Investing in hotels can present a unique blend of potential rewards and significant risks. It's a complex investment decision, far removed from simply buying stocks or bonds. To determine if it's a "wise move" or a "risky gamble," a thorough understanding of the hotel industry, market dynamics, and individual investor circumstances is crucial.

Understanding the Hotel Investment Landscape

Hotels, unlike many other real estate investments, are operating businesses. They generate revenue primarily through room occupancy, but also through ancillary services like food and beverage, events, and spa treatments. This means the financial performance of a hotel is heavily reliant on external factors such as tourism, economic conditions, and even local events.

The hotel market is segmented, ranging from budget-friendly motels to luxury resorts, and everything in between. Each segment caters to a different clientele and operates under varying economic pressures. High-end hotels are vulnerable to economic downturns affecting discretionary spending, while budget hotels are more susceptible to competition from alternative accommodations like Airbnb.

The Allure of Hotel Investment

Despite the inherent risks, several factors make hotel investment attractive to some investors:

- Potential for High Returns: Well-managed hotels in prime locations can generate substantial returns, particularly during periods of economic growth and strong tourism. Occupancy rates and average daily rates (ADR) can surge, leading to significant revenue increases.

- Real Estate Appreciation: Like other real estate assets, hotels can appreciate in value over time, providing an additional source of profit when the property is eventually sold. Strategic renovations and improvements can further enhance the property's value.

- Cash Flow Generation: Successful hotels can produce consistent cash flow, providing investors with a steady stream of income. This is particularly appealing to those seeking passive income or diversification of their investment portfolio.

- Tax Benefits: Hotel investments often qualify for various tax deductions, including depreciation, which can shelter a portion of the income from taxes.

Navigating the Risks: A Cautious Approach

However, it's essential to acknowledge the significant risks associated with hotel investment:

- High Capital Expenditures: Hotels require ongoing investment in maintenance, renovations, and upgrades to remain competitive and attract guests. These capital expenditures can be substantial and unpredictable.

- Operating Expenses: In addition to capital expenditures, hotels incur significant operating expenses, including labor, utilities, marketing, and property taxes. These expenses can fluctuate depending on market conditions and competition.

- Sensitivity to Economic Cycles: The hotel industry is highly sensitive to economic cycles. During economic downturns, tourism declines, occupancy rates plummet, and hotels struggle to maintain profitability.

- Competition: The hotel market is often highly competitive, with new hotels constantly entering the market and existing hotels vying for market share. This can put pressure on pricing and profitability.

- Management Challenges: Running a hotel is a complex undertaking that requires skilled management. Poor management can lead to declining occupancy rates, negative reviews, and ultimately, financial losses.

- Illiquidity: Hotel investments are generally illiquid, meaning they cannot be easily converted into cash. Selling a hotel can take time and may require significant price concessions.

Due Diligence: The Key to Success

Before investing in a hotel, it's imperative to conduct thorough due diligence. This involves:

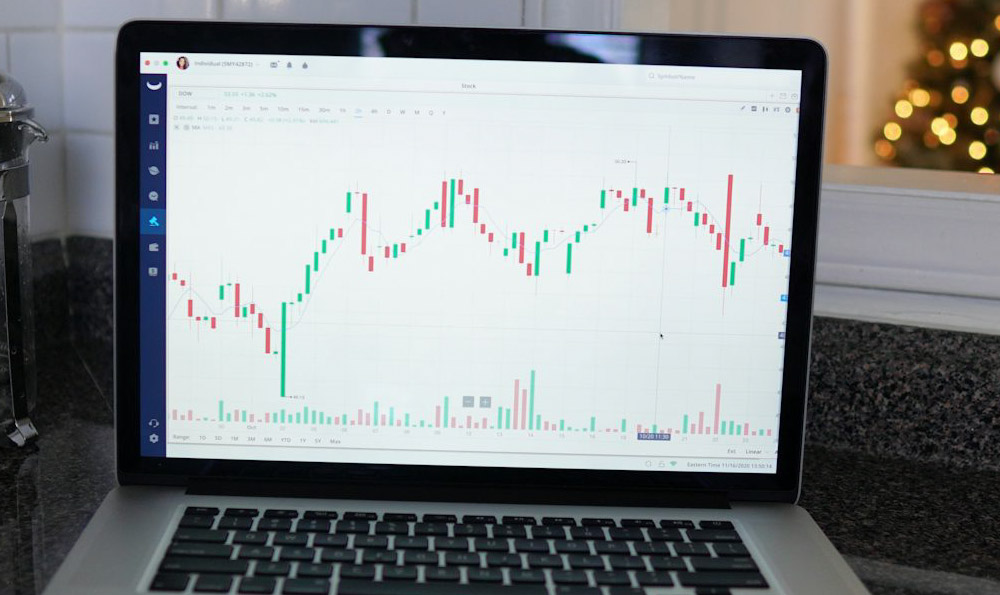

- Market Analysis: A comprehensive analysis of the local hotel market, including occupancy rates, ADR, competitive landscape, and future development plans.

- Financial Analysis: A detailed review of the hotel's financial statements, including revenue, expenses, and profitability. Scrutinizing past performance is critical.

- Property Inspection: A thorough inspection of the property to identify any potential maintenance or renovation needs.

- Management Assessment: An evaluation of the hotel's management team and their track record.

- Legal Review: A review of all relevant legal documents, including contracts, leases, and permits.

- Valuation: Obtaining a professional valuation of the property to ensure the purchase price is reasonable.

Financing Options and Their Implications

Financing a hotel investment typically involves a combination of debt and equity. Securing a loan can be challenging, particularly for inexperienced investors. Lenders will carefully assess the hotel's financial performance, market conditions, and the borrower's creditworthiness. The terms of the loan, including the interest rate and repayment schedule, can significantly impact the profitability of the investment.

Alternative Investment Options

For investors who are hesitant to invest directly in a hotel, there are alternative options available, such as:

- Real Estate Investment Trusts (REITs): REITs are companies that own and operate income-producing real estate, including hotels. Investing in a REIT provides diversification and liquidity.

- Hotel Funds: These are private equity funds that invest in a portfolio of hotels. Hotel funds offer professional management and diversification, but they are typically only available to accredited investors.

- Crowdfunding: Real estate crowdfunding platforms allow investors to pool their resources to invest in hotel projects. This can be a more accessible option for smaller investors.

Conclusion: A Calculated Decision

Investing in hotels is not a passive investment. It requires significant capital, expertise, and a willingness to take on risk. While the potential rewards can be substantial, the risks are equally significant. A thorough understanding of the hotel industry, rigorous due diligence, and a well-defined investment strategy are essential for success. For some, it can be a wise move that generates substantial returns; for others, it could become a risky gamble. The key is to approach the investment with caution, conduct thorough research, and seek professional advice. Consider all factors, then make an informed and calculated decision based on your own financial circumstances and risk tolerance.