The allure of rapid wealth accumulation is a powerful one, captivating the minds of many who dream of financial freedom and escaping the constraints of traditional employment. The question of "how to get rich quick" is frequently posed, but the reality is far more complex than a simple answer. While legitimate strategies for accelerating wealth exist, it's crucial to approach the pursuit of quick riches with a healthy dose of skepticism and a thorough understanding of the associated risks and rewards.

Instead of focusing solely on the "quick" aspect, a more prudent approach involves understanding the principles of wealth creation and strategically leveraging opportunities for accelerated growth. Building a solid financial foundation is paramount. This begins with mastering the fundamentals of personal finance, including budgeting, saving, and debt management. Before even contemplating investments or entrepreneurial ventures, ensuring a stable financial base is crucial. This includes having an emergency fund sufficient to cover several months of living expenses, minimizing high-interest debt like credit card balances, and understanding your personal cash flow. Neglecting these fundamentals is like building a house on sand; any attempt at rapid wealth accumulation is likely to crumble.

One avenue often explored for faster wealth creation is entrepreneurship. Starting a successful business has the potential to generate substantial income and build lasting assets. However, entrepreneurship is not a guaranteed path to riches. It requires significant dedication, hard work, risk-taking, and a deep understanding of the market. Identifying a niche market with unmet needs, developing a unique and valuable product or service, and effectively marketing to your target audience are essential for success. While the rewards can be significant, the failure rate for startups is also high, highlighting the importance of thorough research, a robust business plan, and a willingness to adapt and learn. Scalable business models, which can be easily replicated and expanded without significant increases in costs, offer the greatest potential for rapid growth. Examples include software-as-a-service (SaaS) businesses, e-commerce platforms, and online education providers.

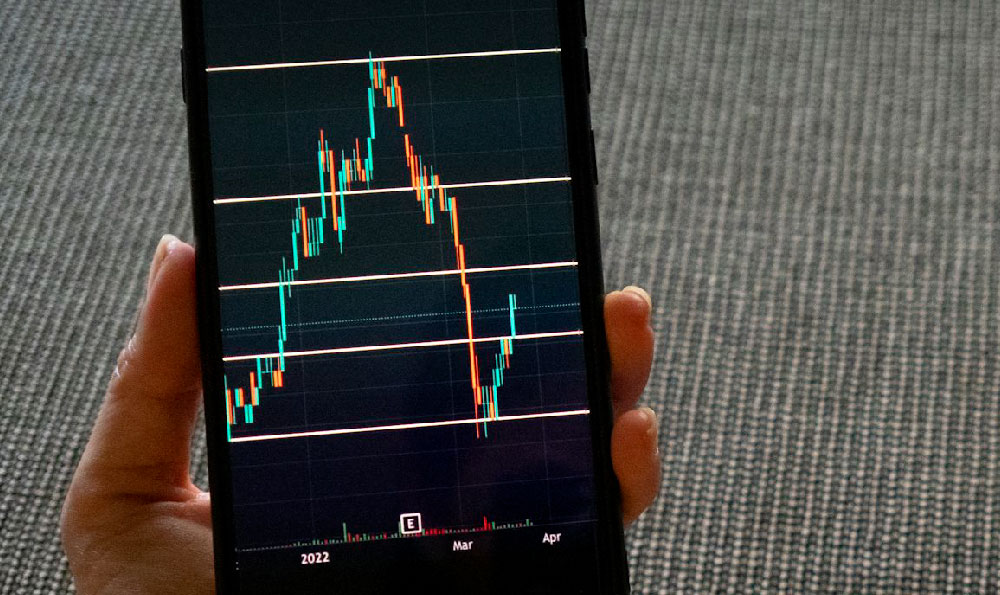

Investing in high-growth potential assets is another strategy frequently considered. This can involve investing in stocks of emerging companies, real estate in rapidly developing areas, or even alternative assets like cryptocurrencies. However, higher potential returns always come with higher risks. It is crucial to conduct thorough due diligence on any investment opportunity, understanding the underlying fundamentals of the asset and the potential downside risks. Diversification is key to mitigating risk; spreading your investments across different asset classes and industries can help cushion the blow if one investment performs poorly. Avoid putting all your eggs in one basket, particularly when pursuing high-risk, high-reward investments. Remember the adage, "Don't invest what you can't afford to lose."

Leveraging the power of compounding is a fundamental principle of wealth creation. Compounding refers to the ability of an investment to generate earnings, which are then reinvested to generate further earnings. Over time, the effect of compounding can be significant, especially when combined with consistent contributions and a long-term investment horizon. While compounding is often associated with long-term investing, it can also be accelerated through strategies that generate higher returns, such as entrepreneurial ventures or strategic real estate investments.

Developing in-demand skills and leveraging them to command higher earnings is another effective strategy. In today's rapidly evolving job market, certain skills are highly valued and can lead to significant income potential. These include skills in technology (e.g., software development, data science, cybersecurity), finance (e.g., financial analysis, investment banking), and marketing (e.g., digital marketing, content creation). Investing in your education and professional development to acquire these skills can significantly increase your earning potential and accelerate your path to wealth. Consider freelancing or consulting in your area of expertise to earn additional income and build your reputation.

While pursuing opportunities for faster wealth accumulation, it is essential to be wary of scams and schemes that promise unrealistic returns. These schemes often prey on people's desire for quick riches and can result in significant financial losses. Be skeptical of any investment opportunity that sounds too good to be true or that promises guaranteed returns. Always do your own research and seek advice from qualified financial professionals before making any investment decisions. Remember, legitimate wealth creation requires time, effort, and a sound financial strategy.

Ultimately, the quest to get rich quick is often misguided. A more sustainable and fulfilling approach focuses on building a solid financial foundation, developing valuable skills, and strategically pursuing opportunities for growth. While the path to wealth may not be immediate, it can be achieved through discipline, perseverance, and a commitment to lifelong learning. Focus on creating value, building assets, and making smart financial decisions, and you will be well on your way to achieving your financial goals. The real key is not necessarily getting rich quick, but building a life of financial security and freedom that allows you to pursue your passions and live life on your own terms. Remember that true wealth encompasses more than just money; it includes your health, relationships, and personal fulfillment.