Navigating the Digital Economy: Strategies for Generating Income Online in 2024 with Prudence and Insight

In the ever-evolving landscape of digital opportunities, the ability to generate income online is no longer a futuristic concept but a tangible reality. As technology advances and global markets shift, individuals seeking to capitalize on this realm must approach it with both strategic acumen and a deep understanding of risks. While the internet offers a vast array of avenues—from e-commerce to digital content creation—success often hinges on informed decision-making, discipline, and a focus on sustainable growth. This guide explores the most promising methods, with a particular emphasis on cryptocurrency investments, while also highlighting the importance of caution and education to avoid pitfalls that can erode financial stability.

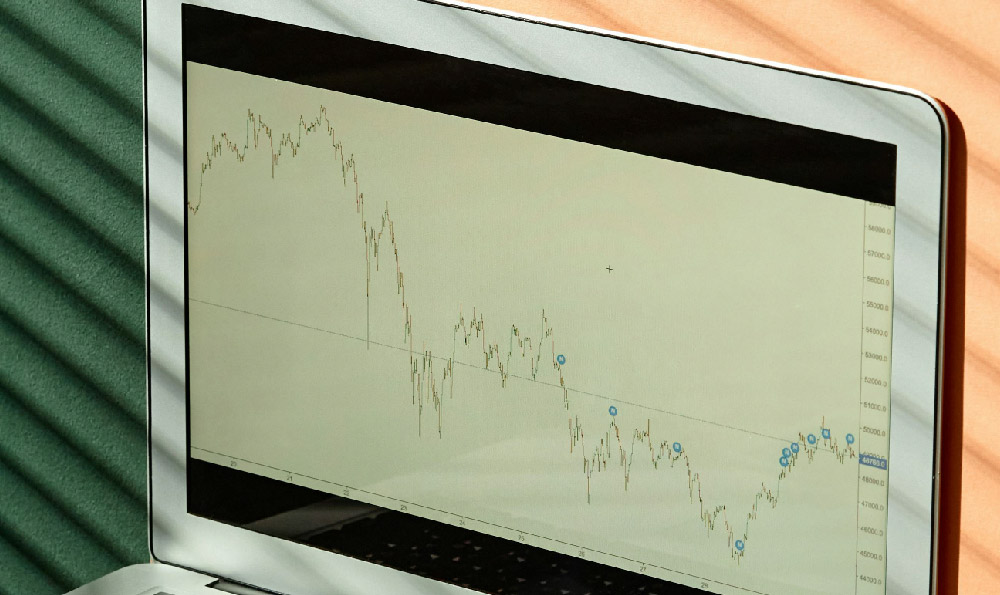

One of the most compelling ways to generate income online is through strategic cryptocurrency investment. The rise of decentralized finance (DeFi) and the integration of blockchain technology into traditional financial systems have created new opportunities for wealth creation. However, the market’s volatility and the intricacies of its dynamics demand a careful approach. In 2024, the focus has shifted toward long-term value capture, with investors increasingly prioritizing projects that align with broader technological and economic trends. For example, the growth of Web3 platforms and the adoption of non-fungible tokens (NFTs) have introduced unique avenues for capital appreciation. Yet, these opportunities are not without challenges. Understanding the fundamentals of a cryptocurrency—such as its use case, team credibility, and market adoption—is critical. Investors should also monitor macroeconomic factors, like interest rates and inflation, which can influence crypto markets. A combination of fundamental analysis and technical indicators, such as moving averages (MA) and the relative strength index (RSI), can help identify potential entry and exit points. However, the key is not to chase short-term gains but to build a diversified portfolio that mitigates risk while aligning with personal financial goals.

For those less inclined toward crypto, exploring digital products and services can yield substantial returns. Selling virtual goods, such as downloadable assets, design templates, or software tools, remains a viable option. Platforms like Gumroad or Etsy provide a space to monetize skills in graphic design, coding, or content creation. Additionally, affiliate marketing has evolved with the rise of targeted online ads and user-generated content, allowing individuals to earn commissions by promoting products or services. The success of these endeavors, however, depends on market demand and niche identification. Conducting thorough research into trending industries, such as sustainability or artificial intelligence, can uncover untapped opportunities. A critical strategy here is to leverage passive income streams, such as creating evergreen content or developing products with long-term utility, rather than relying on time-sensitive promotions.

Another pathway lies in the gig economy, where platforms like Fiverr, Upwork, or Uber enable individuals to monetize their expertise or physical labor. These services thrive on scalability, allowing participants to increase their earnings by expanding their service offerings or optimizing their time management. For instance, remote software development, online tutoring, or virtual event management have seen significant growth in 2024, driven by the increasing preference for remote work. Success in this domain often correlates with continuous skill development and reputation-building. By delivering high-quality work consistently and maintaining a strong online presence, individuals can transform their expertise into a reliable income source.

Yet, the most lucrative opportunities often emerge from the intersection of technology and innovation. Participation in decentralized finance (DeFi) protocols, for example, allows users to earn interest through liquidity provision or yield farming. Platforms like Aave and Compound have become popular for offering competitive returns on crypto holdings. However, the complexity of DeFi systems, combined with the risk of smart contract vulnerabilities, necessitates a cautious approach. Investors should familiarize themselves with the mechanics of these protocols, assess the risks of impermanent loss, and avoid overleveraging. Similarly, staking cryptocurrencies to support network operations has gained traction, with rewards tied to the amount of assets held. Understanding the staking requirements,锁定期和潜在回报率 is essential before committing funds.

In the realm of virtual assets, the ability to generate income through trading and investing hinges on psychological discipline. Markets fluctuate rapidly, and emotions like fear and greed can lead to impulsive decisions that undermine long-term strategies. Adopting a mindset rooted in analysis and patience, rather than speculation, is vital. For instance, using chart patterns and technical indicators like MACD (Moving Average Convergence Divergence) can help identify trends and potential reversals. However, these tools are not foolproof, and their effectiveness depends on a deep understanding of market psychology and macroeconomic influences.

Robust risk management practices are a cornerstone of sustained success in any financial endeavor. Whether investing in crypto, developing digital products, or participating in the gig economy, diversifying income sources and avoiding overexposure to single markets is crucial. For example, allocating a portion of one’s capital to high-growth crypto projects while maintaining a stable income from freelance work provides a safety net. Additionally, securing online assets through hardware wallets, two-factor authentication, and regular audits can safeguard against existential threats like hacking or fraud.

As the digital economy continues to mature, those who approach it with education, adaptability, and caution are poised to thrive. 2024 has seen a growing emphasis on transparency and regulation, with governments worldwide implementing frameworks to legitimize online income generation while protecting participants from exploitation. By staying informed, embracing innovative tools, and prioritizing risk mitigation, individuals can navigate this landscape with confidence and achieve meaningful financial growth.

Ultimately, the path to profitability online is not about seeking shortcuts but about cultivating a strategic mindset. Whether through cryptocurrency, digital products, or alternative revenue streams, success requires a balance of opportunity recognition and disciplined execution. By focusing on long-term value, prioritizing security, and continuously refining one’s approach, individuals can unlock the potential of the digital economy while safeguarding their financial future.