In today's digital age, the concept of earning income from the comfort of one's home has become more viable than ever before. Amidst the growing interest in cryptocurrencies and blockchain technology, many individuals are exploring the potential of virtual currency investments as a means to achieve financial growth. However, this field is inherently complex, requiring a balanced approach that combines market analysis, technical evaluation, and strategic foresight to navigate its challenges effectively. The following insights aim to illuminate a path for those seeking to leverage virtual currency investments while working remotely, emphasizing the importance of preparing for potential risks and avoiding common pitfalls.

The rise of remote work has created a global shift in how people engage with financial markets. With access to digital tools and platforms, individuals can now participate in trading activities that were once limited to physical trading floors. Cryptocurrency, as a decentralized digital asset, has emerged as a particularly attractive option for home-based investors due to its 24/7 market availability, low transaction costs, and the potential for high returns. However, success in this space demands more than mere exposure to the market; it requires a thorough understanding of how to identify profitable opportunities while safeguarding against the volatile nature of these assets.

One of the foundational elements of effective virtual currency investment is the ability to analyze market trends. The cryptocurrency market is influenced by a myriad of factors, including macroeconomic conditions, technological advancements, and geopolitical developments. For instance, inflation rates, interest rates, and fiat currency devaluations often impact investor sentiment and drive demand for alternative assets like Bitcoin or Ethereum. Additionally, technological breakthroughs—such as the launch of new blockchain protocols or significant upgrades to existing networks—can create short-term volatility, but also long-term value. Understanding these dynamics allows investors to anticipate shifts in market direction and make informed decisions.

Technical indicators play a crucial role in evaluating the performance of virtual currency assets. Tools like Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements help determine whether a cryptocurrency is overbought or oversold, signaling potential entry or exit points. For example, a Moving Average Convergence Divergence (MACD) crossover can indicate a bullish trend, while an RSI below 30 often suggests a bearish reversal. These indicators are not infallible, but when combined with fundamental analysis, they provide a more comprehensive view. Fundamental analysis involves assessing the intrinsic value of a cryptocurrency by examining its project's development, adoption rate, team credibility, and market utility.

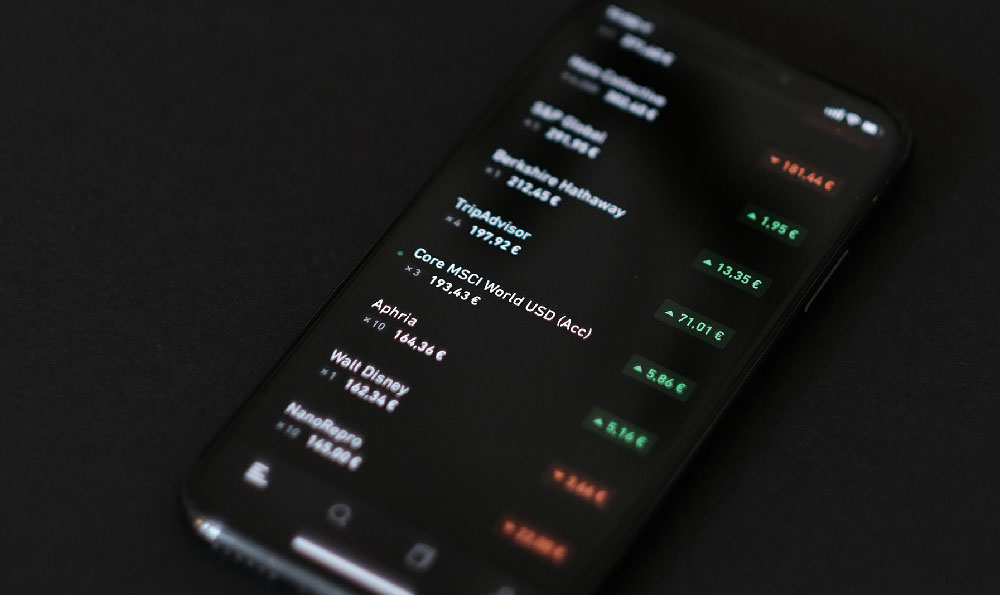

Developing a strategic investment approach is essential for long-term profitability. Diversification remains a key principle, as concentrating investments in a single cryptocurrency can amplify risk. Allocating capital across various asset classes—such as blue-chip cryptocurrencies, altcoins, and stablecoins—can create a balanced portfolio that mitigates the impact of sudden market corrections. Additionally, setting clear investment goals and adhering to a disciplined risk management plan are critical. For instance, defining a maximum risk percentage per trade and using stop-loss orders can limit potential losses while preserving capital.

Another vital aspect of successful virtual currency investment is maintaining emotional discipline. The market's unpredictability often leads to impulsive decisions driven by fear or greed, which can result in significant financial setbacks. Establishing a predefined strategy, such as setting targets for profit-taking or loss-cutting, helps investors stay grounded in their goals rather than reacting to short-term price fluctuations. Furthermore, practicing patience and avoiding the trap of frequent trading are important, as long-term holding can yield more sustainable returns.

The importance of cybersecurity cannot be overstated when engaging in home-based virtual currency investments. As investors interact with online platforms, the risk of cyberattacks, phishing attempts, and fraudulent schemes increases. Ensuring the use of strong passwords, enabling two-factor authentication (2FA), and depositing funds into secure wallets are fundamental steps to protect against theft or unauthorized access. Additionally, staying informed about potential scams, such as Ponzi schemes or fake initial coin offerings (ICOs), is crucial to avoid losing hard-earned capital.

For those new to virtual currency investment, the journey begins with education. Understanding the basics of blockchain technology, the mechanics of trading, and the risks associated with market volatility is the first step. Engaging with reputable educational resources, such as books, online courses, or forums, can equip investors with the necessary knowledge. However, it is essential to approach this learning with caution, as some sources may disseminate misleading information.

Incorporating a long-term perspective can also enhance the potential for success in virtual currency investments. While short-term trading may offer quick profits, the long-term value of cryptocurrencies often hinges on adoption rates, technological progress, and regulatory developments. For example, Bitcoin's status as a store of value and Ethereum's potential to drive the future of decentralized applications position these assets as attractive long-term investments. However, this approach requires patience and a willingness to weather market fluctuations.

Finally, the importance of continuous learning and adaptation cannot be ignored. The cryptocurrency market is in a state of constant evolution, with new technologies, trends, and regulatory changes emerging regularly. Staying updated with these developments ensures investors can adjust their strategies accordingly. For instance, understanding the implications of regulatory changes in major economies can influence market behavior and investment decisions.

In conclusion, virtual currency investment presents a unique opportunity for home-based financial growth, but it requires careful planning, strategic foresight, and a commitment to risk management. By analyzing market trends, utilizing technical indicators, and adhering to a disciplined investment approach, individuals can navigate this complex landscape with greater confidence. However, it is equally important to remain vigilant against potential risks and to protect personal assets through robust cybersecurity practices and continuous education. Success in this field is not guaranteed, but with the right mindset and approach, it becomes a feasible path for those seeking to earn income while working remotely.