Investment banks, often perceived as enigmatic powerhouses of finance, operate on a complex landscape of deals, strategies, and intricate market maneuvers. Understanding how they generate profit and the diverse sources that feed their revenue streams is crucial for anyone seeking to navigate the financial world, whether as a potential client, employee, or simply an informed observer. The profitability of these institutions stems from their role as intermediaries, facilitators, and advisors in a myriad of financial transactions.

One of the most significant revenue streams for investment banks is investment banking fees. This encompasses a broad category of services provided to corporations, governments, and other entities seeking to raise capital. A primary component is underwriting, where the investment bank helps a company issue and sell new securities – such as stocks (Initial Public Offerings or IPOs and secondary offerings) and bonds – to the public or private investors. The bank acts as an intermediary, purchasing the securities from the issuer at a discount and then reselling them to investors at a higher price. The difference, known as the underwriting spread, represents the bank's profit. This spread is a function of the risk associated with the offering, the size of the deal, and the competitive landscape. IPOs, especially for innovative or high-growth companies, can generate substantial fees due to the inherent risk and complexity involved in valuing a private company and gauging market demand. Beyond underwriting, investment banks also provide advisory services related to mergers and acquisitions (M&A). These services include identifying potential targets or acquirers, conducting due diligence, valuing companies, structuring deals, and negotiating terms. M&A advisory fees can be substantial, often representing a percentage of the total transaction value. Complex cross-border transactions or hostile takeovers command even higher fees due to the increased legal and regulatory hurdles involved. Investment banks also advise companies on restructurings, spin-offs, and other corporate finance transactions, earning fees commensurate with the complexity and impact of the advice.

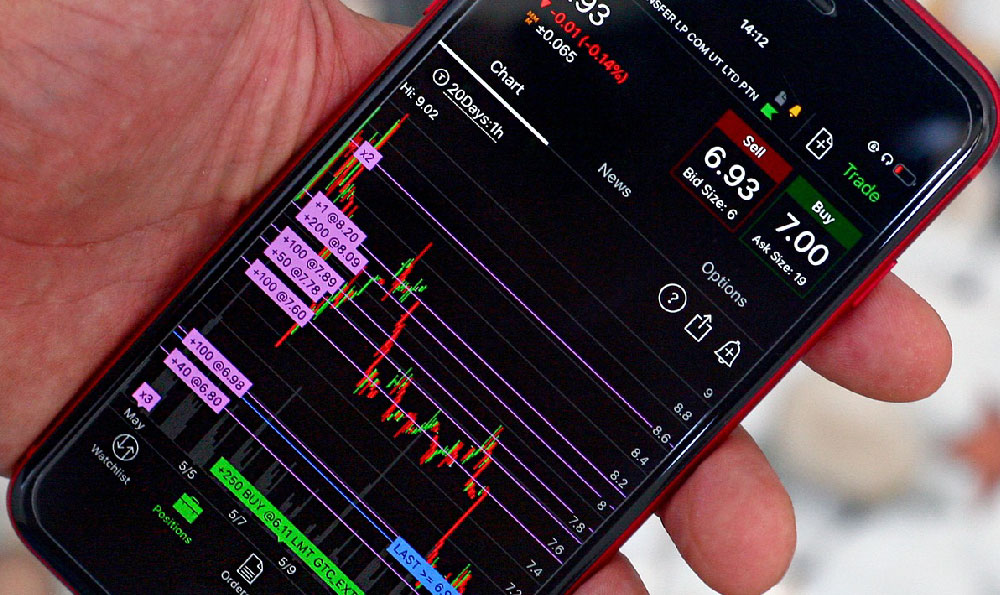

Another significant contributor to investment bank revenue is trading and sales. Investment banks act as market makers, facilitating the buying and selling of securities for their clients. This involves maintaining inventories of various financial instruments, including stocks, bonds, currencies, and commodities. The bank profits from the bid-ask spread, the difference between the price at which it is willing to buy a security (the bid) and the price at which it is willing to sell it (the ask). The narrower the spread, the more competitive the market making operation. Successful trading and sales divisions require sophisticated risk management systems, experienced traders, and a deep understanding of market dynamics. Banks also engage in proprietary trading, where they trade securities for their own account with the goal of generating profits. This activity is subject to stricter regulations following the 2008 financial crisis, with limitations imposed on the amount of capital banks can allocate to proprietary trading activities. Sales functions involve selling the bank's trading and research products to institutional investors, such as hedge funds, pension funds, and mutual funds. Salespeople earn commissions on the trades they execute for clients and play a critical role in distributing the bank's research and investment ideas.

Asset management is another crucial revenue stream for many investment banks, particularly those that have diversified beyond traditional investment banking activities. This involves managing investment portfolios for institutions and high-net-worth individuals. Fees are typically charged as a percentage of assets under management (AUM), providing a recurring revenue stream. Asset management divisions often offer a wide range of investment products, including mutual funds, hedge funds, private equity funds, and real estate funds. Performance-based fees, such as incentive fees charged by hedge funds, can significantly boost revenue if the fund outperforms its benchmark.

Research is a crucial support function that indirectly generates revenue. Investment banks employ analysts who conduct in-depth research on companies, industries, and macroeconomic trends. This research is disseminated to clients, providing them with valuable insights and investment recommendations. While research is often provided free of charge to clients who generate trading volume, it plays a crucial role in attracting and retaining clients. Top-tier research analysts can command significant salaries and contribute to the bank's reputation and brand. In recent years, regulations have increasingly unbundled research from trading commissions, leading to a more transparent pricing of research services.

Finally, investment banks also generate revenue through lending activities. They provide loans to corporations and other entities, earning interest income on these loans. This lending activity can be particularly important for financing leveraged buyouts and other complex transactions. The risk associated with lending is carefully managed through credit analysis and collateralization. Investment banks may also participate in syndicated loans, where a group of lenders jointly provides financing for a large borrower.

In summary, investment banks profit from a diverse range of activities, including investment banking fees, trading and sales, asset management, research, and lending. The relative importance of each revenue stream can vary depending on the size and focus of the bank, as well as the prevailing market conditions. The most successful investment banks are those that can effectively manage risk, adapt to changing market dynamics, and provide valuable services to their clients. The landscape continues to evolve with technological advancements and regulatory reforms, making adaptability and innovation paramount for sustained profitability. Understanding these diverse profit centers is crucial for navigating the complex world of finance.