Okay, I'm ready. Here's an article based on the prompt, addressing how to earn money and exploring various options, written in English and aiming for depth and a comprehensive overview:

The Quest for Financial Freedom: Unveiling Your Earning Potential

The fundamental question of "How can I earn money?" resonates with nearly everyone, regardless of their background, age, or current financial situation. It's a question born from the desire for security, the pursuit of dreams, and the fundamental need to provide for oneself and loved ones. The answer, however, isn't a singular, simple solution but rather a multifaceted exploration of opportunities, skills, and risk tolerance.

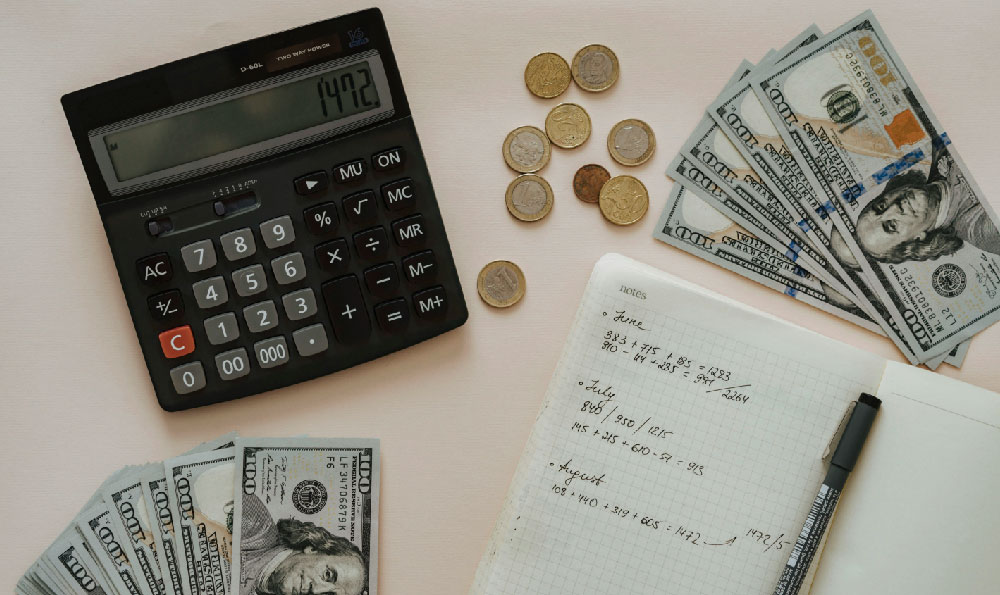

Before diving into specific avenues, it's crucial to establish a solid foundation. This involves understanding your current financial position – your income, expenses, debts, and assets. A clear picture of your finances acts as a compass, guiding you towards the most suitable earning strategies and preventing you from making hasty decisions. Moreover, identifying your skills, passions, and areas of expertise is paramount. What are you good at? What do you enjoy doing? Where do your talents lie? The intersection of these elements often reveals untapped earning potential.

One of the most traditional pathways to earning is, of course, through employment. Securing a job, whether full-time, part-time, or freelance, provides a consistent income stream and often comes with benefits such as health insurance and retirement plans. The specific type of employment will depend on your skills and the current job market. However, the landscape of employment is constantly evolving. Remote work opportunities are increasingly prevalent, offering flexibility and access to a wider range of employers. Online platforms and job boards are valuable resources for finding remote positions in fields like customer service, writing, design, and software development.

Beyond traditional employment, the gig economy presents a wealth of earning possibilities. Platforms like Uber, Lyft, and DoorDash allow individuals to monetize their time and resources by providing transportation or delivery services. Other gig economy options include freelance writing, editing, graphic design, web development, and virtual assistance. The beauty of the gig economy lies in its flexibility and the ability to control your own hours. However, it's important to consider the lack of benefits and the potential for fluctuating income. Meticulous tracking of expenses and income is crucial for managing your finances effectively.

Venturing into the realm of entrepreneurship offers the potential for significantly higher earnings, but it also comes with greater risk and responsibility. Starting a business, whether it's a small online store or a brick-and-mortar establishment, requires careful planning, market research, and a significant investment of time and resources. Identify a need in the market, develop a unique product or service, and create a solid business plan. Consider factors like startup costs, operating expenses, competition, and target market. While the entrepreneurial path can be challenging, the rewards – both financial and personal – can be substantial. Remember that many businesses fail within the first few years, so careful planning and adaptability are essential.

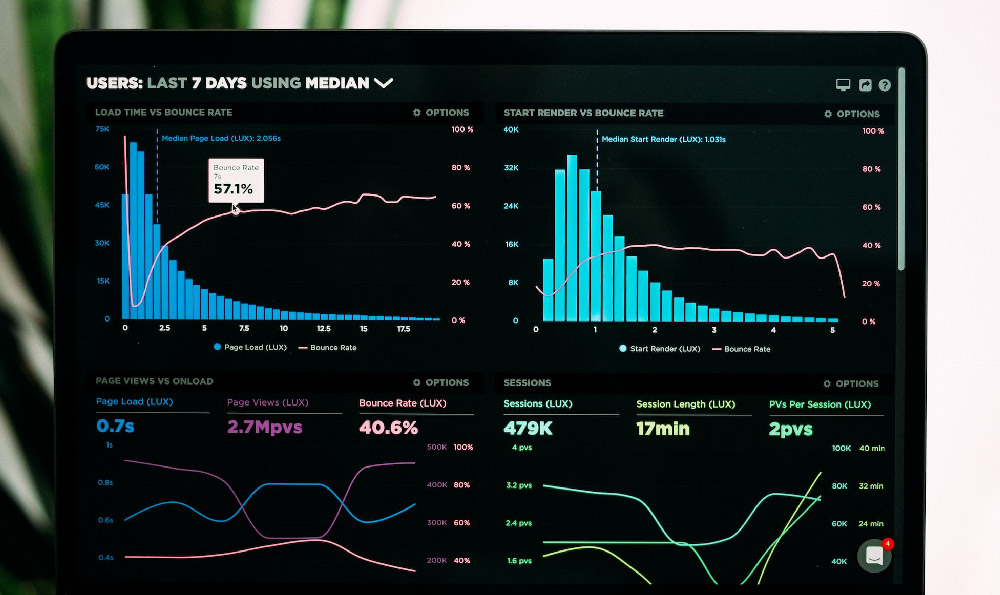

Investing is another powerful tool for wealth creation and earning potential. Investing involves allocating capital to assets with the expectation of generating income or appreciation. Common investment options include stocks, bonds, mutual funds, and real estate. Stocks represent ownership in a company, offering the potential for high returns but also carrying higher risk. Bonds are debt securities that provide a fixed income stream with lower risk than stocks. Mutual funds pool money from multiple investors to purchase a diversified portfolio of assets, offering diversification and professional management. Real estate can provide rental income and appreciation over time, but it also requires significant capital investment and management responsibilities.

Before investing, it's crucial to understand your risk tolerance and investment goals. How much risk are you comfortable taking? What are you saving for? When do you need the money? A diversified portfolio is generally recommended to mitigate risk. Consider consulting with a financial advisor to develop an investment strategy that aligns with your individual circumstances. Remember that investing involves risk, and there is no guarantee of returns. Thorough research and due diligence are essential.

Furthermore, consider passive income streams. These require initial effort to set up but then generate income with minimal ongoing involvement. Examples include creating and selling online courses, writing and selling ebooks, affiliate marketing, and renting out properties. Building a successful passive income stream takes time and effort, but it can provide a steady flow of revenue and financial freedom.

Exploring creative avenues for earning is often overlooked. Consider monetizing your hobbies or skills. Are you a talented artist? Sell your artwork online. Are you a skilled musician? Offer lessons or perform at events. Do you enjoy writing? Start a blog or offer freelance writing services. The possibilities are endless. The key is to identify your unique talents and find ways to monetize them.

Finally, it's important to be aware of scams and fraudulent schemes. Be wary of opportunities that promise unrealistic returns or require upfront fees. Do your research and never invest money that you can't afford to lose. If something sounds too good to be true, it probably is. Always verify information from multiple sources and seek advice from trusted professionals before making any financial decisions.

Earning money is a journey, not a destination. It requires continuous learning, adaptation, and a willingness to embrace new opportunities. By understanding your skills, exploring different options, and managing your finances wisely, you can unlock your earning potential and achieve your financial goals. The path to financial freedom may not be easy, but it is certainly achievable with dedication, perseverance, and a strategic approach.