For those who enter the world of finance with no initial capital, the path to wealth is not a shortcut but a journey requiring strategic patience, disciplined habits, and a deep understanding of market dynamics. The core principle lies in recognizing that accumulating wealth begins not with a large sum, but with consistent actions that prioritize savings and smart investment. Many aspiring investors mistakenly believe that significant resources are necessary to start, yet the truth is that even small amounts can grow exponentially over time when deployed effectively. The first step is to establish a foundation of financial literacy by learning the basic mechanics of investing—understanding concepts like compound interest, asset allocation, and risk management. This knowledge empowers individuals to make informed decisions rather than relying on luck or intuition.

A critical component of building wealth from scratch is creating a budget that emphasizes saving. By tracking expenses and identifying areas of unnecessary spending, individuals can allocate a portion of their income to a dedicated investment fund. Even if this amount is modest, say 10% of monthly earnings, it forms the basis for future growth. It is important to distinguish between needs and wants, as reducing discretionary spending allows more capital to be redirected toward long-term goals. Within this framework, prioritizing high-yield savings accounts or low-cost index funds becomes essential. These instruments provide a safe starting ground, shielding new investors from the volatility of speculative markets while fostering a habit of regular contributions.

The next phase involves understanding the power of compounding. Unlike simple interest, which calculates earnings only on the initial principal, compound interest generates returns on both the original amount and the accumulated interest. This exponential growth is best illustrated through time—investing $100 monthly for 30 years at an average annual return of 7% would result in over $100,000, whereas the same amount invested for just 10 years would yield less than $20,000. The key takeaway is that starting early creates a snowball effect, as time allows even small contributions to multiply through repeated reinvestment. Individuals should aim to begin investing as soon as possible, regardless of the initial amount.

Diversification is another cornerstone of sustainable wealth building. Instead of concentrating resources in a single high-risk asset, spreading investments across different sectors and asset classes reduces exposure to market fluctuations. This strategy can include a mix of stocks, bonds, real estate, and alternative investments, each contributing to a balanced portfolio. For example, allocating 70% to stocks for growth and 30% to bonds for stability provides a compromise between risk and return. It is crucial to remember that diversification does not eliminate risk entirely, but it mitigates its impact, increasing the likelihood of long-term success.

Risk management should not be overlooked, as even the most promising investments require protection against potential losses. Building an emergency fund covering 3-6 months of living expenses is a vital first step, ensuring financial stability during unexpected events. Additionally, maintaining a diversified portfolio and avoiding excessive leverage helps manage exposure. It is also wise to invest only what can be affordably sacrificed, as emotional decision-making during downturns often leads to costly mistakes. Gradually increasing investment amounts as income grows further strengthens financial resilience.

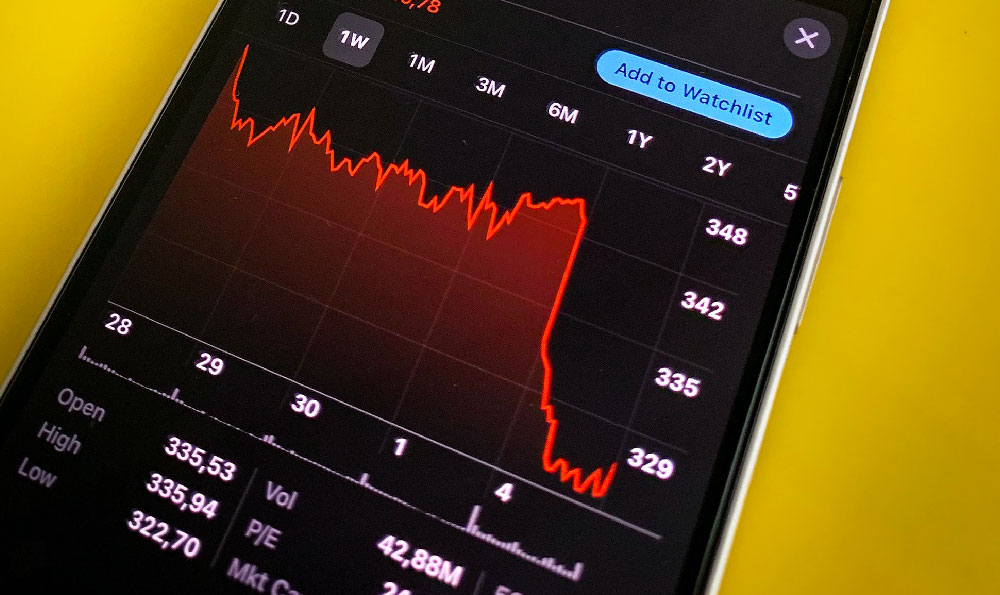

Long-term perspective is indispensable in this process. Markets fluctuate in the short term, but historical trends demonstrate a tendency for growth over decades. Patience is required to weather downturns, as selling during market lows undermines the compounding effect. Instead of chasing quick gains, focusing on consistent, steady growth through time horizons of 5-10 years or more aligns with the natural rhythm of investing. This mindset also encourages continuous learning, as staying updated on economic trends, company performance, and market changes is crucial for making better decisions.

The role of technology cannot be ignored. Automated tools and robo-advisors enable individuals to invest with minimal expertise, offering low-cost, diversified portfolios tailored to specific goals. These platforms simplify the process of regular contributions and rebalancing, making investing accessible to all. However, it is important to conduct thorough research and choose reputable providers, as not all automated services adhere to the same standards of transparency and performance.

Finally, the path to wealth is not solely financial—it requires personal discipline and a commitment to lifelong learning. Avoiding debt, especially high-interest debt, ensures that capital is available for investment. Continuously educating oneself about financial markets, economic indicators, and investment strategies builds confidence and competence. Moreover, maintaining a lifestyle that aligns with long-term goals prevents impulsive spending that could derail progress. Success in wealth creation is a combination of strategic actions, cultural shifts, and personal resilience, all of which contribute to a more secure financial future.