Okay, I understand. Here's an article on investing in the Indian share market, aimed at providing a comprehensive overview for beginners and beyond:

Investing in the Indian stock market can seem like navigating a complex maze, especially for newcomers. However, with a solid understanding of the fundamentals, a well-defined strategy, and a commitment to continuous learning, it can become a rewarding avenue for wealth creation. The Indian stock market, represented primarily by the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), offers a diverse range of investment opportunities across various sectors, making it an attractive option for both domestic and international investors.

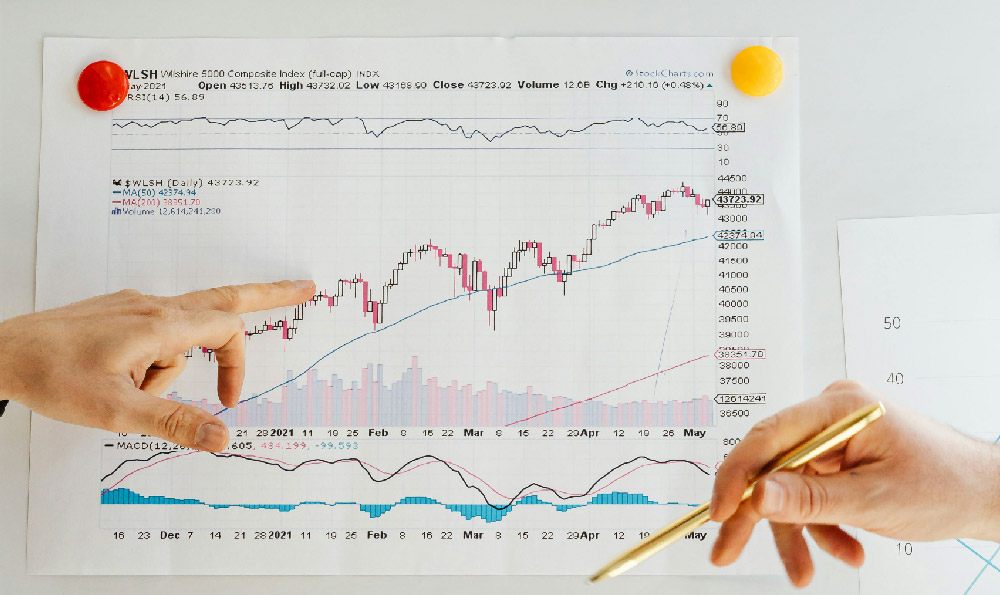

The initial step involves understanding the basic terminology and concepts. Stocks, also known as shares, represent ownership in a company. When you buy a share, you essentially become a part-owner and are entitled to a portion of the company's profits (in the form of dividends) and a vote in certain company matters. The BSE Sensex and NSE Nifty 50 are benchmark indices that track the performance of the top 30 and 50 companies listed on the respective exchanges, providing a snapshot of the overall market sentiment. Understanding concepts like market capitalization (the total value of a company's outstanding shares), price-to-earnings ratio (P/E ratio, which indicates how much investors are willing to pay for each rupee of a company's earnings), and earnings per share (EPS, which represents a company's profitability) is crucial for informed decision-making.

Before diving into stock picking, opening a Demat (Dematerialized) and Trading account is essential. A Demat account holds your shares in electronic form, while a trading account is used to buy and sell shares on the stock exchanges. Several brokerage firms, both online and traditional, offer these services. When choosing a broker, consider factors such as brokerage fees, account maintenance charges, trading platform usability, research reports, and customer service quality. Discount brokers offer lower brokerage fees but may provide limited research and advisory services, while full-service brokers offer comprehensive support but charge higher fees. Select a broker that aligns with your investment needs and risk tolerance. KYC (Know Your Customer) compliance is mandatory for opening these accounts, requiring you to submit identity proof, address proof, and income proof.

Once your accounts are set up, the next step is to develop a well-defined investment strategy. This involves determining your investment goals (e.g., retirement planning, buying a house, funding education), risk appetite (how much loss you are willing to tolerate), and investment horizon (the length of time you plan to invest). Based on these factors, you can choose from various investment approaches, such as value investing (buying undervalued companies), growth investing (investing in companies with high growth potential), dividend investing (investing in companies that pay regular dividends), or a combination of these.

Diversification is a cornerstone of successful investing. Spreading your investments across different asset classes (e.g., stocks, bonds, real estate, gold) and different sectors within the stock market can significantly reduce your overall risk. For example, if one sector performs poorly, the impact on your portfolio will be mitigated by the performance of other sectors. Within the stock market, consider diversifying across companies of different sizes (large-cap, mid-cap, and small-cap) and different industries (e.g., technology, healthcare, finance, consumer goods).

Thorough research is vital before investing in any stock. This involves analyzing the company's financial statements (balance sheet, income statement, cash flow statement), understanding its business model, assessing its competitive landscape, and evaluating its management team. Look for companies with strong fundamentals, consistent earnings growth, low debt levels, and a proven track record. Utilize financial analysis tools and resources, such as company websites, annual reports, and analyst reports, to gather relevant information. Remember that past performance is not necessarily indicative of future results, and it's important to conduct your own independent research rather than blindly following recommendations.

Another avenue for investing in the Indian share market, especially for beginners, is through mutual funds. Mutual funds are professionally managed investment schemes that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer several advantages, including professional management, diversification, and liquidity. There are various types of mutual funds, such as equity funds (investing primarily in stocks), debt funds (investing primarily in bonds), and hybrid funds (investing in a mix of stocks and bonds). Index funds are a type of equity fund that passively tracks a specific market index, such as the Sensex or Nifty 50, offering a cost-effective way to invest in the overall market. Exchange-Traded Funds (ETFs) are similar to index funds but are traded on stock exchanges like individual stocks, offering greater flexibility.

Systematic Investment Plans (SIPs) are a popular and disciplined way to invest in mutual funds. With SIPs, you invest a fixed amount of money at regular intervals (e.g., monthly or quarterly), regardless of market conditions. This helps you to average out your purchase price and potentially benefit from rupee-cost averaging, which means buying more units when prices are low and fewer units when prices are high. SIPs are an excellent option for long-term investing and can help you build a substantial corpus over time.

Staying informed about market trends, economic developments, and company news is essential for successful investing. Regularly monitor your portfolio and make adjustments as needed based on your investment goals and risk tolerance. Consider consulting with a financial advisor for personalized guidance and support. Beware of get-rich-quick schemes and unrealistic promises. Investing in the stock market involves risks, and there are no guarantees of returns. A patient, disciplined, and informed approach is crucial for achieving your financial goals. Continuous learning through reading books, articles, and attending seminars can also enhance your investment knowledge and skills. Investing in the Indian stock market requires careful planning, diligent research, and a long-term perspective. By following these guidelines, you can navigate the complexities of the market and potentially achieve your financial aspirations.