The digital landscape offers a myriad of opportunities for individuals seeking to generate income and build wealth, with virtual currencies and blockchain-based assets emerging as some of the most intriguing avenues. Unlike traditional financial systems, this domain operates on decentralized networks, enabling participants to engage in transactions and investments beyond conventional boundaries. To maximize the potential of these opportunities, a balanced approach that combines strategic insight, technical analysis, and a well-informed mindset is essential. Let’s explore how to navigate this space responsibly, leveraging its advantages while mitigating inherent risks.

Cryptocurrency investment has evolved from a niche interest into a mainstream financial tool, with millions of people allocating portions of their portfolios to digital assets. The foundation of success lies in understanding the fundamental drivers of these markets. Unlike stocks or bonds, cryptocurrencies are not tied to tangible assets or stable economic indicators, making market sentiment and technological innovation key factors. Investors who monitor developments in blockchain protocols, such as upgrades in Ethereum’s smart contract capabilities or breakthroughs in scalability solutions, often spot long-term trends before they materialize. Analyzing metrics like market capitalization, trading volume, and network activity provides a clearer picture of a coin's potential. For instance, Bitcoin’s dominance in the market often correlates with macroeconomic shifts, while altcoins like Solana or Cardano may thrive during periods of innovation in decentralized finance (DeFi).

Diversifying income streams is another critical strategy for sustainable growth. While cryptocurrencies can yield substantial returns, relying solely on this sector exposes investors to significant volatility. Combining digital assets with other online income sources, such as freelancing, affiliate marketing, or online education, creates a more resilient financial framework. For example, individuals may use cryptocurrency profits to fund their entrepreneurial ventures or invest in staking as a passive income method. Staking, which involves holding and validating transactions on proof-of-stake blockchains, has demonstrated higher yields compared to traditional savings accounts, often reaching 5-10% annually. This dual approach not only spreads risk but also capitalizes on complementary opportunities, ensuring a more stable path to financial independence.

Long-term wealth building requires a commitment to continuous learning and adaptation. The virtual currency market is highly dynamic, with new projects, technologies, and regulations shaping its trajectory. Investors who stay informed about industry advancements, such as the rise of non-fungible tokens (NFTs) in digital art or the integration of blockchain in supply chain management, can identify emerging trends. For example, the growth of DeFi platforms has enabled users to earn interest on digital assets through liquidity pools, while NFTs have created avenues for value creation in unique digital collectibles. These innovations require a deep understanding of their mechanics, use cases, and potential risks, emphasizing the importance of educating oneself through credible sources like whitepapers, forums, and expert analyses.

Risk management is paramount in ensuring that the pursuit of wealth does not lead to financial loss. The market's volatility, driven by factors like regulatory changes, security breaches, and macroeconomic shifts, necessitates strategies to protect capital. Implementing stop-loss orders, which automatically sell assets when they reach a predetermined price, can prevent significant downturns. Similarly, diversifying holdings across multiple cryptocurrencies and sectors reduces the impact of a single asset's performance. Beginners should start with small investments, using demo accounts or paper trading to test strategies without real financial exposure. Furthermore, prioritizing secure storage solutions, such as hardware wallets and multi-signature accounts, safeguards against hacking and theft, which are prevalent threats in the digital space.

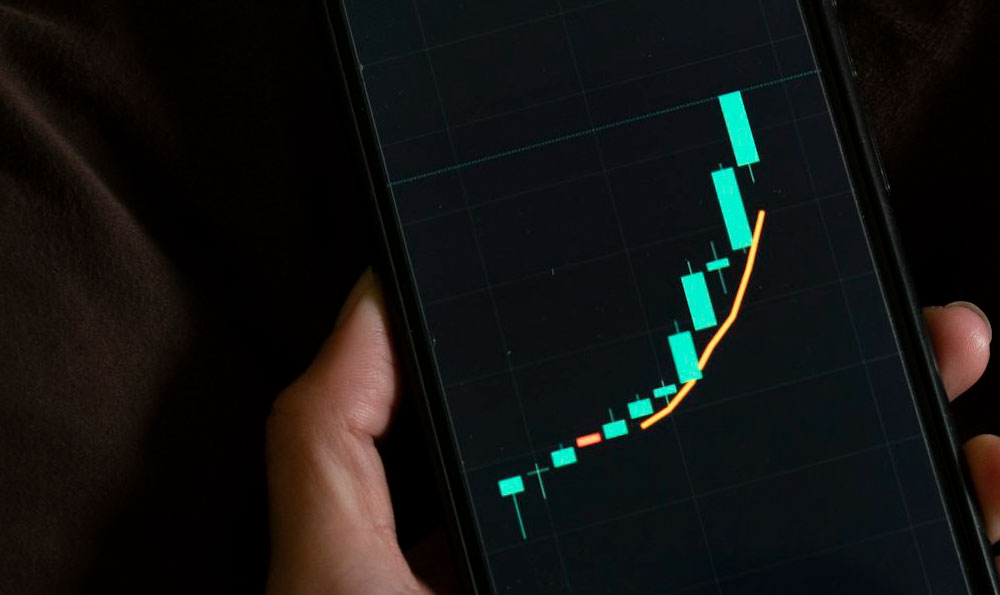

The journey to financial growth through virtual currencies also demands discipline and patience. Short-term speculation often leads to emotional trading decisions, which can undermine long-term success. Investors who adopt a strategy of regular compounding—reinvesting profits to accelerate growth—can harness the power of exponential returns. For example, a modest investment in a high-performing coin, reinvested over time, may generate substantial wealth through cumulative gains. This approach aligns with the principles of wealth building, where consistency and strategic planning outpace fleeting market opportunities. Additionally, focusing on value investing, such as acquiring utility tokens with real-world applications, minimizes the appeal of speculative bubbles and fosters a more grounded perspective.

Technological literacy plays a pivotal role in navigating the complexities of virtual currency markets. Understanding how blockchain networks function, from consensus mechanisms to smart contract security, enables investors to make informed decisions. For instance, the shift from proof-of-work to proof-of-stake models has improved energy efficiency and reduced transaction costs, making certain cryptocurrencies more attractive for long-term holding. Similarly, developers who engage in code reviews or audit platforms before investing can identify vulnerabilities that might lead to security compromises. This level of technical awareness not only mitigates risks but also enhances the ability to capitalize on emerging technologies and innovations.

The interplay between market forces and investor psychology shapes the trajectory of digital assets. During bullish trends, optimism often drives prices to unsustainable levels, while bearish phases may create undervalued opportunities. Recognizing these cycles allows investors to position themselves strategically. For example, buying during market corrections, when prices dip due to fear or uncertainty, can yield significant returns when confidence returns. Conversely, avoiding over-leveraged positions or high-risk projects, such as unverified Initial Coin Offerings (ICOs), prevents capital from being eroded during downturns. This balance between timing and caution ensures that investment decisions are grounded in logic rather than emotion.

To build wealth in this digital age, a holistic strategy that integrates multiple dimensions is necessary. Educating oneself through continuous learning, diversifying income sources, and implementing robust risk management practices create a resilient framework for growth. The virtual currency market, while challenging, offers tools and opportunities for those willing to adapt. By focusing on both short-term gains and long-term value, investors can navigate this space with confidence, ensuring their financial success in an ever-evolving landscape. This approach not only maximizes returns but also empowers individuals to take control of their financial futures, leveraging the power of digital assets to achieve lasting wealth.