Short selling is a strategy that has long intrigued investors and traders, offering the potential to profit from market declines in addition to upward trends. While some may perceive it as a high-risk endeavor, a well-structured approach can transform it into a valuable tool for portfolio diversification. The core mechanism involves borrowing shares of a stock, selling them at the current market price, and repurchasing them later at a lower price to return to the lender, pocketing the difference. This inverse play on stock prices requires a deep understanding of market dynamics, risk management, and psychological factors. For those willing to commit time and effort, there are opportunities to exploit volatility and generate returns, albeit with careful consideration.

One of the most effective strategies in short selling is identifying overvalued stocks with inherent weaknesses in their fundamentals or execution. Traders who spot companies losing market share, facing regulatory issues, or experiencing poor management can capitalize on the anticipated price drop. This approach often involves analyzing financial statements to uncover red flags, such as declining revenue, increasing debt, or unsustainable profit margins. For instance, a company that invests heavily in unprofitable ventures or neglects operational efficiency may experience a sharp decline in share price, making it a candidate for short selling. However, the success of this strategy depends on the ability to accurately assess a company's long-term prospects, as short-term fluctuations can sometimes mask underlying issues.

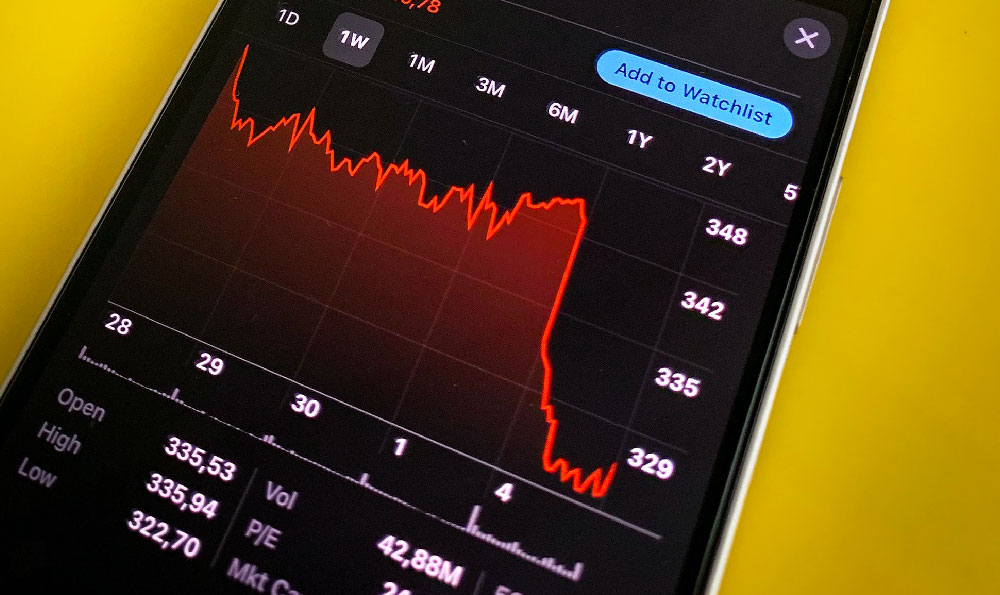

Another popular method is using technical analysis to anticipate market corrections or bearish trends. By studying historical price movements and volume patterns, traders can identify key support and resistance levels that may signal a reversal in momentum. A decline in volume during a price increase, for instance, can indicate weakening buying pressure, while a sharp drop in price following a prolonged uptrend might suggest an overbought condition. These indicators help traders pinpoint entry points for shorting, but the effectiveness of this approach relies on discipline and the ability to distinguish between temporary volatility and long-term trends. Additionally, monitoring macroeconomic factors and sector-specific risks can provide further insight into potential market shifts.

Risk management is paramount in short selling, as the strategy carries significant downside potential. Unlike long positions, which benefit from price increases, short sellers must protect against unexpected market rallies that can erode profits. A common tactic is setting strict stop-loss orders to limit losses if a stock price moves against their prediction. For example, a trader who shorts a stock at $50 may establish a stop-loss at $55 to mitigate risk in case of an upward surge. Similarly, managing leverage is critical, as excessive borrowing can amplify losses. Maintaining a diversified short portfolio across different industries and timeframes can further balance risk, preventing excessive exposure to any single asset.

Psychological resilience is another cornerstone of successful short selling. The ability to remain calm during market downturns and avoid emotional decision-making can make a significant difference. Short sellers often face scrutiny from peers and the public, as their strategy contradicts traditional investing principles. Overcoming self-doubt and staying committed to a well-researched plan is essential for long-term profitability. For instance, during the 2020 market crash, traders who had identified overvalued stocks in certain sectors could have profited, but only if they resisted the urge to panic-sell or chase quick gains.

For more advanced traders, combining short selling with other strategies can enhance returns. Event-driven shorting, for example, involves anticipating specific news events that may negatively impact a company’s stock, such as earnings surprises, mergers, or regulatory actions. This approach requires monitoring news feeds and economic data to identify catalysts that could trigger price drops. Similarly, arbitrage opportunities, such as those arising from mispricings between different markets or asset classes, can be exploited using short positions. By integrating these strategies, traders can create a more robust approach to profiting from market declines.

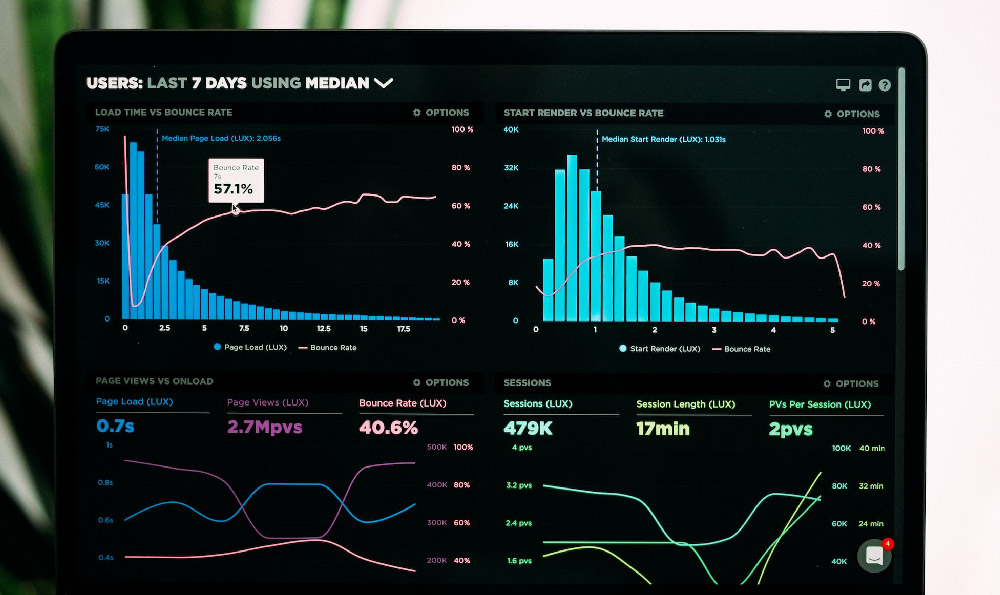

Technology and tools also play a crucial role in modern short selling. Platforms that offer margin accounts, futures contracts, or options trading provide access to tools that enable traders to execute short positions more efficiently. Additionally, algorithms and automated systems can analyze market data in real-time, identifying patterns and opportunities that might be overlooked by manual analysis. These tools can help traders refine their strategies and manage risk more effectively, but they require careful calibration and regular oversight.

Educational resources are equally important for those new to short selling. Online courses, books, and forums dedicated to this topic can provide insights into proven techniques and common mistakes to avoid. Studying historical case studies, such as the performance of legendary traders like Jesse Livermore or short sellers who successfully profited from market downturns, can offer valuable lessons. However, it is essential to recognize that past success does not guarantee future outcomes, and each market environment is unique.

In conclusion, short selling stock offers a pathway to profit from market declines, but it is not without challenges. A successful approach requires a combination of in-depth research, disciplined risk management, and strong psychological attributes. While the potential rewards are attractive, traders must remain vigilant and prepared for market uncertainties. By incorporating these principles into their strategy, investors can navigate the complexities of short selling and unlock new opportunities for wealth creation.