As a professional with expertise in virtual currencies and investment strategies, I've seen firsthand how digital assets are reshaping traditional financial landscapes, including the agricultural sector. Understanding the economic realities of farmers is crucial for anyone considering investments in rural industries or exploring innovative ways to enhance agricultural productivity. The income of farmers is a complex subject that intersects with factors such as regional agricultural output, scale of operations, technological adaptation, and global market forces. This intricate web of influences creates a dynamic environment where both traditional and modern financial tools play a role in determining profitability.

The most critical factor influencing farmer income is the stability and scale of crop yields. In regions with favorable climates and fertile land, such as the United States Midwest or parts of Brazil, large-scale commercial farmers often report higher annual earnings due to industrialized farming practices and access to advanced technologies. According to the U.S. Department of Agriculture, the average income for a U.S. farm in 2023 was approximately $12,000, but this figure varies drastically. For example, soybean and corn producers in Iowa earned significantly more, with average incomes exceeding $75,000, while small-scale organic farmers in California earned less than $15,000 annually. These disparities highlight the importance of diversification in agricultural enterprises, as well as the need for farmers to adapt to market fluctuations and consumer demand shifts.

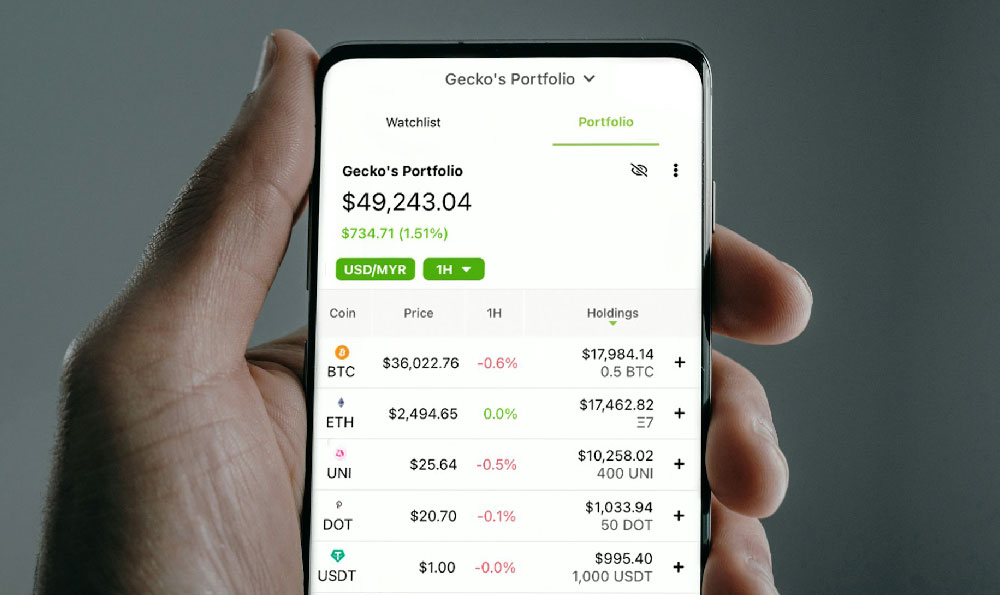

Another essential element is the integration of technology into farming operations. The agricultural sector has been increasingly adopting smart farming solutions, such as blockchain-based supply chain management, precision agriculture tools, and cryptocurrency for direct payment transactions. These innovations not only reduce operational costs but also open new revenue streams for farmers. For instance, some agribusinesses now use blockchain platforms to track organic produce from farm to market, ensuring transparency and commanding higher prices. At the same time, farmers in developing countries are beginning to adopt mobile payment technologies, including cryptocurrency, to access financial services without relying on traditional banking systems. This shift is particularly relevant in regions where blackouts and economic instability have historically disrupted cash flow, making digital currencies a viable alternative for managing finances and securing earnings.

Market volatility also plays a significant role in the financial success of farmers. Commodity prices are subject to global events, such as geopolitical tensions, weather patterns, and shifts in international trade policies. For example, the 2022 Ukraine war caused a global fertilizer shortage, directly impacting crop yields and reducing profits for farmers worldwide. Similarly, climate change has increasingly affected agricultural output, with extreme weather conditions such as droughts, floods, and pests threatening income stability. In response, many farmers are now investing in weather-indexed insurance products and exploring alternative assets such as farmland tokens, which allow investors to gain exposure to agricultural properties without physical ownership. This trend is especially evident in regions with high agricultural value, where investors are leveraging blockchain technology to secure returns while mitigating physical and financial risks.

Financial literacy and strategic planning are equally vital for maximizing returns in agriculture. Farmers who diversify their income sources, such as engaging in agrotourism, value-added products, or direct-to-consumer sales, often achieve greater financial resilience. For example, some farmers in China and India have successfully integrated cryptocurrency into their business models by accepting crypto payments for agricultural products, thereby reducing reliance on traditional fiat currencies and mitigating exchange rate risks. At the same time, others are using decentralized finance (DeFi) platforms to access low-interest loans for investing in advanced equipment or expanding their operations. These strategies not only improve productivity but also create opportunities for farmers to grow their wealth through alternative financial channels.

In addition to traditional financial tools, the adoption of virtual currencies is reshaping the agricultural sector in unique ways. For instance, some agricultural cooperatives are now using blockchain-based token systems to distribute profits and manage transactions among members. These tokens can be traded on digital exchanges, offering a new avenue for financial growth. Moreover, the use of cryptocurrency in cross-border agricultural trade is becoming more common, as it allows for faster and more secure transactions compared to traditional remittance methods. This is particularly beneficial for farmers in emerging markets, where financial infrastructure is often underdeveloped, and traditional banking systems may be unreliable.

However, as with any investment strategy, there are inherent risks associated with virtual currencies in agriculture. The price volatility of cryptocurrencies can make them a risky asset for farmers who rely on stable income to cover operational costs. For example, a sudden drop in the value of a farmland token could result in significant financial losses for investors. Furthermore, the regulatory environment surrounding virtual currencies remains uncertain, with governments around the world imposing varying levels of restrictions on their use. Farmers who wish to engage in crypto-based transactions must stay informed about legal and policy developments to avoid potential pitfalls.

Despite these challenges, the integration of virtual currencies into agriculture offers a compelling opportunity for financial innovation. By adopting smart contracts for agricultural contracts and using blockchain-based platforms for transparent pricing, farmers can enhance their profitability and reduce risks associated with traditional financial systems. Additionally, the use of cryptocurrency for direct payments and access to DeFi-based financial services can provide farmers with greater control over their earnings and financial security.

Farmers who embrace these technological advancements and stay informed about market trends are better positioned to achieve long-term financial stability and growth. Whether through traditional income sources, diversification, or the adoption of virtual currencies, the key to success lies in strategic planning, financial literacy, and the ability to adapt to changing economic conditions. As the agricultural sector continues to evolve, the role of virtual currencies will become increasingly important, offering new opportunities for farmers to protect and expand their earnings.