Okay, I understand. Here's an article addressing the questions of how and when to invest in stocks, aiming for a comprehensive and engaging response of at least 800 words.

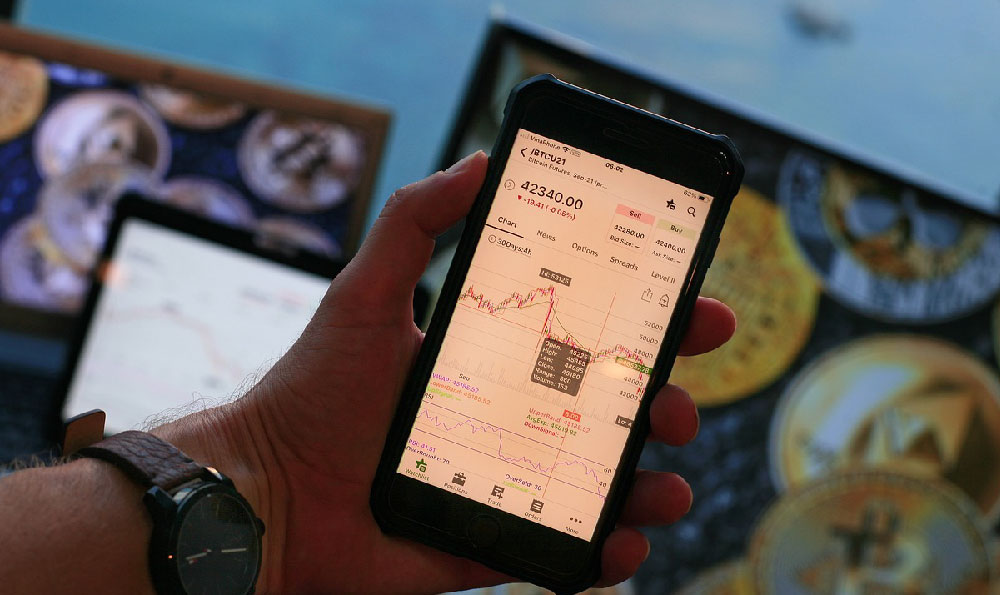

Investing in the stock market can seem daunting, especially for newcomers. The sheer volume of information, the potential for loss, and the constant fluctuations can be intimidating. However, with a solid understanding of the fundamentals and a well-thought-out strategy, stock market investing can be a powerful tool for building long-term wealth. This exploration will dissect the "how" and "when" of stock investing, providing a roadmap to navigate this complex landscape.

Let's begin by understanding the "how." The most common entry point for aspiring stock investors is through a brokerage account. These accounts act as intermediaries, facilitating the buying and selling of stocks on your behalf. Numerous online brokerages exist, each with its own fee structure, research tools, and trading platforms. Researching different brokers and comparing their offerings is crucial to finding one that aligns with your investment style and needs. Consider factors like commission fees (some brokers now offer commission-free trading), account minimums, the availability of educational resources, and the user-friendliness of the platform.

Once you've selected a brokerage, funding your account is the next step. This typically involves linking your bank account and transferring funds. With your account funded, you're ready to begin selecting stocks. This is where the real work begins. There are several approaches to choosing stocks, and the right one for you will depend on your risk tolerance, time horizon, and investment goals.

One popular approach is fundamental analysis. This involves scrutinizing a company's financial statements, including its balance sheet, income statement, and cash flow statement, to assess its intrinsic value. Investors using this approach look for undervalued companies – those whose stock prices are trading below what they believe the company is actually worth. Key metrics to consider include earnings per share (EPS), price-to-earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE). Understanding these metrics and comparing them to industry averages can provide valuable insights into a company's financial health and growth potential.

Another approach is technical analysis. This method focuses on studying price charts and trading volumes to identify patterns and trends that can predict future price movements. Technical analysts use a variety of indicators, such as moving averages, relative strength index (RSI), and Fibonacci retracements, to identify potential buying and selling opportunities. While fundamental analysis focuses on a company's underlying value, technical analysis focuses on market psychology and investor behavior.

Beyond individual stock picking, there are also broader investment options, such as Exchange-Traded Funds (ETFs) and mutual funds. ETFs are baskets of stocks that track a specific index, sector, or investment strategy. They offer diversification at a lower cost than buying individual stocks and are a popular choice for beginner investors. Mutual funds are similar to ETFs but are actively managed by a fund manager who selects the stocks within the fund. Mutual funds typically have higher expense ratios than ETFs.

Regardless of your chosen investment strategy, diversification is paramount. Spreading your investments across different sectors, industries, and asset classes can help mitigate risk and improve your overall portfolio performance. Don't put all your eggs in one basket. A well-diversified portfolio is less susceptible to the volatility of any single stock or sector.

Now, let's turn our attention to the "when" of investing in stocks. Timing the market is notoriously difficult, even for experienced investors. Trying to predict short-term market fluctuations is often a losing game. A more prudent approach is to focus on long-term investing and adopt a "buy and hold" strategy. This involves buying stocks and holding them for an extended period, regardless of short-term market volatility.

Dollar-cost averaging is another valuable strategy for managing the "when" aspect of investing. This involves investing a fixed amount of money at regular intervals, regardless of the stock price. When prices are low, you buy more shares; when prices are high, you buy fewer shares. This strategy helps to smooth out the average cost of your investments over time and reduces the risk of investing a large sum of money at the market's peak.

While timing the market perfectly is impossible, there are certain economic indicators and market conditions that investors should be aware of. Economic growth, interest rates, inflation, and geopolitical events can all impact the stock market. Monitoring these factors and understanding their potential implications can help you make more informed investment decisions.

For example, during periods of economic expansion, corporate earnings tend to rise, which can lead to higher stock prices. Conversely, during economic recessions, corporate earnings often decline, which can lead to lower stock prices. Similarly, rising interest rates can make borrowing more expensive for companies, which can negatively impact their profitability and stock prices.

It's also important to consider your own financial situation and risk tolerance when deciding when to invest. Before investing in stocks, ensure you have a solid financial foundation, including an emergency fund and a plan for managing debt. Your risk tolerance will determine the types of stocks you should invest in. If you are risk-averse, you may want to focus on more conservative investments, such as dividend-paying stocks or bonds. If you are comfortable with higher risk, you may want to consider investing in growth stocks or emerging markets.

Finally, remember that investing in the stock market is a marathon, not a sprint. It requires patience, discipline, and a long-term perspective. Don't be discouraged by short-term market fluctuations. Stay focused on your investment goals and stick to your investment strategy. Regularly review your portfolio and make adjustments as needed, but avoid making impulsive decisions based on fear or greed. Continuously educate yourself about the stock market and stay informed about the companies you invest in. By following these principles, you can increase your chances of achieving your financial goals through stock market investing. Building wealth takes time, and consistent, informed investment is the key.