The cryptocurrency market is a dynamic and complex ecosystem where opportunities and risks coexist. For those seeking profitable ventures, understanding the interplay between market movements, technical analysis, and strategic discipline is essential. While the allure of quick returns can be tempting, sustainable success requires a combination of analytical rigor, psychological resilience, and long-term vision. Here's a comprehensive approach to navigating this landscape, balancing ambition with caution.

Analyzing market trends and cycles is the cornerstone of any effective strategy. Cryptocurrencies, like stocks or commodities, often exhibit cyclical behavior influenced by macroeconomic factors, regulatory changes, and technological advancements. For instance, the rise of institutional adoption or the launch of a major blockchain-based innovation can trigger upward momentum, while geopolitical events or market corrections may lead to volatility. Seasoned investors study historical price patterns to identify recurring cycles, such as the bull and bear phases, and use them to time their entries. Bitcoin’s upward trend during periods of economic uncertainty, for example, has shown patterns that align with gold’s traditional role as a hedge. By recognizing these dynamics, traders can position themselves to capitalize on trends while avoiding timing pitfalls.

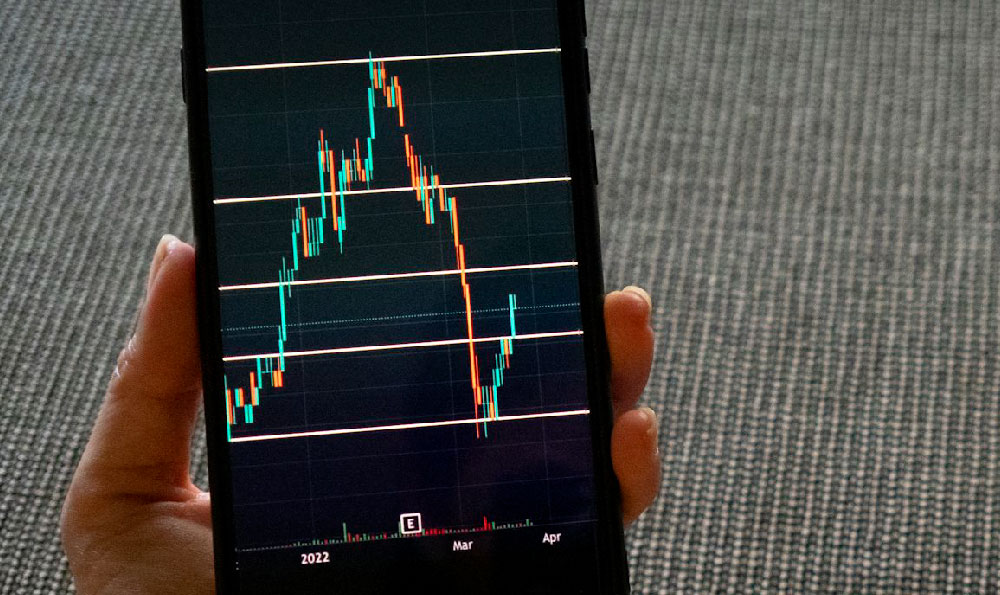

Technical indicators serve as tools to decode price action and predict market sentiment. The relative strength index (RSI) helps assess overbought or oversold conditions, while the moving average convergence divergence (MACD) identifies potential trend reversals. Chart patterns, such as head and shoulders or double bottoms, also offer insights into market psychology. A successful trader might combine these metrics with volume analysis to confirm the strength of a trend. For example, a surge in Bitcoin’s price accompanied by increasing trading volume suggests robust demand, whereas a decline with low volume could indicate a lack of conviction. However, technical analysis should not be viewed as infallible; market anomalies and unexpected news events can disrupt even the most carefully crafted strategies.

Diversification is a key principle for mitigating risk while maintaining exposure to growth opportunities. Relying solely on one cryptocurrency can be perilous, as each asset has unique fundamentals and market behaviors. A balanced portfolio may include a mix of established coins like Ethereum, promising altcoins with innovative use cases, and even stablecoins for liquidity management. For instance, during the 2021 market rally, investors who allocated a portion of their capital to DeFi projects alongside traditional cryptocurrencies realized higher returns than those focused on a single asset. This approach not only reduces the impact of a single asset’s underperformance but also spreads risk across different sectors of the blockchain economy.

Risk management techniques must be integrated into every investment decision. Setting appropriate stop-loss levels, for example, safeguards against significant losses during market downturns. A trader might place a stop-loss at 10% below their entry point for a high-volatility asset, ensuring they exit before potential damage escalates. Position sizing is another critical factor; allocating only a fraction of one’s portfolio to high-risk trades prevents catastrophically large losses. Moreover, avoiding over-leveraging is vital, as margin trading can amplify both gains and losses. During the 2022 market crash, many traders who used leverage experienced severe drawdowns, whereas those with conservative risk profiles weathered the storm more effectively.

Psychological discipline plays a pivotal role in separating successful investors from the rest. Emotional reactions to price fluctuations can lead to impulsive decisions, such as panic selling during a market correction or overbuying when prices appear to rebound. A seasoned trader maintains a detached mindset, adhering to pre-defined strategies rather than reacting to short-term swings. For example, during the 2020 Bitcoin rebound following the pandemic, many retail investors succumbed to FOMO (fear of missing out) and purchased at unsustainable levels, only to face losses when the market corrected. By cultivating patience and self-control, investors can avoid these common pitfalls and make decisions based on logic rather than emotion.

Leveraging market insights and innovative projects can unlock new avenues for growth. The emergence of new blockchain protocols, such as Layer 2 solutions or decentralized finance (DeFi) platforms, often creates alpha opportunities for those willing to take calculated risks. However, due diligence is crucial; investors should research a project’s team, technology, and community before committing capital. A promising example is the rise of staking-based cryptocurrencies, which allow users to earn passive income by validating transactions. These opportunities, while lucrative, require careful evaluation of potential risks, such as network security and regulatory uncertainty.

Sustainable wealth accumulation in the crypto space relies on adaptability and continuous learning. Market conditions are in a state of perpetual evolution, driven by technological breakthroughs, regulatory developments, and macroeconomic shifts. A forward-thinking investor stays informed by analyzing whitepapers, tracking industry news, and engaging with blockchain communities. For instance, the shift toward sustainable energy solutions has influenced the development of eco-friendly blockchains, presenting new investment opportunities for those attuned to emerging trends. By remaining agile and open to new ideas, investors can navigate uncertainty with confidence.

Ultimately, the path to profitable crypto investments demands a balance between decisiveness and caution. While the market offers the potential for rapid wealth creation, it also presents significant challenges that require careful navigation. By combining in-depth market analysis, disciplined risk management, and a resilient mindset, investors can position themselves to thrive in this unpredictable environment. The most successful strategies are those that prioritize long-term growth over short-term gains, ensuring stability even in the face of market volatility.