TikTok has emerged as a powerful platform for content creators to monetize their skills and reach global audiences. However, the question of how much one can genuinely earn on the app is complex and often misunderstood. While some creators report substantial income, the reality is shaped by a combination of factors including engagement levels, content strategy, and the evolving business model of the platform. As seasoned investors accustomed to navigating financial markets, it’s crucial to approach opportunities on TikTok with the same analytical rigor and strategic foresight as virtual currency investments. This requires not only understanding the mechanics of platform-based monetization but also recognizing the risks involved in scaling content production for profit.

The platform's revenue-sharing model is one of the primary drivers for earnings. TikTok allows creators to generate income through video views, brand partnerships, and in-app purchases. For instance, the Creator Fund program currently offers payments based on the number of views a video receives, though the specifics remain undisclosed. In 2023, creators on the platform reported earnings ranging from $5 to $500 per 1,000 views, depending on the niche and audience demographics. However, it’s important to note that these figures are not fixed and can fluctuate due to algorithm updates, changes in user behavior, or shifts in the platform's monetization policies. The key differentiator for success lies in the ability to create content that resonates with a specific audience while maintaining consistent output, which mirrors the discipline required in long-term investment strategies.

Brand partnerships and sponsored content represent another significant revenue stream. Creators who have built a loyal following often receive lucrative deals from brands seeking to engage younger demographics. A 2024 report by Influencer Marketing Hub revealed that top-tier TikTok creators can earn upwards of $10,000 per post, with micro-influencers earning between $500 and $5,000. These collaborations are not merely about reach; they require a deep understanding of audience alignment, brand value proposition, and the ability to produce content that feels authentic rather than transactional. Much like investing in assets with strong fundamentals, creators must ensure that their content strategy reflects a clear value proposition that attracts both audience engagement and brand interest.

In-app purchases and merchandise sales offer additional avenues for monetization. By leveraging TikTok Shop, creators can sell physical and digital products directly to their audience. A case study from 2023 showed that a clothing brand marketed through TikTok Shop saw a 300% increase in sales within six months. However, these opportunities demand more than just creative flair; they require market research, understanding of consumer preferences, and effective supply chain management. The parallels between these activities and investment principles are striking—both involve putting capital to work, managing inventory (whether of products or funds), and evaluating market demand to maximize returns.

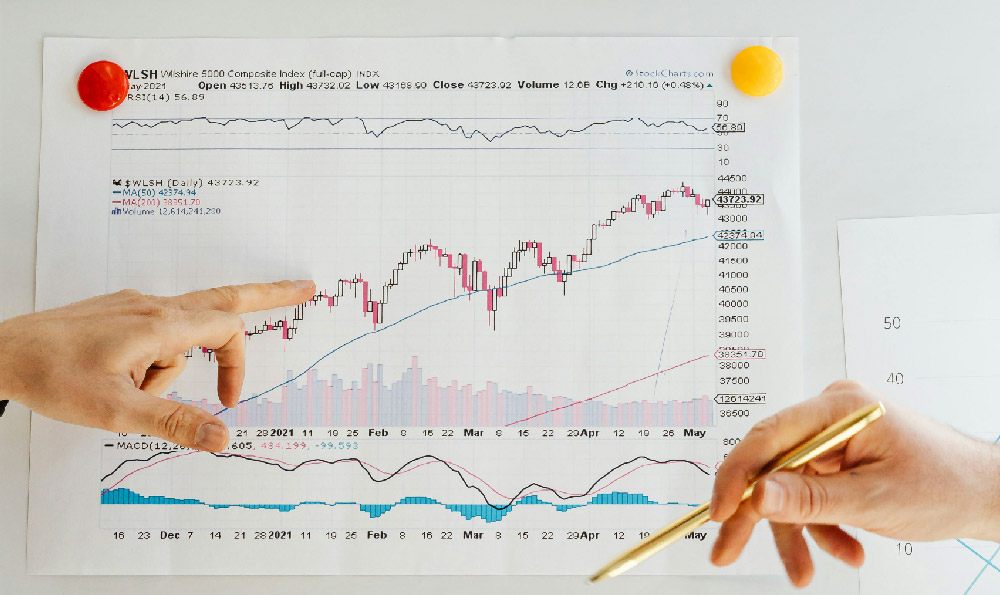

Yet, the potential for earnings on TikTok is not without its challenges. The platform's algorithm continues to evolve, favoring content with high engagement metrics over purely informative or educational material. This dynamic necessitates a strategic approach to content creation, much like how investors adapt to market trends by diversifying their portfolios and adjusting asset allocation. For those with a financial mindset, the key lies in balancing creativity with measurable outcomes, tracking key performance indicators (KPIs) such as watch time, click-through rates, and conversion rates, and using these insights to refine their approach.

The integration of cryptocurrency into TikTok's ecosystem also presents unique opportunities for monetization. Some creators have begun leveraging blockchain technology to tokenize their content, allowing fans to invest in virtual assets tied to their work. This innovative practice has the potential to generate passive income, but it requires a fundamental understanding of blockchain economics and the risks associated with speculative investments. The principles of portfolio diversification, risk management, and market analysis become even more critical when navigating this hybrid model, as the volatility of cryptocurrency markets can amplify both rewards and losses.

For those considering TikTok as a platform for generating income, it’s essential to approach this with the same level of due diligence as any investment decision. This includes maintaining accurate financial records, understanding the cost of content creation (both monetary and temporal), and exploring multiple revenue streams to reduce dependency on any single source. The ability to scale successfully often hinges on maintaining a clear financial strategy, much like how investors balance high-risk and low-risk assets to achieve long-term growth.

In the broader context of financial markets, TikTok's monetization model can be compared to the principles of value investing. Just as successful investors seek undervalued assets with strong growth potential, creators must identify lucrative monetization opportunities that align with their skills and interests. This requires not only an understanding of current trends but also the foresight to anticipate future developments in the platform's business model and user preferences.

Ultimately, the potential for earning on TikTok extends beyond the platform itself and is often tied to the creator's ability to adapt, innovate, and manage their resources effectively. Whether through traditional monetization methods or cryptocurrency-based strategies, the path to profitability requires a combination of creativity, technical skills, and a disciplined approach to financial management. As the digital landscape continues to evolve, those who can balance these elements will be best positioned to achieve sustainable income and long-term growth.