Investing in Apple, a tech giant synonymous with innovation and profitability, presents a compelling opportunity for investors. However, navigating the various investment options and understanding the nuances of the market is crucial for maximizing returns and mitigating risks. This exploration delves into the available avenues for investing in Apple, examining the pros and cons of each, and providing a framework for making informed investment decisions.

The most straightforward method is, of course, purchasing Apple shares (AAPL) directly on the stock market. This grants you ownership of a portion of the company and entitles you to potential dividends and capital appreciation. Buying shares directly allows you to participate fully in Apple's growth, as the stock price reflects the market's perception of the company's performance, future prospects, and overall economic conditions. The price of AAPL stock can fluctuate based on numerous factors, including new product releases, earnings reports, competitor activity, and macroeconomic events. Therefore, thorough research, a solid understanding of market dynamics, and a long-term investment horizon are paramount. This strategy requires an active brokerage account and a willingness to monitor market conditions.

For investors seeking a more managed approach, investing in Exchange-Traded Funds (ETFs) that hold Apple as a significant component could be a prudent choice. Many technology-focused or broad market index ETFs allocate a substantial portion of their holdings to Apple due to its market capitalization. These ETFs offer diversification, reducing the risk associated with investing solely in one company. While you won't directly own Apple shares, your investment's performance will be influenced by Apple's performance along with that of other companies within the ETF. This approach provides a less volatile and more diversified exposure to the technology sector. It's important to scrutinize the ETF's holdings, expense ratio, and tracking error to ensure it aligns with your investment goals. Lower expense ratios are generally preferable, and a smaller tracking error indicates that the ETF accurately mirrors the performance of its underlying index.

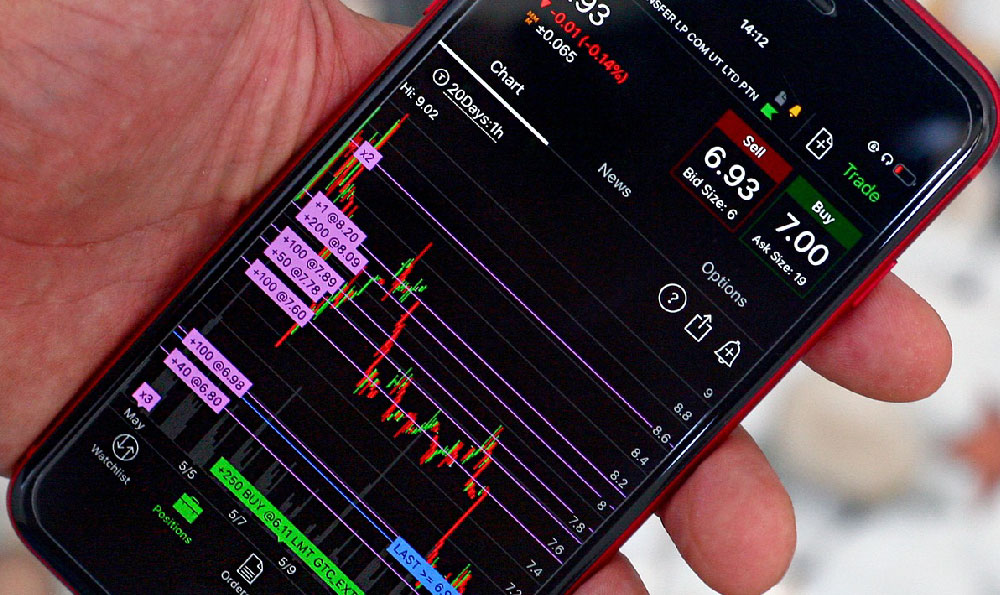

Another avenue, albeit one with higher risk and potential reward, involves options trading. Options contracts provide the right, but not the obligation, to buy (call option) or sell (put option) Apple shares at a predetermined price (strike price) before a specific expiration date. Buying call options allows you to profit if the stock price rises above the strike price, while buying put options allows you to profit if the stock price falls below the strike price. Options trading is a complex strategy that requires a deep understanding of market volatility, time decay, and risk management. It's generally not recommended for novice investors due to the potential for significant losses. Options are highly leveraged instruments, meaning a small price movement in the underlying stock can result in a large percentage gain or loss in the option's value. Careful consideration of your risk tolerance, capital allocation, and understanding of options strategies is crucial before engaging in options trading related to Apple.

Furthermore, depending on your location and access, participating in Apple's Employee Stock Purchase Plan (ESPP), if available through your employer, can be an attractive option. ESPPs typically allow employees to purchase company stock at a discounted price, providing an immediate return on investment. However, ESPPs often come with restrictions on selling the shares, and it's essential to weigh the benefits against the potential risk of overexposure to a single stock. Concentrating a significant portion of your investment portfolio in your employer's stock can be risky, as your financial well-being becomes heavily tied to the company's performance.

Before making any investment decision, consider the following critical factors:

- Your Risk Tolerance: Determine how much risk you are comfortable taking. Apple, while a relatively stable company, is still subject to market fluctuations.

- Your Investment Goals: Are you seeking long-term capital appreciation, dividend income, or short-term gains? Your goals will dictate the appropriate investment strategy.

- Your Time Horizon: How long do you plan to hold the investment? A longer time horizon allows you to weather market volatility and potentially benefit from long-term growth.

- Diversification: Avoid putting all your eggs in one basket. Diversify your portfolio across different asset classes and sectors to reduce risk.

- Due Diligence: Conduct thorough research on Apple's financials, competitive landscape, and future prospects. Stay informed about market trends and news that could impact the stock price.

Moreover, it's imperative to be wary of investment scams and unsolicited advice. Always verify the legitimacy of any investment opportunity before investing. Consult with a qualified financial advisor to receive personalized advice tailored to your specific financial situation and investment goals. A financial advisor can help you assess your risk tolerance, develop a comprehensive investment plan, and provide ongoing guidance to help you stay on track.

Investing in Apple can be a rewarding endeavor, but it requires a thoughtful and informed approach. By understanding the various investment options, assessing your risk tolerance, and conducting thorough due diligence, you can increase your chances of achieving your financial goals. Remember, investing is a marathon, not a sprint, and a long-term perspective, coupled with careful planning, is essential for success. Regular portfolio reviews are also crucial to ensure your investment strategy remains aligned with your evolving goals and risk tolerance. Market conditions change, and your investment plan should adapt accordingly.