Kevin O'Leary, the sharp-tongued investor and entrepreneur known for his role on Shark Tank, didn't amass his wealth overnight. His journey to financial success is a multi-faceted tale woven with astute business decisions, calculated risks, and a relentless drive to capitalize on opportunities. Understanding how he built his empire provides valuable insights into the world of investing and entrepreneurship, revealing not just his strategies, but also the mindset that fuels his success.

O'Leary's initial foray into the business world wasn't paved with guaranteed victories. After graduating with an MBA from the Ivey Business School at Western University, he initially pursued a career in television production. However, recognizing the limitations and potential instability of that industry, he made a pivotal decision to shift his focus toward something more scalable and financially rewarding. This ability to recognize the signs of an unfavorable environment and pivot toward more promising prospects is a key element of his success.

His first major venture, SoftKey International, is a testament to this adaptability and his keen eye for undervalued assets. In the mid-1980s, O'Leary and his partners started SoftKey, a company that acquired struggling software companies and packaged their products for sale in the home computer market. The initial capital was modest, a mere $10,000 from his mother. This demonstrates the importance of resourcefulness and the ability to leverage even limited resources to achieve significant gains. SoftKey didn't revolutionize the software landscape with groundbreaking innovations; instead, it focused on acquiring and streamlining existing products, targeting a specific consumer demographic. This strategy of identifying underserved markets and offering affordable, accessible solutions proved incredibly effective.

The success of SoftKey wasn't simply a matter of luck; it was rooted in a deliberate and strategic approach. O'Leary and his team understood the value of efficient distribution and marketing. They focused on mass-market retailers, making their software readily available to a broad audience. Furthermore, they were adept at cutting costs and improving operational efficiency, turning around struggling companies and making them profitable. This focus on financial discipline and operational excellence is a recurring theme in O'Leary's business ventures.

SoftKey's growth culminated in a series of acquisitions, including The Learning Company, a much larger competitor. This acquisition, while ambitious, ultimately proved problematic, leading to financial difficulties and a subsequent sale to Mattel. While this period was undoubtedly challenging, it provided invaluable lessons in navigating complex mergers and acquisitions, and understanding the potential pitfalls of over-expansion. Even in the face of setbacks, O'Leary demonstrated resilience and the ability to learn from his mistakes.

Following the sale of The Learning Company, O'Leary leveraged his experience and capital to explore new opportunities. He ventured into the world of investing, becoming a venture capitalist and angel investor. This transition marks a significant shift in his career, from operating a business to actively seeking out and supporting promising startups. His experience as an entrepreneur provided him with a unique perspective, allowing him to identify viable businesses and assess the capabilities of their founders.

His role on Shark Tank further amplified his profile and cemented his reputation as a shrewd investor. On the show, O'Leary is known for his direct and often brutally honest assessments of business pitches. However, beneath his tough exterior lies a deep understanding of financial principles and a commitment to investing in companies with strong fundamentals. He often emphasizes the importance of profitability, scalability, and a clear path to revenue generation. He often seeks royalties or equity stakes that provide him with ongoing financial returns, showcasing his focus on long-term value creation.

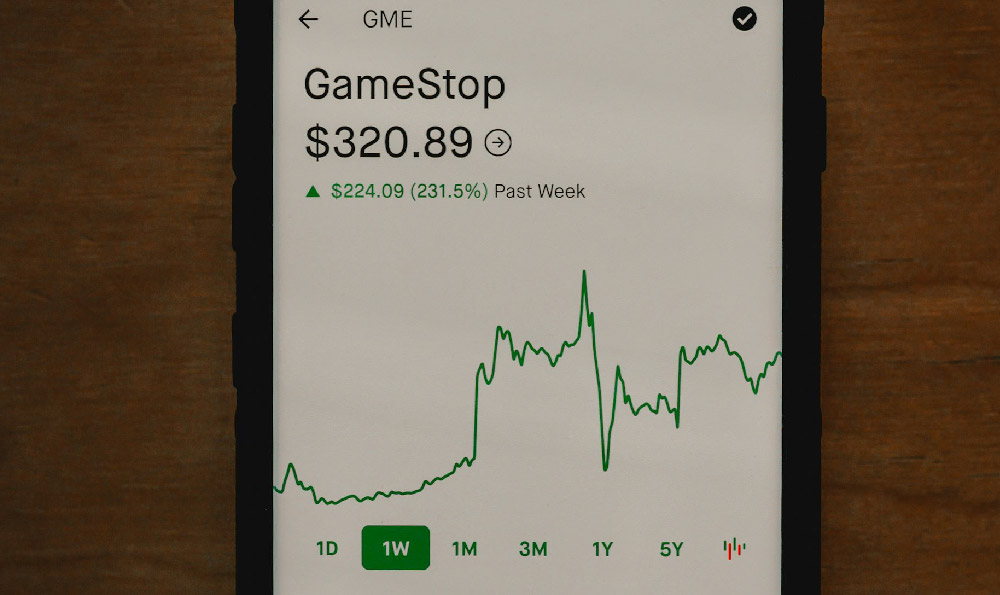

Beyond his television appearances and venture capital activities, O'Leary has also diversified his investments into other asset classes, including real estate, wine, and precious metals. This diversification strategy is a cornerstone of sound financial planning, as it helps to mitigate risk and protect against market volatility. His involvement in various industries demonstrates his willingness to explore new opportunities and his belief in the importance of not putting all his eggs in one basket.

So, what's the secret to Kevin O'Leary's wealth? It's not one single factor, but rather a combination of several key elements:

- Adaptability: The ability to recognize opportunities and pivot when necessary. He was willing to abandon a career in television production when he saw a more promising path in software.

- Strategic Acquisitions: Targeting undervalued assets and turning them into profitable ventures. SoftKey's success was largely due to its ability to acquire and streamline struggling software companies.

- Financial Discipline: A relentless focus on profitability, cost control, and operational efficiency. This is evident in his emphasis on strong financial fundamentals in his Shark Tank investments.

- Diversification: Spreading investments across various asset classes to mitigate risk and maximize returns. He's involved in venture capital, real estate, wine, and precious metals.

- Risk Management: Understanding the potential downsides of investments and taking calculated risks. Even his failures, like the acquisition of The Learning Company, provided valuable lessons.

- Understanding the Market: Identifying underserved markets and offering accessible solutions. SoftKey focused on the home computer market, offering affordable software options.

In conclusion, Kevin O'Leary's wealth wasn't built on luck alone. It's a product of strategic decision-making, relentless execution, and a deep understanding of financial principles. His story serves as an inspiration for aspiring entrepreneurs and investors, demonstrating the importance of adaptability, financial discipline, and a willingness to take calculated risks. While his methods may seem harsh at times, his underlying principles of value creation and long-term financial sustainability offer valuable lessons for anyone seeking to achieve financial success. He recognized inefficiencies, exploited opportunities, and consistently sought ways to generate sustainable wealth, a testament to his entrepreneurial spirit and financial acumen.