand its intricacies and approach it with caution. Building a sustainable investment portfolio requires more than luck—it hinges on identifying patterns, analyzing trends, and making informed decisions based on both fundamental and technical insights.

One of the most critical aspects of stock investing is recognizing the importance of time horizon. Short-term fluctuations are inherent in financial markets, but they should not dictate your long-term strategy. Markets tend to reward patients who allocate capital to companies with strong fundamentals, such as consistent revenue growth, competitive advantages, and solid balance sheets. A company's ability to generate cash flow over time is often a stronger indicator of future success than its current stock price. For example, a dividend-paying stock from a mature industry may offer steady returns, while a high-growth tech stock could capitalize on emerging trends and innovation. The key is aligning your investment choices with your financial goals and risk tolerance, ensuring that your approach is both flexible and disciplined.

Understanding market trends is equally vital. Economic indicators, geopolitical events, and industry-specific developments all influence stock prices. For instance, a shift toward renewable energy may propel stocks in the clean technology sector, while monetary policy changes can impact financial institutions or consumer goods companies. By staying informed about macroeconomic factors, you can anticipate market movements and adjust your portfolio accordingly. Investors who track news cycles and analyze sector performance often gain an edge in navigating uncertainty, such as inflationary pressures or regulatory changes. However, it's important to distinguish between short-lived catalysts and long-term structural shifts, as the latter tend to create more enduring value.

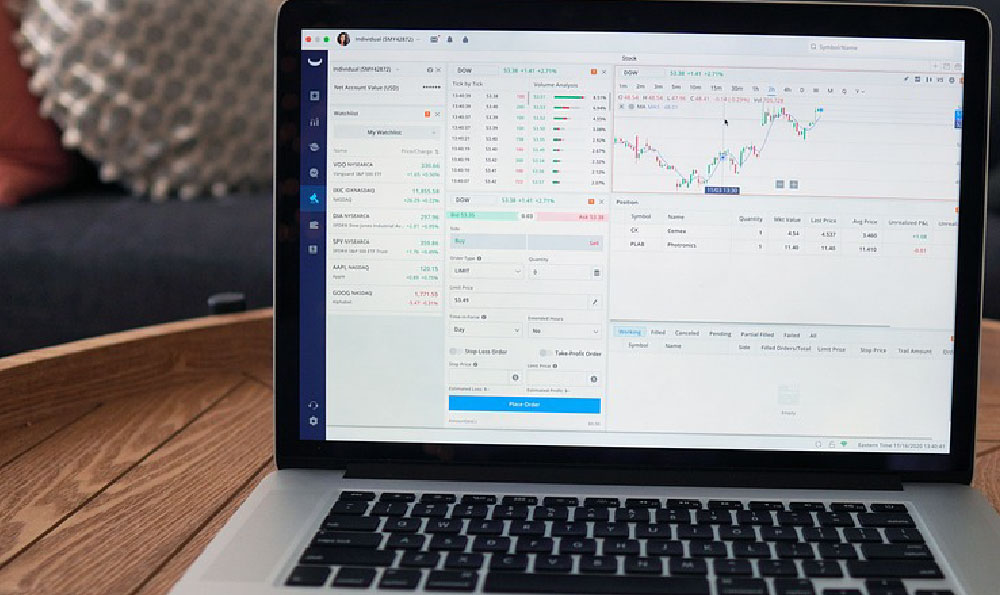

Technical analysis plays a complementary role in stock investing. Patterns in price movements and trading volumes can reveal potential entry or exit points, but they should not be viewed as infallible signals. Tools like moving average lines, relative strength index (RSI), and volume trends help quantify market sentiment, yet they require interpretation. For example, a stock that breaks above its 50-day moving average might signal a bullish trend, but this should be confirmed by other indicators like MACD or volume spikes. Combining technical analysis with fundamental research allows investors to make well-rounded decisions, mitigating the risk of overreliance on any single method.

Risk management is the cornerstone of successful stock investing. No strategy is foolproof, and losses are inevitable in any market. The critical factor is how you respond to them. Diversification is a fundamental principle that spreads risk across different sectors and geographies, reducing the impact of a single stock's underperformance. However, diversification alone is not enough—investors must also implement risk mitigation techniques like position sizing, stop-loss orders, and regular portfolio rebalancing. For example, allocating no more than 10% of your portfolio to any individual stock, regardless of its perceived potential, is a prudent rule to avoid catastrophic losses during market downturns.

Avoiding common pitfalls requires vigilance and emotional control. The allure of overnight gains often tempts investors to chase hot stocks or engage in speculative trading, but such practices frequently lead to significant losses. Instead, focus on value investing principles—buying stocks at a discount to their intrinsic value and holding them for the long term. This approach demands patience, as the market may take time to recognize a company's true worth. For instance, during the 2008 financial crisis, stocks of companies with strong balance sheets and resilient business models rebounded sharply, rewarding those who remained composed and exercised restraint.

Moreover, the psychological dimension of investing cannot be overlooked. Emotions like fear and greed often cloud judgment, leading to impulsive decisions. A disciplined investor recognizes these tendencies and adheres to a predefined strategy, regardless of market noise. For example, during periods of extreme volatility, maintaining a long-term perspective and resisting the urge to panic sell can preserve capital and allow for compounding growth over time. The ability to remain detached from short-term fluctuations is a hallmark of seasoned investors who consistently outperform their peers.

Innovation is another driving force in stock markets, particularly in technology and disruptive industries. Companies that lead in automation, artificial intelligence, or sustainable solutions often benefit from long-term demand, creating opportunities for growth. However, these stocks can be highly volatile, requiring careful evaluation of the underlying business model and scalability. For example, a breakthrough in semiconductors may elevate a company's stock, but without clear revenue streams or market adoption, the hype can fade quickly. Investors must differentiate between speculative growth and sustainable value, ensuring that their choices are grounded in reality.

Ultimately, stock investing is a journey of continuous learning and adaptation. The market evolves with technological advancements, regulatory changes, and shifting consumer preferences, demanding that investors stay agile. This involves regular portfolio reviews, updating investment criteria, and refining strategies based on new data. By committing to lifelong learning—whether through books, courses, or mentorship—you can cultivate the expertise needed to navigate complex markets confidently. The most successful investors are those who approach the market with humility, recognizing that while they can influence outcomes, they cannot control the market itself. With a combination of strategic thinking, discipline, and continuous education, stock investing becomes a manageable and rewarding endeavor.