Investing in gold online has become increasingly popular as a way to diversify portfolios, hedge against inflation, and potentially profit from market volatility. However, navigating the online gold market can be daunting, especially for newcomers. It's crucial to understand the different options available, the associated risks, and whether gold aligns with your overall investment strategy before diving in.

One of the primary considerations is determining how you want to own gold. Physical gold, in the form of bars or coins, offers direct ownership and tangible assets. Several online dealers specialize in selling and securely storing physical gold. These dealers often provide insured storage options, allowing you to hold your gold in a secure vault without the hassle of personal storage. While physical gold offers a sense of security, it also comes with storage fees, insurance costs, and the potential challenges of resale. You'll need to carefully research reputable dealers, compare prices, and understand the costs associated with storage and insurance. Consider premiums over spot price, which can vary significantly between dealers. Authenticity is also a crucial concern; always purchase from established and trustworthy sources to avoid counterfeit products.

Another popular method is investing in gold exchange-traded funds (ETFs). These ETFs track the price of gold and offer a convenient way to gain exposure to the gold market without directly owning the physical metal. Gold ETFs are easily traded on stock exchanges, offering liquidity and transparency. However, it's important to understand that you are not directly owning gold when you invest in a gold ETF. The ETF provider owns the gold, and you own shares representing a portion of that gold. The value of the ETF shares will fluctuate with the price of gold, but tracking errors can occur, meaning the ETF's performance might not perfectly mirror the spot price of gold. Expense ratios associated with managing the ETF also need to be considered, as they can impact your overall return.

Gold mining stocks represent another avenue for investing in the gold market. These stocks are shares of companies that are involved in the exploration, mining, and production of gold. While gold mining stocks can offer significant upside potential, they are also subject to risks that are unrelated to the price of gold. A company's performance can be affected by factors such as management decisions, operational challenges, geopolitical risks, and environmental regulations. It's crucial to conduct thorough research on the specific companies you are considering investing in, analyzing their financial performance, production costs, and reserve estimates. Investing in gold mining stocks is generally considered riskier than owning physical gold or gold ETFs, as the company's success depends on numerous factors beyond just the price of gold.

Gold futures contracts offer a more sophisticated way to invest in gold. These contracts are agreements to buy or sell gold at a predetermined price and date in the future. Gold futures are leveraged instruments, meaning you can control a large amount of gold with a relatively small amount of capital. While leverage can amplify potential profits, it can also magnify losses. Gold futures are best suited for experienced traders who understand the complexities of the futures market and are comfortable with the high level of risk involved. Margins, rollover risks, and the potential for substantial losses should be carefully considered before trading gold futures.

Before investing in gold, it's essential to consider your investment goals, risk tolerance, and time horizon. Gold is often viewed as a safe haven asset, performing well during times of economic uncertainty and market volatility. However, gold prices can also be volatile, and it's not guaranteed to always increase in value. It's crucial to diversify your portfolio across different asset classes to mitigate risk. A common recommendation is to allocate a small percentage of your portfolio to gold, typically between 5% and 10%, depending on your individual circumstances and investment goals.

Moreover, understanding the current market conditions is critical. Factors such as inflation rates, interest rates, geopolitical events, and currency fluctuations can all influence the price of gold. Staying informed about these factors can help you make more informed investment decisions.

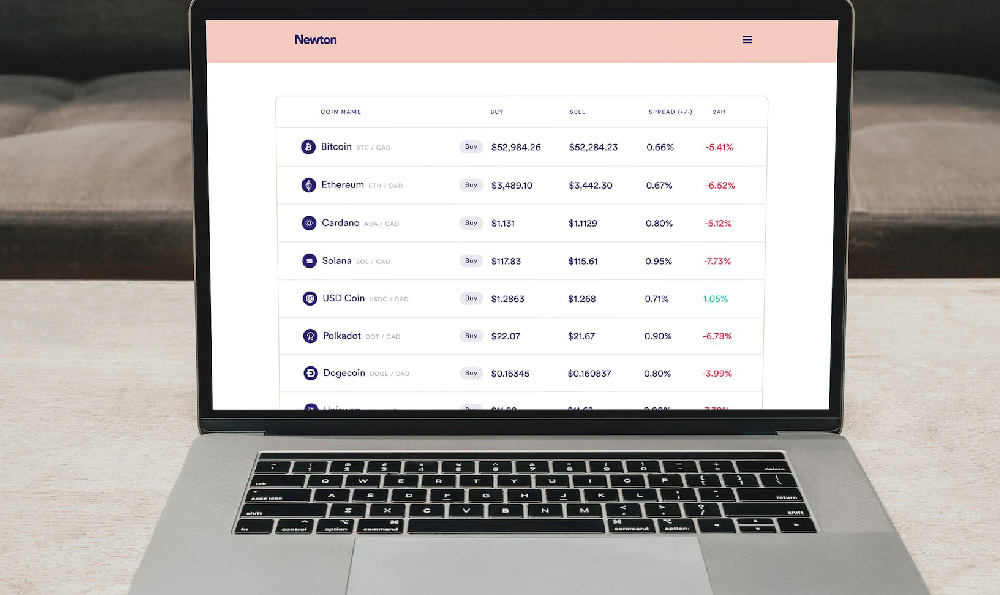

When choosing an online platform to invest in gold, prioritize security and reputation. Look for platforms that are regulated by reputable financial authorities and have strong security measures in place to protect your assets. Read reviews and compare fees and services before making a decision. Transparency is key; the platform should provide clear and accurate information about pricing, storage, and transaction costs.

Finally, consider seeking professional advice from a financial advisor before investing in gold. A financial advisor can help you assess your financial situation, understand your risk tolerance, and develop a personalized investment strategy that includes gold as part of a well-diversified portfolio. They can provide guidance on which type of gold investment is most suitable for your needs and help you navigate the complexities of the gold market.

In conclusion, investing in gold online can be a valuable addition to a well-diversified investment portfolio. However, it's essential to understand the different options available, the associated risks, and your own investment goals before making any decisions. Careful research, due diligence, and professional advice can help you make informed choices and potentially benefit from the unique characteristics of gold as an investment asset. Remember that past performance is not indicative of future results, and all investments involve risk.