The pursuit of financial well-being is a universal aspiration, a desire woven into the fabric of our society. The question "How to make money, and is it even possible?" reflects both the ambition and the underlying anxieties surrounding this goal. To address this question effectively, we need to move beyond simplistic notions of instant riches and delve into the multifaceted world of wealth creation.

The possibility of making money is undeniably real. History is replete with individuals who have transformed modest beginnings into substantial fortunes. The key lies not in blind luck or fleeting trends, but in a combination of understanding fundamental economic principles, developing valuable skills, and adopting a disciplined approach to financial management.

One of the most fundamental avenues for wealth creation is through earned income. This encompasses the wages, salaries, or profits derived from labor or services. While a steady paycheck provides financial security, it is unlikely to be the sole driver of significant wealth accumulation for most people. To truly accelerate the process, it's crucial to actively seek opportunities to increase earning potential. This can involve acquiring new skills through education, training, or mentorship, negotiating for higher compensation in current roles, or exploring more lucrative career paths. Entrepreneurship, with its inherent risks and rewards, offers another pathway to significantly boosting income. Starting a business, whether it's a small side hustle or a large-scale venture, allows individuals to directly control their income and capitalize on market opportunities. However, successful entrepreneurship requires careful planning, dedication, and a willingness to adapt to changing circumstances.

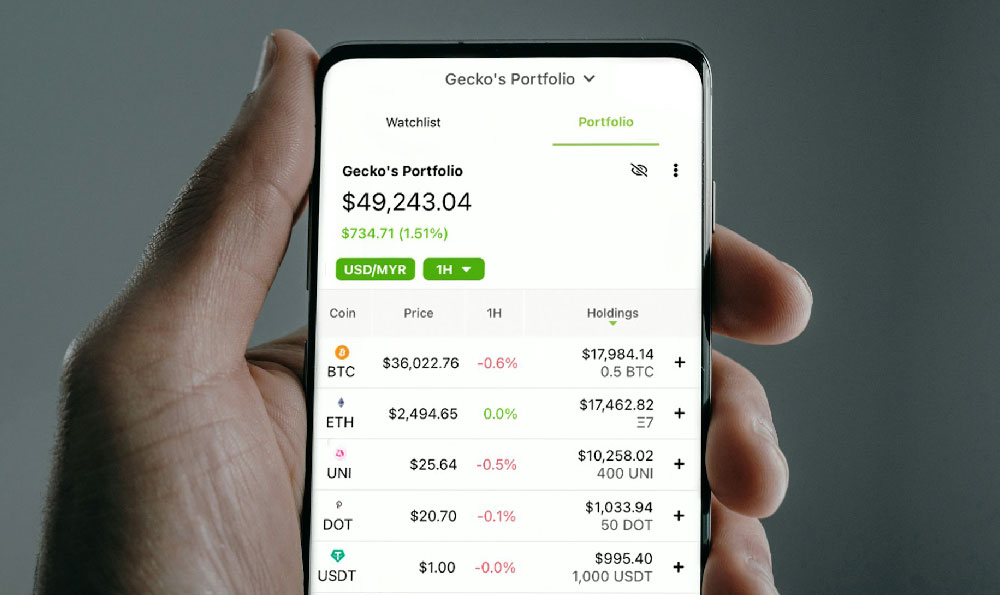

Beyond earned income, strategic investment plays a pivotal role in wealth creation. Simply saving money in a low-interest savings account is often insufficient to outpace inflation and build substantial wealth over time. Investing involves allocating capital to assets with the expectation of generating future income or appreciation in value. The range of investment options is vast and includes stocks, bonds, real estate, mutual funds, exchange-traded funds (ETFs), and alternative investments like precious metals or cryptocurrencies.

Each investment carries its own risk-reward profile, which is the relationship between the potential returns and the potential losses. Stocks, for example, generally offer higher potential returns but also come with greater volatility and risk. Bonds, on the other hand, tend to be less volatile but offer lower returns. Real estate can provide both income through rental properties and appreciation in value, but it also requires significant capital investment and ongoing management.

Successful investing involves understanding these risk-reward trade-offs and constructing a diversified portfolio that aligns with one's financial goals, time horizon, and risk tolerance. Diversification involves spreading investments across different asset classes, industries, and geographic regions to mitigate the impact of any single investment performing poorly. A well-diversified portfolio can help to smooth out returns over time and reduce overall risk.

Before embarking on any investment journey, it's crucial to conduct thorough research and due diligence. This involves understanding the underlying assets, the market conditions, and the fees associated with the investment. It's also wise to seek guidance from qualified financial advisors who can provide personalized recommendations based on individual circumstances.

Beyond income and investment, disciplined financial management is an essential ingredient in the recipe for wealth creation. This involves creating a budget, tracking expenses, managing debt, and saving regularly. A budget provides a clear picture of income and expenses, allowing individuals to identify areas where they can cut back on spending and allocate more resources to savings and investments. Managing debt is crucial because high-interest debt can erode wealth over time. Prioritizing the repayment of high-interest debt, such as credit card debt, can free up significant cash flow for savings and investments. Saving regularly, even if it's a small amount each month, can accumulate into a substantial sum over time thanks to the power of compounding. Compounding refers to the process of earning interest on both the principal and the accumulated interest, allowing wealth to grow exponentially over time.

Making money is not solely about accumulating wealth, but also about making smart choices that minimize losses and maximize returns over the long term. This requires understanding the impact of taxes, inflation, and other economic factors on financial well-being. Tax-efficient investing involves structuring investments in a way that minimizes tax liabilities. For example, contributing to tax-advantaged retirement accounts, such as 401(k)s and IRAs, can provide significant tax benefits. Inflation erodes the purchasing power of money over time, so it's important to invest in assets that can outpace inflation. Real estate, stocks, and commodities are often considered inflation hedges.

Furthermore, understanding market cycles and economic trends can help investors make more informed decisions. Economic downturns can present opportunities to buy undervalued assets, while periods of rapid growth can be a time to take profits and rebalance portfolios.

In conclusion, making money is not only possible but also achievable for those who are willing to acquire the necessary knowledge, develop valuable skills, and adopt a disciplined approach to financial management. It's a journey that requires continuous learning, adaptation, and a long-term perspective. By focusing on increasing earned income, investing strategically, managing finances prudently, and understanding the economic landscape, individuals can pave the way to financial security and wealth creation. The key is to start early, stay committed, and never stop learning. The path to financial well-being is not a sprint, but a marathon, and with the right strategies and mindset, the finish line is within reach.