The age-old question, “How can I make money?” resonates with nearly everyone, regardless of their current financial standing. While there’s no magic formula guaranteeing instant wealth, a strategic and informed approach can significantly improve your chances of building a secure and prosperous financial future. It boils down to understanding that making money is often a blend of earning, saving, investing, and even strategic risk-taking. Let's dissect some effective strategies:

First and foremost, focusing on your earning potential is critical. This might seem obvious, but it's the bedrock of any solid financial plan. The simplest path is to hone your existing skills and seek opportunities for advancement in your current role. Are there specialized training programs or certifications that could make you a more valuable asset to your employer? Negotiating a raise is crucial; research industry standards for your position and experience level and present a compelling case for your increased value to the company. Don't underestimate the power of side hustles. The gig economy offers a multitude of avenues for generating extra income, from freelancing in your area of expertise to driving for ride-sharing services. Even pursuing a passion like photography, writing, or crafting can be monetized through online platforms. Critically, the income earned should be managed wisely, not simply spent.

Once you have a reliable income stream, mastering the art of saving is essential. Creating a budget is not about restriction; it's about awareness. Track your income and expenses meticulously. Identify areas where you can cut back without significantly impacting your quality of life. Small changes, like reducing your daily coffee shop visits or negotiating better rates on your insurance policies, can accumulate into substantial savings over time. The key is to prioritize essential expenses while being mindful of discretionary spending. Furthermore, consider automating your savings. Set up regular transfers from your checking account to a high-yield savings account or a retirement fund. This "pay yourself first" approach ensures that you consistently save a portion of your income before you have a chance to spend it. Building an emergency fund should be a priority. Aim to save at least three to six months' worth of living expenses in a readily accessible account. This cushion will protect you from unexpected financial setbacks, such as job loss or medical emergencies, preventing you from derailing your long-term financial goals.

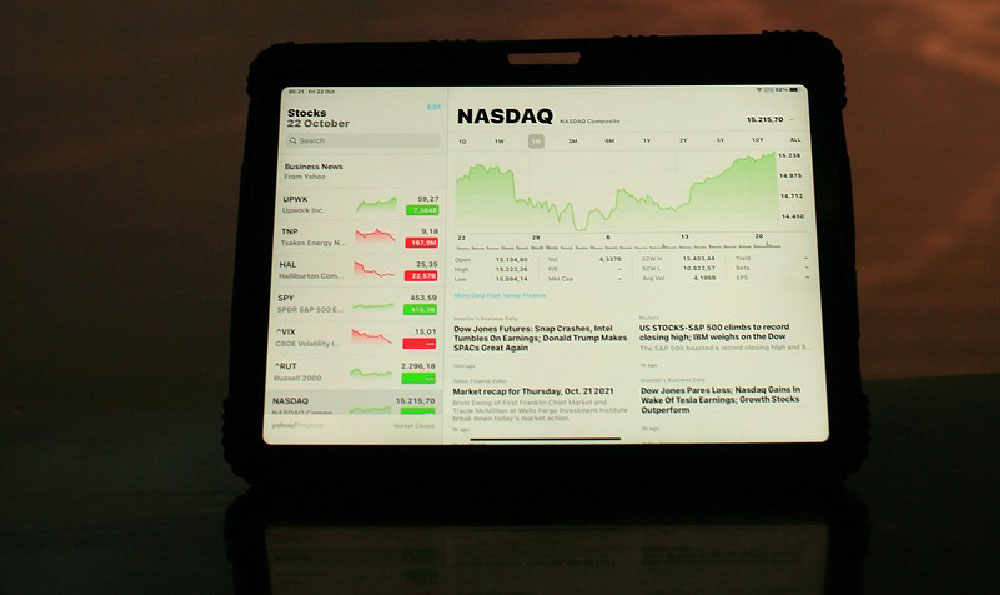

Investing is where your savings can truly work for you. However, it's crucial to approach investing with a well-defined strategy and a clear understanding of your risk tolerance. There is no one-size-fits-all investment strategy, so you must carefully consider your investment goals, time horizon, and risk appetite. For example, someone saving for retirement decades in the future can afford to take on more risk than someone saving for a down payment on a house in the next few years. Investing in a diversified portfolio of stocks, bonds, and other assets is generally recommended to mitigate risk. Stocks offer the potential for higher returns but also carry greater volatility. Bonds are typically less volatile but offer lower returns. A well-balanced portfolio will combine these asset classes to optimize risk and return based on your individual circumstances. Consider investing in index funds or exchange-traded funds (ETFs), which offer instant diversification at a low cost. These funds track a specific market index, such as the S&P 500, providing broad exposure to a basket of stocks. Actively managed mutual funds may offer the potential for higher returns, but they also come with higher fees and don't always outperform the market.

Real estate can be a lucrative investment, but it also requires significant capital and careful planning. Purchasing a home can provide a stable place to live and build equity over time. Investing in rental properties can generate passive income, but it also comes with responsibilities such as property management and tenant relations. Thoroughly research the local real estate market, assess your ability to manage properties, and consider the potential risks and rewards before investing in real estate.

Beyond traditional investment options, consider exploring alternative investments, such as peer-to-peer lending, crowdfunding, or even investing in startups. These investments offer the potential for high returns but also carry significant risk. Only allocate a small portion of your portfolio to these investments, and be prepared to lose your entire investment.

Entrepreneurship can be a high-risk, high-reward path to making money. Starting your own business requires a significant investment of time, effort, and capital. However, if you have a strong business idea, a solid business plan, and the determination to succeed, entrepreneurship can be a path to financial independence. Before launching your business, thoroughly research your target market, assess your competition, and develop a detailed financial plan. Seek advice from experienced entrepreneurs and consider joining a business incubator or accelerator program.

It's important to continuously educate yourself about personal finance and investing. Read books, articles, and blogs on relevant topics. Attend seminars and workshops to learn from experts. Stay informed about market trends and economic developments. The more you know, the better equipped you will be to make informed financial decisions. Remember that making money is not just about accumulating wealth; it's also about managing your finances responsibly. Pay off high-interest debt, such as credit card debt, as quickly as possible. Avoid unnecessary expenses and live within your means. Protect your assets with adequate insurance coverage. Plan for your retirement and ensure you have sufficient savings to live comfortably in your later years.

In conclusion, making money is a multi-faceted endeavor that requires a combination of hard work, smart choices, and a strategic approach. By focusing on your earning potential, mastering the art of saving, investing wisely, and continuously educating yourself, you can significantly improve your chances of building a secure and prosperous financial future. Remember to be patient, disciplined, and adaptable, and don't be afraid to seek advice from financial professionals.