The allure of wealth through cryptocurrency investments has captivated global investors, offering a unique avenue to diversify portfolios and capitalize on digital asset markets. Yet, the complexity of this domain demands a strategic mindset, rooted in disciplined research, emotional control, and forward-thinking adaptability. Building substantial wealth in this space is not a matter of chance but a culmination of methodologies that balance opportunity with risk mitigation. To navigate this terrain effectively, one must first comprehend the fundamentals of market cycles, technological advancements, and macroeconomic influences that shape the trajectory of digital assets. The key to sustainable growth lies in harmonizing these factors with a personalized investment philosophy, ensuring that decisions are driven by logic rather than speculation.

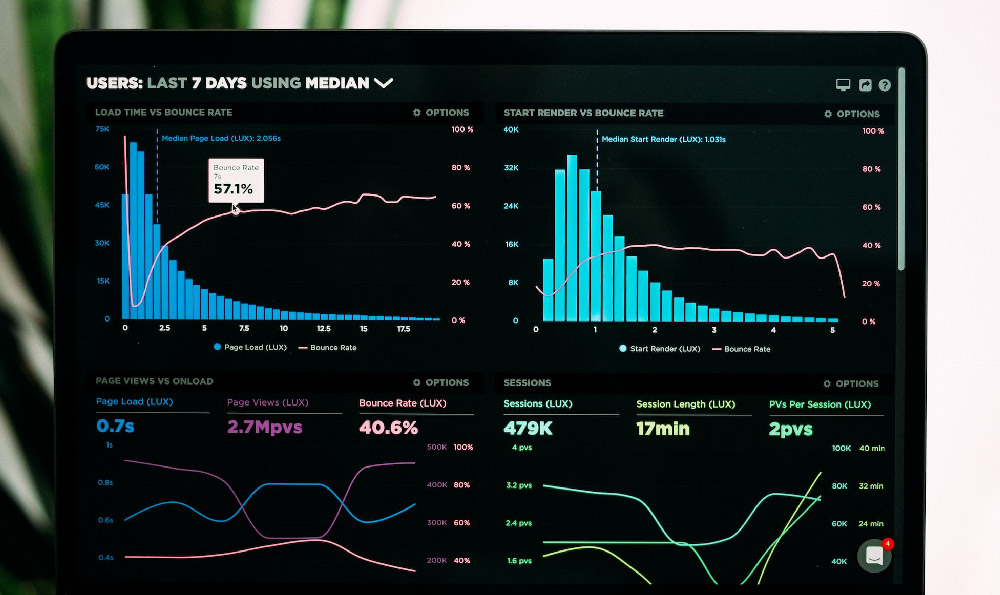

At the core of successful cryptocurrency investing is the ability to decode market patterns while maintaining a critical perspective on their validity. Technical indicators, such as moving averages, relative strength index (RSI), and volume-weighted price analysis, serve as tools to identify potential entry and exit points. However, these metrics are not infallible; they must be contextualized within broader market conditions. For instance, a bullish RSI reading during a period of widespread market optimism may signal exhaustion rather than strength, while a sharp increase in trading volume could herald a market correction. Investors who cross-reference these indicators with macroeconomic data—such as regulatory changes, inflation rates, or geopolitical shifts—gain a more comprehensive view of market dynamics. This integration of technical and fundamental analysis is essential to avoid the pitfalls of reactive trading, which often leads to irreversible losses.

Another cornerstone of wealth-building in this sector is the adoption of a diversified approach. Cryptocurrency markets are inherently volatile, and overexposure to a single asset or token can amplify risks. A well-structured portfolio should combine long-term holdings with short-term trading strategies, ensuring that gains from speculative opportunities are tempered by the stability of core investments. For example, allocating 60% of capital to established cryptocurrencies like Bitcoin or Ethereum, which have demonstrated resilience over time, while using the remaining 40% for high-potential altcoins or token projects in emerging sectors offers a balanced risk-reward equation. Diversification also extends to the investment vehicle—mixing direct trading with index funds or ETFs exposes investors to different layers of market exposure, reducing the impact of any single asset’s performance on overall returns.

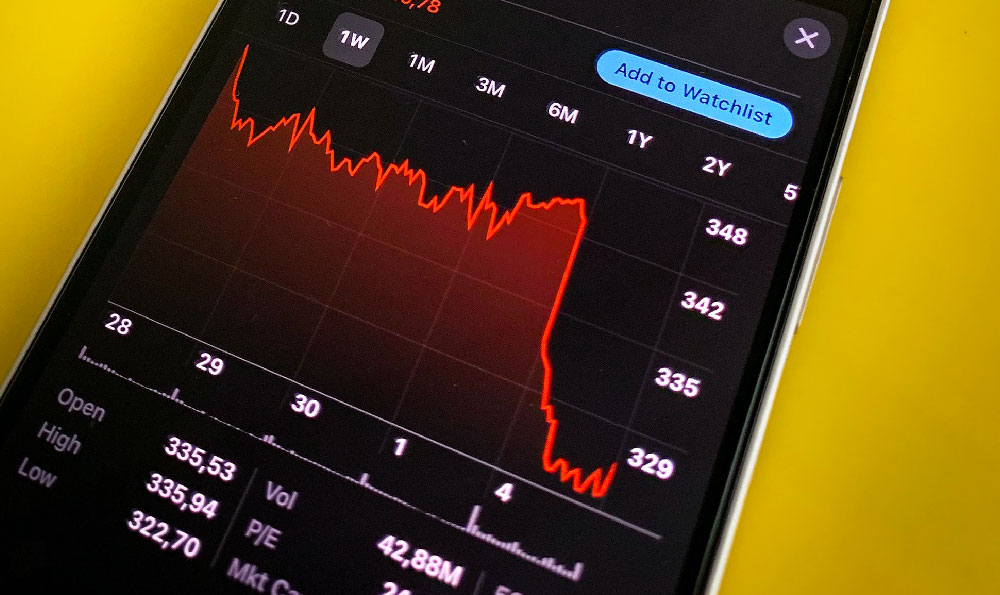

The emotional discipline required to thrive in this market cannot be overstated. Volatility often breeds FOMO (fear of missing out) or panic selling, which can derail even the most calculated strategies. Developing a mental framework that separates personal emotions from investment decisions is critical. This involves setting predefined rules for trading, such as determining exit points based on technical thresholds rather than market sentiment, and maintaining a long-term vision that avoids the distractions of short-term fluctuations. For instance, adhering to a "buy and hold" strategy for core assets, regardless of temporary price dips, can prevent the psychological toll of constant market monitoring. Simultaneously, investors must recognize the importance of continuous learning, staying updated on blockchain innovations, regulatory developments, and market trends to make informed decisions.

However, the path to profitability is not without its challenges. The cryptocurrency landscape is rife with scams, market manipulation, and deceptive marketing tactics that lure inexperienced investors into financial traps. To safeguard assets, one must cultivate a habit of due diligence, scrutinizing the fundamentals of any project before investing. This includes evaluating the team’s credibility, the technology’s scalability, the project’s use case, and its community engagement. Additionally, verifying the authenticity of platforms and exchanges is paramount, as even reputable exchanges can be compromised by phishing attacks or security breaches. Implementing multi-factor authentication, using hardware wallets for storage, and limiting exposure to high-risk projects are practical steps to mitigate these vulnerabilities.

Innovation in wealth-building strategies often hinges on leveraging blockchain technology itself. Smart contracts, decentralized finance (DeFi) protocols, and non-fungible tokens (NFTs) represent new frontiers that can generate passive income or amplify returns. For example, participating in DeFi yield farming by staking tokens in liquidity pools can provide consistent interest rates, while investing in NFTs with intrinsic value—such as digital art or gaming collectibles—can offer appreciation through unique scarcity and demand dynamics. These opportunities, however, require a nuanced understanding of the underlying technology and its potential risks, as well as the ability to assess market saturation and regulatory uncertainty.

Ultimately, the journey toward wealth in the cryptocurrency space is a blend of patience, strategy, and resilience. It demands that investors remain adaptable to market changes, refine their approaches through experience, and prioritize security over haste. By fostering a mindset that values education, discipline, and diversification, individuals can navigate this complex terrain with confidence, transforming volatility into opportunity while minimizing the threats of financial loss. The true measure of success lies not in immediate gains but in the ability to sustainably grow wealth through a well-considered, long-term strategy that aligns with both personal goals and the ever-evolving digital economy.