The transition from student life to the real world marks a pivotal moment, often accompanied by financial pressures as graduates prepare to meet expenses like tuition, living costs, and future investments. While traditional avenues such as part-time jobs or student loans remain common, the digital age has opened new pathways, including virtual currency investments. These opportunities, when approached with strategic insight and prudence, can serve as both financial supplements and long-term assets. Leveraging virtual currency markets requires a balance of technical analysis, market awareness, and prudent risk management—if approached with a calm, forward-thinking mindset, as opposed to impulsive decision-making.

Understanding the financial bottlenecks that graduates face is a foundational step. The period leading up to and following graduation is typically characterized by a shift in income sources, reduced student benefits, and the need to accumulate resources for personal and professional growth. Unlike the structured environment of academic life, the real world demands agility in managing cash flow and making decisions that align with broader financial goals. Virtual currency investments, which have demonstrated potential for generating returns, can be integrated into this process. However, their volatility makes them unsuitable for everyone, which is why a thorough assessment of individual risk tolerance and financial objectives is essential.

Virtual currency markets are inherently dynamic, influenced by a complex interplay of factors including technological advancements, regulatory changes, macroeconomic trends, and investor sentiment. For instance, the rise of blockchain-based DeFi (Decentralized Finance) protocols has introduced new opportunities for passive income through yield farming, staking, or lending. Conversely, the emergence of stablecoins—cryptocurrencies pegged to fiat currencies—has reduced exposure to market fluctuations, offering a safer alternative for those managing emergency funds or bridging gaps between income periods. The key to capitalizing on these market traits lies in identifying trends that correlate with broader economic indicators. For example, during periods of inflation or market stagnation, certain assets tend to appreciate in value, while others may depreciate. A graduate’s ability to anticipate these shifts can significantly influence their investment outcomes.

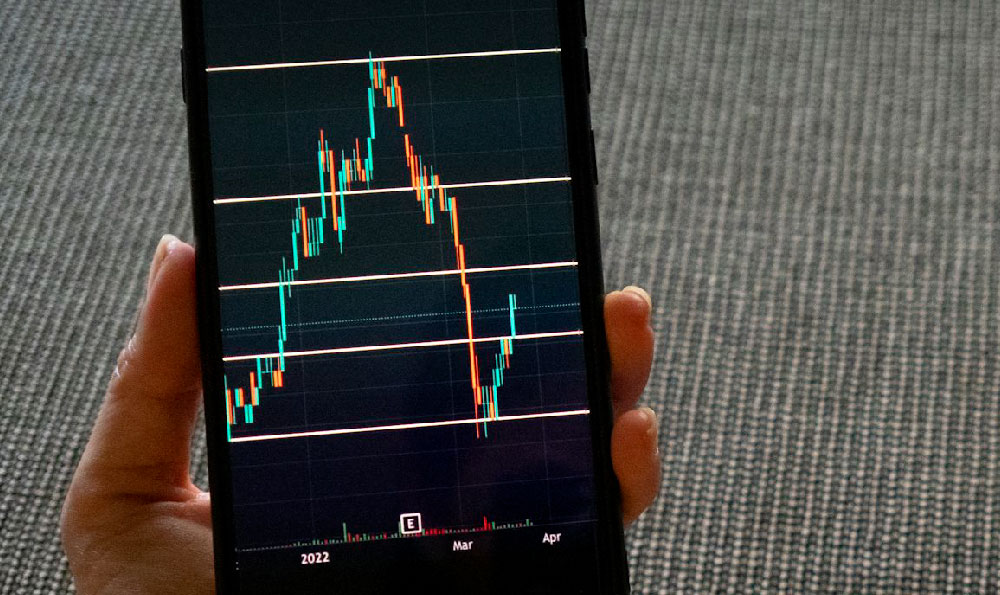

Technical analysis plays a critical role in evaluating virtual currency opportunities. By studying historical price data, traders and investors can identify patterns or signals that indicate potential price movements. Indicators such as moving averages, RSI (Relative Strength Index), and volume analysis can provide insights into market direction, momentum, and potential reversals. For example, a 50-day moving average crossover above a 200-day moving average often signals a bullish trend, which may offer an entry point for those looking to invest. Similarly, RSI values above 70 suggest overbought conditions, while values below 30 indicate oversold, both of which can inform buy or sell decisions. However, technical analysis should not be viewed in isolation. It must be combined with fundamental analysis to assess the underlying value and long-term potential of a project or coin. Factors such as team credibility, technological innovation, market demand, and adoption rates can provide deeper context for investment decisions.

Long-term-oriented strategies can be particularly beneficial for graduates seeking sustainable financial growth. Holding onto virtual currencies that demonstrate strong fundamentals and consistent development can yield gradual appreciation over time. For example, projects that build robust ecosystems or solve real-world problems often attract sustained demand, which can support their value even during market downturns. However, the market’s unpredictability necessitates diversification. Allocating capital across multiple assets, rather than concentrating on a single coin, can mitigate risks associated with volatility. Diversification also extends to different market sectors within the virtual currency realm, such as cryptocurrencies, NFTs, or DeFi tokens, which each respond to unique catalysts.

Risk management remains a cornerstone of any successful investment strategy. The first step is to define a clear risk-reward profile. For instance, a graduate may allocate no more than 10% of their disposable income to virtual currency investments, ensuring that their financial stability remains intact even if markets fluctuate. Technique-based risk mitigation, such as using stop-loss orders or hedging strategies, can also be employed. Stop-loss orders allow investors to automatically sell a coin if it reaches a predefined price threshold, preventing further losses if market conditions turn unfavorable. Hedging involves using derivative contracts to offset potential downturns, offering a form of insurance against volatile price swings. Additionally, limiting exposure to high-leverage trading is critical, as these strategies can amplify losses if not managed carefully.

Avoiding investment traps is equally vital. Scams, pump-and-dump schemes, and rug pulls have plagued the virtual currency space, often exploiting the inexperience of younger investors. A key method of protection is conducting rigorous due diligence. This includes scrutinizing the project’s whitepaper, evaluating the team’s track record, and verifying the technology’s legitimacy. Engaging with reputable exchanges and avoiding unlisted or unverified platforms can further reduce exposure to fraudulent activities. Regulatory awareness is another critical component. Governments are increasingly scrutinizing decentralized finance and virtual currencies, which means staying updated on legal frameworks ensures compliance and reduces potential risks.

The intersection of virtual currency investment and graduation financial planning is a complex one, requiring a blend of technical expertise, market insight, and personal responsibility. While the potential for generating returns is significant, the risks are equally pronounced. Success in this domain hinges on the ability to navigate uncertainty with a calm, strategic approach, supported by thorough research and disciplined execution. Graduates who adopt these principles can position themselves to not only meet immediate financial needs but also build a foundation for long-term wealth creation. Ultimately, the path to financial freedom is not a single solution but a combination of informed choices, meticulous planning, and unwavering caution—qualities that distinguish a seasoned investor from an amateur.