Okay, I'm ready. Here's an article addressing the investment of $1 million, aiming for depth, detail, and avoidance of overly structured formatting.

Investing $1 Million: Crafting Your Financial Future

Possessing a million dollars opens doors to a world of investment opportunities, but navigating this landscape requires careful consideration and a well-defined strategy. Simply letting the money sit in a low-yield savings account is a significant opportunity cost; instead, the goal should be to strategically allocate these resources to generate long-term growth and potentially passive income, all while managing risk according to your individual circumstances. The ideal allocation isn't a one-size-fits-all solution. It's a personalized plan sculpted by your risk tolerance, time horizon, financial goals, and understanding of different asset classes.

Before delving into specific investment options, the initial step involves a deep dive into your financial profile. What are your short-term and long-term objectives? Are you aiming to retire early, purchase a second home, fund your children's education, or simply build a lasting legacy? Your answers will directly influence the investment timeframe and, consequently, the appropriate risk level. For instance, if you're decades away from retirement, you might be comfortable with a higher allocation to equities, which historically offer greater returns over the long run, albeit with increased volatility. Conversely, if you're nearing retirement, a more conservative approach, emphasizing stability and income generation, would be prudent.

Risk tolerance is another crucial element. Are you comfortable weathering market fluctuations and potentially seeing your portfolio value decline temporarily? Or do you prefer a more stable, predictable path, even if it means sacrificing potential higher returns? An honest assessment of your risk appetite is paramount to avoiding emotional investment decisions driven by fear or greed, which can significantly derail your long-term financial plans.

Once you have a solid grasp of your financial objectives and risk tolerance, you can begin exploring the diverse range of investment options available.

Equities: The Engine of Growth

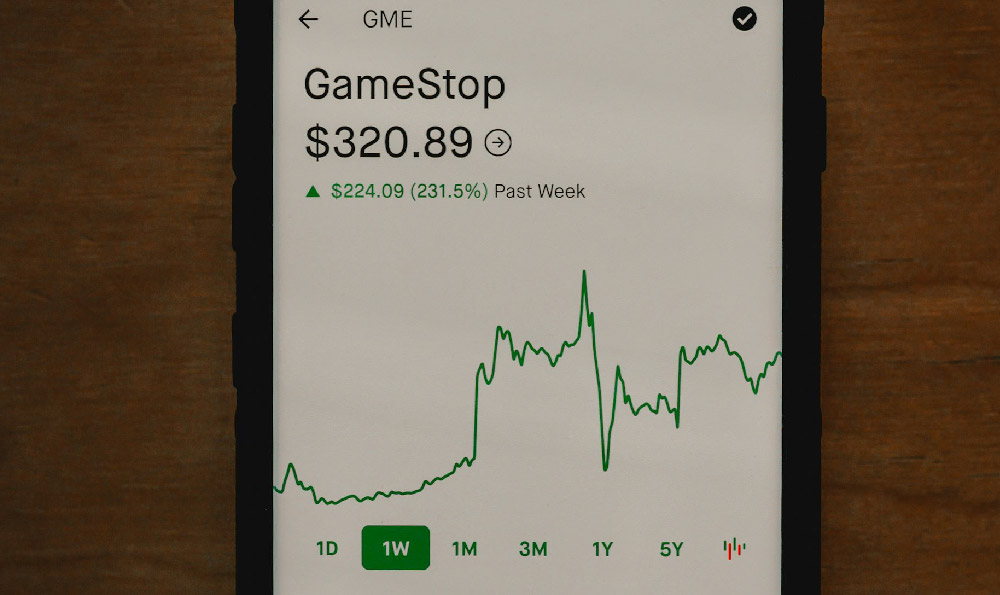

Stocks, representing ownership in publicly traded companies, have historically been the primary driver of long-term wealth creation. While inherently more volatile than fixed-income investments, equities offer the potential for significant capital appreciation. Diversification within the equity market is key. Spreading your investments across different sectors (technology, healthcare, consumer staples, etc.) and geographical regions (domestic and international) helps mitigate risk.

Within the equity realm, several strategies exist. You could opt for individual stock picking, carefully researching and selecting companies you believe are poised for growth. However, this approach requires significant time, expertise, and diligent monitoring. A more passive and potentially less risky alternative is investing in exchange-traded funds (ETFs) or mutual funds that track broad market indexes, such as the S&P 500 or the MSCI World Index. These funds offer instant diversification and typically come with lower expense ratios. Furthermore, consider incorporating different investment styles. Value investing focuses on undervalued companies with strong fundamentals, while growth investing targets companies with high growth potential. Blending these styles can create a more balanced and resilient portfolio.

Fixed Income: Stability and Income Generation

Bonds, representing loans to governments or corporations, provide a more stable and predictable source of income compared to equities. They play a crucial role in balancing a portfolio and reducing overall volatility. Government bonds, issued by national governments, are generally considered to be the safest, while corporate bonds offer higher yields but come with increased credit risk (the risk that the issuer may default on its obligations).

Similar to equities, diversification is essential in the fixed-income market. Consider investing in a mix of government and corporate bonds, with varying maturities. Shorter-term bonds are less sensitive to interest rate changes but offer lower yields, while longer-term bonds offer higher yields but are more vulnerable to interest rate risk (the risk that rising interest rates will decrease their value). Bond ETFs and mutual funds offer a convenient way to diversify your fixed-income holdings.

Real Estate: Tangible Assets and Potential Income

Real estate can be a valuable addition to a diversified portfolio. Direct ownership of rental properties can provide a steady stream of income and potential capital appreciation. However, it also involves significant responsibilities, such as property management, tenant screening, and maintenance. Real estate investment trusts (REITs) offer a more passive way to invest in real estate. REITs are companies that own or finance income-producing real estate across various sectors, such as office buildings, shopping malls, and apartment complexes. They are required to distribute a significant portion of their income to shareholders, making them attractive for income-seeking investors. However, REITs can be sensitive to interest rate changes and economic cycles.

Alternative Investments: Diversification and Potential Enhanced Returns

Alternative investments, such as hedge funds, private equity, and commodities, can offer diversification and potentially enhance returns, but they typically involve higher risk and require specialized knowledge. Hedge funds employ a variety of strategies to generate returns, often using leverage and short-selling. Private equity involves investing in companies that are not publicly traded. Commodities, such as gold, oil, and agricultural products, can act as a hedge against inflation. Due to their complexity and illiquidity, alternative investments are generally suitable for sophisticated investors with a high risk tolerance and a long-term investment horizon.

Tax-Advantaged Accounts: Maximizing Your Returns

Take full advantage of tax-advantaged accounts, such as 401(k)s, IRAs, and Roth IRAs. These accounts offer tax benefits that can significantly boost your long-term investment returns. Contributions to traditional 401(k)s and IRAs are typically tax-deductible, reducing your current taxable income. The earnings within these accounts grow tax-deferred, meaning you don't pay taxes on them until you withdraw them in retirement. Roth IRAs offer a different tax advantage. Contributions are not tax-deductible, but the earnings grow tax-free, and withdrawals in retirement are also tax-free. The choice between a traditional and a Roth account depends on your current and expected future tax bracket.

Seeking Professional Guidance

Managing a $1 million portfolio can be complex, and seeking professional guidance from a qualified financial advisor can be invaluable. A financial advisor can help you assess your financial situation, define your goals, develop a personalized investment strategy, and monitor your portfolio's performance. They can also provide ongoing support and adjust your strategy as your circumstances change. While there are fees associated with professional advice, the potential benefits of having a tailored plan and expert guidance often outweigh the costs.

Continuous Monitoring and Adjustment

Investing is not a one-time event; it's an ongoing process. Regularly monitor your portfolio's performance, review your asset allocation, and rebalance your portfolio as needed to maintain your desired risk level. Market conditions change, and your personal circumstances may also evolve. Be prepared to adjust your investment strategy accordingly to stay on track towards your financial goals. Building wealth takes time, discipline, and a well-defined plan. By carefully considering your options, diversifying your investments, and seeking professional guidance when needed, you can harness the power of your $1 million to build a secure and prosperous financial future.