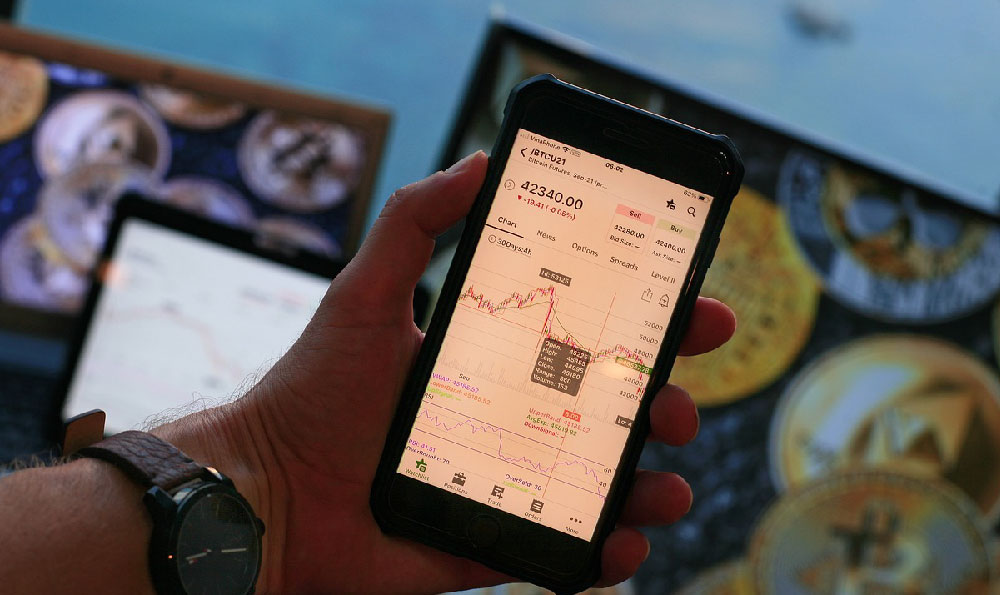

Investing in the cryptocurrency market has become increasingly popular, attracting investors of all ages. The allure of potentially high returns and the innovative nature of blockchain technology have drawn many young people to consider investing in crypto. However, for individuals under the age of 18, navigating the world of crypto investing presents unique challenges and considerations. The question isn't just about the feasibility of such investments, but also about the legal and ethical implications, the necessary safeguards, and the responsible approach to financial literacy for minors.

The simple answer to whether someone under 18 can invest in crypto is generally no, not directly. Most cryptocurrency exchanges and brokerage platforms require users to be at least 18 years old to create an account and trade. This age restriction aligns with legal standards surrounding contracts and financial responsibility. Minors typically cannot enter into legally binding agreements, which is a fundamental requirement for opening and managing investment accounts. These platforms enforce this rule through identity verification processes that include age confirmation. Attempting to circumvent these checks through fraudulent means is not only unethical but also carries legal risks.

While direct investment might be restricted, there are indirect ways for minors to participate in the crypto market, although these methods come with their own set of stipulations. One option involves investing through a custodial account. A custodial account is an investment account opened and managed by an adult (usually a parent or legal guardian) on behalf of a minor. In this scenario, the adult has control over the investment decisions and is responsible for managing the account. The crypto assets purchased through the custodial account are legally owned by the minor, but the adult maintains control until the minor reaches the age of majority, at which point the assets are transferred to the now-adult individual.

The setup and use of custodial accounts for crypto investments demand careful planning and open communication. Parents should thoroughly research the chosen platform and understand the associated fees, security measures, and available crypto assets. It's also crucial to educate the minor about the risks involved in crypto investing and to involve them in the decision-making process, fostering financial literacy from a young age. This transparent approach helps to instill responsible investment habits and prepares the child for managing their own finances in the future.

Another, less direct, method involves investing in companies that are involved in the cryptocurrency space. While a minor still can't directly own crypto, they could potentially own stock in companies that mine Bitcoin, develop blockchain technologies, or provide crypto exchange services. Investing in these companies exposes the investor to the crypto market indirectly, as their performance is often correlated to the overall health and sentiment surrounding cryptocurrencies. However, this approach also diversifies the risk, as the company's success depends on more than just the price of crypto. The company's management, technological advancements, and market positioning also play a role. Again, this type of investment would likely need to be facilitated through a custodial account.

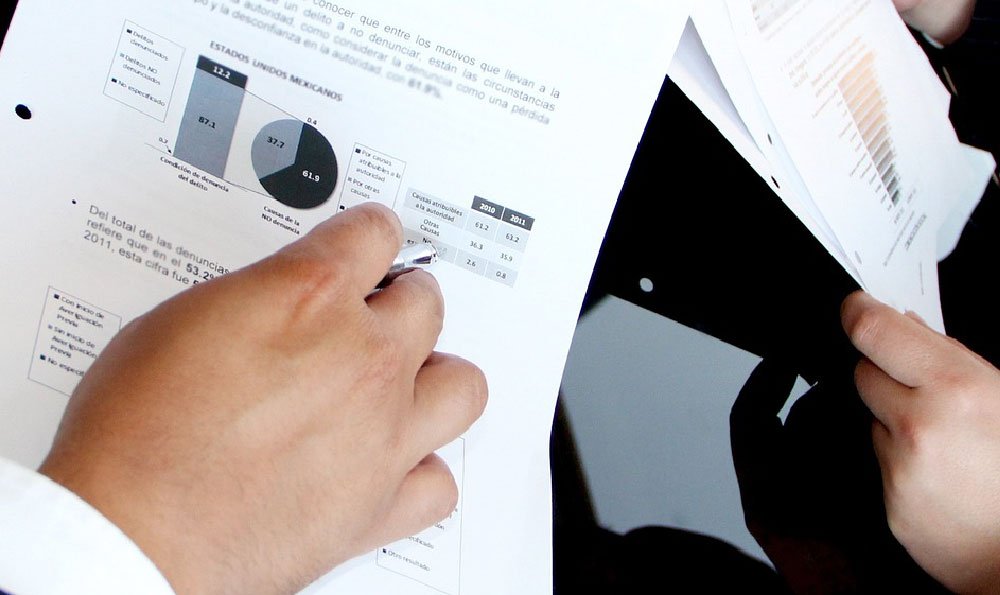

Before proceeding with any of these strategies, it is vital to consider the potential risks involved. The cryptocurrency market is known for its volatility. Prices can fluctuate dramatically in short periods, leading to significant gains or losses. Minors, with their limited financial resources and experience, are particularly vulnerable to the negative effects of such volatility. It is crucial to emphasize the importance of responsible investing and to avoid investing more than one can afford to lose. A long-term investment horizon and a diversified portfolio can help mitigate some of these risks.

Furthermore, the regulatory landscape surrounding cryptocurrencies is constantly evolving. New regulations can impact the value and legality of crypto assets, creating uncertainty for investors. It's important to stay informed about the latest regulatory developments and to understand how they might affect investments. This is where the guidance of a qualified financial advisor can be invaluable. A financial advisor can provide personalized advice based on the individual's financial situation, risk tolerance, and investment goals. They can also help navigate the complex regulatory environment and ensure compliance with all applicable laws.

Beyond the practical aspects of investing, there's an ethical dimension to consider. It is the responsibility of parents and guardians to ensure that minors are not being exploited or taken advantage of by unscrupulous individuals or platforms in the crypto space. This means carefully vetting any platform or investment opportunity and being wary of promises of guaranteed high returns. It also means educating the minor about scams and other fraudulent activities that are prevalent in the crypto world.

Financial literacy is paramount. Regardless of whether a minor invests in crypto directly or indirectly, it's crucial to provide them with a solid foundation in financial principles. This includes teaching them about budgeting, saving, debt management, and the importance of long-term financial planning. Understanding these concepts will empower them to make informed investment decisions and to manage their finances responsibly throughout their lives. This education should extend beyond the specific risks and rewards of crypto and encompass broader financial concepts.

In conclusion, while directly investing in crypto might not be possible for individuals under 18, there are alternative pathways that can allow them to participate in the market under the supervision of a responsible adult. These methods require careful planning, open communication, and a strong emphasis on financial literacy. The focus should always be on responsible investing and protecting the minor's financial well-being. By approaching crypto investing with caution and prioritizing education, parents and guardians can help young people learn about the exciting, yet complex, world of digital assets in a safe and responsible manner, fostering a new generation of informed and financially savvy individuals.