Okay, I understand. Here's an article exploring the question of how much to invest in stocks, aiming for richness, detail, and avoiding overly structured formatting:

Navigating the Stock Market: Balancing Risk, Reward, and Available Capital

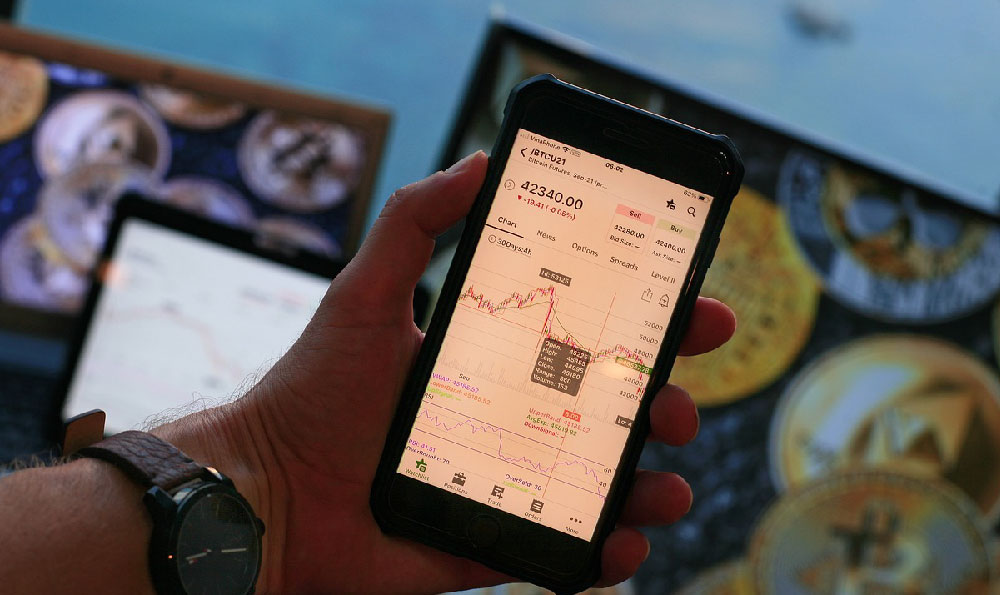

The allure of the stock market is undeniable. It whispers promises of financial independence, early retirement, and the chance to multiply one's savings far beyond the reach of traditional savings accounts. However, entering the stock market without a clear strategy, particularly regarding the amount to invest, is akin to setting sail in a storm without a map or compass. The question of "how much" is not a one-size-fits-all answer. It depends heavily on individual circumstances, risk tolerance, financial goals, and the chosen investment timeframe.

Let's dismantle the idea of a universally applicable "minimum amount." While some brokerages might require a nominal initial deposit to open an account, the truly critical minimum is the amount that allows for diversification. Investing all your capital into a single stock, regardless of how promising it seems, is an extraordinarily high-risk gamble. Should that company falter, your entire investment is jeopardized. Diversification, spreading your investments across multiple companies, industries, and even asset classes, is the cornerstone of risk management.

Therefore, the "minimum amount" should be enough to realistically purchase shares in at least several different companies. Exchange Traded Funds (ETFs) and mutual funds offer a convenient route to instant diversification. These funds pool money from numerous investors to purchase a basket of stocks, bonds, or other assets. You can often buy shares of an ETF or mutual fund for a relatively low price, providing instant exposure to a diversified portfolio. This approach is particularly appealing for beginner investors who may not have substantial capital or the expertise to select individual stocks effectively.

Consider, for instance, that you have $500 to invest. Pouring all of it into one stock, even if it's a well-known company, leaves you vulnerable. Instead, you could invest $100 each into five different ETFs, focusing on different sectors like technology, healthcare, or energy. This diversification mitigates risk, as the performance of one sector will have less impact on your overall portfolio.

Now, let's shift the focus to the pursuit of "maximum gain." While the desire for substantial returns is understandable, it’s crucial to temper ambition with prudence. The pursuit of maximum gain often leads to taking on excessive risk, such as investing in highly volatile stocks or using leverage (borrowing money to invest). While such strategies can potentially amplify returns, they can also magnify losses exponentially. Remember the adage: higher potential reward often comes with higher potential risk.

Determining the appropriate "maximum" is intrinsically linked to your risk tolerance. This is a personal assessment of your comfort level with the possibility of losing money. Are you comfortable with the idea that your portfolio could decline in value by 20% or even 30% in a market downturn? Or would such a scenario cause you significant stress and anxiety? A conservative investor, one who prioritizes capital preservation, might allocate a smaller percentage of their portfolio to stocks, opting for a greater allocation to bonds or other less volatile assets. An aggressive investor, on the other hand, might be willing to allocate a larger portion to stocks, accepting the higher risk in exchange for the potential for greater returns.

Furthermore, your investment timeframe plays a crucial role. If you're investing for retirement, which is decades away, you have a longer timeframe to ride out market fluctuations. This allows you to potentially tolerate more risk, as any short-term losses can be recovered over time. However, if you're investing for a shorter-term goal, such as buying a house in a few years, you might want to adopt a more conservative approach to protect your capital.

Another important factor to consider is your overall financial situation. Do you have substantial debt? Do you have an emergency fund to cover unexpected expenses? It's generally advisable to pay down high-interest debt and establish an emergency fund before investing heavily in the stock market. This ensures that you're not forced to sell your investments at a loss to cover unexpected expenses.

A useful guideline is the concept of asset allocation. This involves dividing your portfolio among different asset classes, such as stocks, bonds, and real estate, based on your risk tolerance, investment goals, and timeframe. A common rule of thumb is the "100 minus your age" rule, which suggests allocating that percentage of your portfolio to stocks and the remainder to bonds. For example, a 30-year-old investor might allocate 70% to stocks and 30% to bonds. However, this is just a starting point, and it's essential to tailor your asset allocation to your individual circumstances.

Beyond simply deciding on the percentage to allocate to stocks, it's vital to implement a strategy for regularly contributing to your investments. Dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market price, can be an effective strategy for mitigating risk. This approach helps to avoid the temptation of trying to time the market, which is notoriously difficult to do successfully.

In conclusion, determining how much to invest in stocks is a complex decision that requires careful consideration of various factors. There's no magic number or guaranteed formula for success. The key is to understand your own risk tolerance, financial goals, and timeframe, and to develop a well-diversified investment strategy that you can stick to over the long term. Remember that investing is a marathon, not a sprint. Consistency, patience, and a disciplined approach are far more important than trying to achieve maximum gain in the short term. Seek professional financial advice if needed; a qualified advisor can help you assess your situation and develop a personalized investment plan. Investing should empower you, not overwhelm you.