The landscape of high-yield investments in 2023 is shaped by a dynamic interplay of global economic currents, evolving market dynamics, and shifting investor priorities. As central banks navigate the delicate balance between inflation control and economic growth, traditional asset classes such as stocks and bonds have seen pronounced fluctuations, prompting a reevaluation of strategies to optimize returns. This year, investors are increasingly seeking opportunities that not only provide competitive yields but also align with macroeconomic trends and risk management principles. Among the most promising avenues are alternative assets, sector-specific stocks, and emerging markets, each offering distinct advantages contingent upon individual financial goals and risk tolerance.

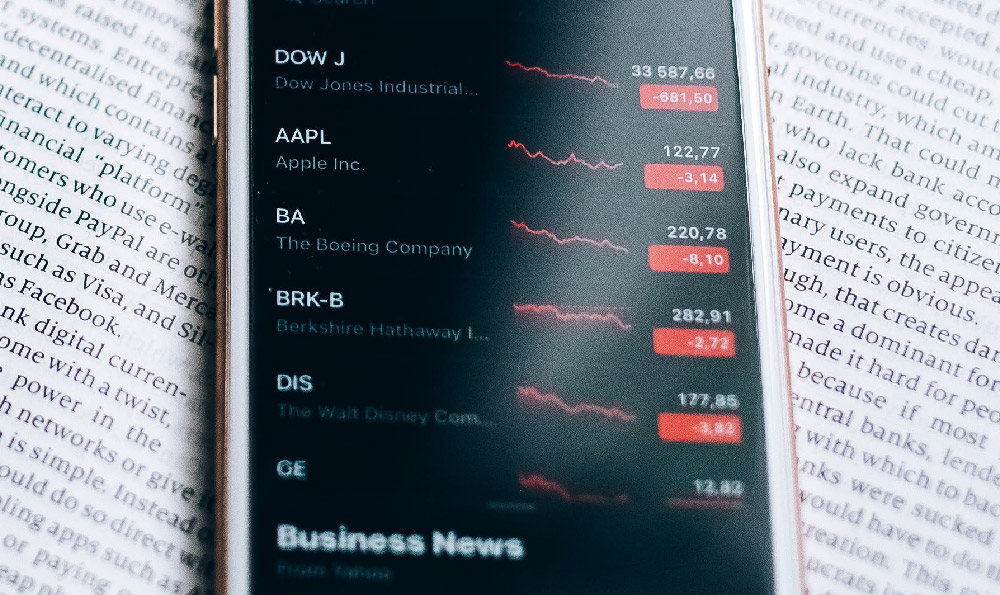

In the equity market, high-yield opportunities often emerge from sectors experiencing structural growth or technological disruption. The technology and innovation sector continues to be a focal point, with companies leveraging artificial intelligence, cloud computing, and sustainability initiatives to drive profitability. However, the allure of these stocks is matched by their volatility, necessitating a long-term perspective and thorough due diligence. Conversely, the consumer discretionary sector presents a compelling case for income generation, as resilient demand for services and products remains robust despite macroeconomic headwinds. Companies with strong brand equity and supply chain adaptability are particularly attractive, though investors should remain vigilant against overvaluation in growth stocks. Value investing, which focuses on undervalued companies with strong fundamentals, has regained traction as market corrections create buying opportunities, though its effectiveness is often contingent on macroeconomic stability and corporate earnings consistency.

The fixed-income market has also transformed, with high-yield bonds and alternative debt instruments offering attractive returns amid persistently high interest rates. Corporate bonds with BBB ratings and below have become increasingly appealing, as the spread between these securities and government bonds widens, reflecting heightened risk premiums. Investors should pay close attention to credit quality, industry exposure, and the financial health of issuers when considering these instruments. Additionally, inflation-linked bonds and floating-rate notes have emerged as smart options for hedging against rising price levels, providing a buffer against the erosion of purchasing power. However, the complexity of these instruments requires a nuanced understanding of interest rate risk dynamics and inflation forecasts.

Real estate investment trusts (REITs) remain a cornerstone of income generation, with their ability to distribute a significant portion of earnings to shareholders making them an attractive choice. The commercial real estate sector, particularly in industrial and logistics properties, has experienced explosive growth due to the ongoing shift toward e-commerce and supply chain diversification. Meanwhile, residential REITs offer stability through consistent rental income and demand-driven appreciation, though they may be less sensitive to macroeconomic fluctuations. Investors should consider the performance of specific sectors, geographic distribution, and the macroeconomic implications of interest rate changes when evaluating REITs.

Cryptocurrency and digital assets present a high-risk, high-reward proposition that has captivated a growing segment of investors. While the market remains volatile and regulatory uncertainty persists, the long-term growth potential of blockchain technology and decentralized finance continues to attract attention. However, investors should approach these assets with caution, given the significant price swings and the lack of intrinsic value in many tokens. Diversification within the cryptocurrency space, such as allocating to stablecoins, enterprise blockchain solutions, or crypto index funds, can help mitigate risk while capitalizing on innovation.

Private equity and alternative investments, though less accessible to retail investors, offer the prospect of substantial returns through direct ownership of companies and active management of assets. The private equity market has shown resilience in 2023, with firms focusing on sectors exhibiting robust growth potential, such as healthcare, renewable energy, and technology. Strategic partnerships, operational improvements, and secondary market transactions underpin these opportunities, though liquidity constraints and high minimum investment requirements necessitate careful consideration.

Emerging markets continue to be a compelling frontier for high-yield investing, as economies in Asia, Africa, and Latin America demonstrate robust growth potential despite geopolitical uncertainties. The rise of digital economies in countries like India and Brazil, coupled with the increasing financial inclusion in regions such as Southeast Asia and Sub-Saharan Africa, presents a unique opportunity for diversification. However, currency fluctuations, political instability, and regulatory challenges require investors to adopt a cautious yet opportunistic approach, balancing potential returns with risk mitigation.

Ultimately, the pursuit of maximum returns in 2023 demands a strategic approach that integrates asset allocation, risk management, and market analysis. As the economic environment remains complex, investors should prioritize diversification across multiple asset classes, maintain a forward-looking perspective, and remain attuned to macroeconomic developments. The key lies in identifying opportunities that align with personal financial objectives, risk profiles, and investment horizons, ensuring that high-yield strategies are both effective and sustainable.