Crafting a sustainable income stream through online streaming requires a blend of strategic foresight, adaptability, and a keen understanding of the evolving digital economy. In an era where viewers are inundated with content across platforms, streamers must differentiate themselves not just by their skills or creativity, but by their ability to harness emerging technologies and financial instruments that amplify both earning potential and risk mitigation. With the global streaming market projected to grow beyond $300 billion by 2026, the pathway to profitability has expanded beyond traditional models, offering opportunities to integrate blockchain-based systems and cryptocurrencies into their revenue strategies. This convergence of entertainment and finance transforms the process of creating content from a passive endeavor into an opportunity for strategic wealth building, requiring careful analysis of market trends and a proactive approach to diversification.

The foundation of any successful streaming venture lies in building a loyal audience. However, with 2.6 billion monthly active users on YouTube alone, merely attracting viewers is insufficient. Streamers must cultivate a brand identity that resonates with their niche while anticipating shifts in consumer behavior. For example, the rise of algorithmic-driven platforms has made content discoverability a critical factor. A forward-thinking approach would involve leveraging data analytics to understand viewer engagement patterns and refining content delivery to align with algorithmic preferences, ensuring visibility without compromising creative integrity. This requires a balance between strategic optimization and maintaining authenticity, as over-reliance on metrics can alienate organic growth.

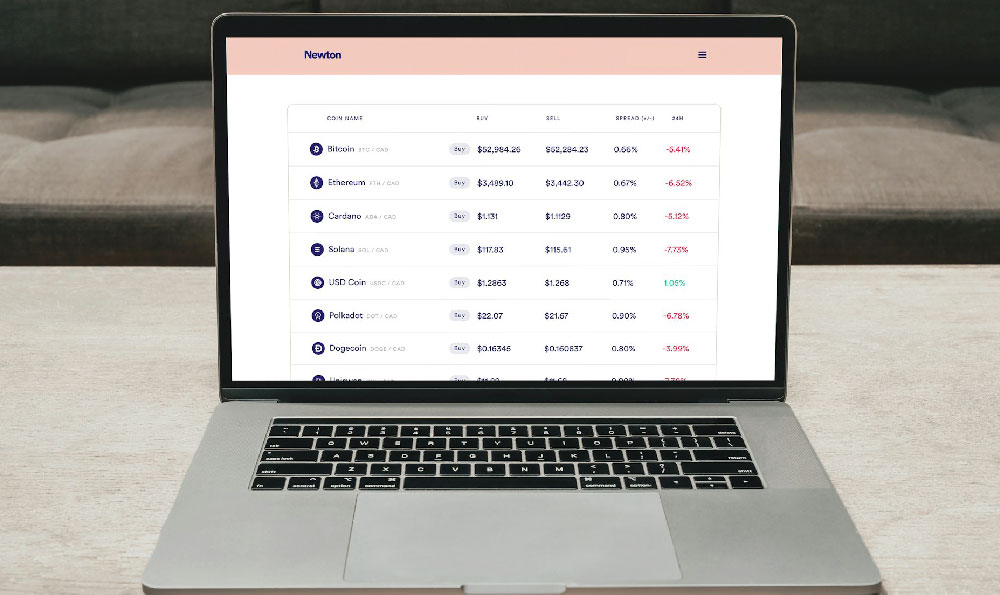

Beyond content creation, diversifying income streams is essential to long-term stability. While ad revenue and subscriptions form the core of most streaming models, increasingly, creators are exploring alternative monetization methods. The integration of cryptocurrency into this landscape offers unique advantages, particularly for those seeking to minimize transaction fees and gain access to a global audience. Platforms like Twitch and YouTube have introduced crypto-based payment options, allowing streamers to receive donations in digital assets. This not only provides an additional revenue channel but also exposes creators to the volatility and opportunities of the crypto market. However, such diversification demands careful risk management, as the fluctuating nature of cryptocurrencies can impact returns unpredictably.

For streamers contemplating crypto integration, selecting the right platform and currency is paramount. While Bitcoin and Ethereum remain the most recognizable, smaller altcoins may offer higher rewards for specific audiences. The key lies in aligning the payment method with the audience's preferences, as not all viewers are comfortable with digital assets. Additionally, multi-currency wallets and stablecoins can mitigate the risks of price fluctuations by providing a hedge against volatility. This approach allows streamers to diversify their revenue sources while maintaining financial control, an essential component of any robust investment strategy.

The intersection of streaming and cryptocurrency also opens avenues for monetizing the intersection of content and community. NFTs (Non-Fungible Tokens) have emerged as a novel way to tokenize unique content, offering streamers a means to sell exclusive streaming experiences or virtual merchandise directly to fans. This not only provides an additional revenue stream but also fosters a deeper sense of community engagement. However, this strategy requires a nuanced understanding of the NFT market, as it is still characterized by high volatility and speculative behavior. Streamers interested in this avenue must conduct thorough research, considering factors such as platform fees, audience demand, and the long-term value of digital assets.

Financial management becomes even more critical when diversifying income sources. Traditional methods such as ad revenue and subscriptions contribute to irregular cash flow, which can lead to financial instability. To address this, streamers should consider building a treasury of digital assets, benefiting from the decentralization of cryptocurrency to avoid reliance on centralized payment processors. This also provides an opportunity for passive income through staking or lending protocols, turning idle digital assets into a productive financial tool. Such strategies require a balance between income generation and capital preservation, ensuring that financial growth is not sacrificed for short-term gains.

The digital economy is evolving at an unprecedented pace, and successful streamers are those who adapt to these changes with strategic foresight. While the core of streaming remains content creation, the integration of blockchain-based systems offers new dimensions to financial growth. By exploring these opportunities with a calm and analytical approach, streamers can transform their platforms into a comprehensive financial ecosystem, while being mindful of the risks associated with these emerging technologies. Ultimately, the key to sustained success lies in combining visionary thinking with practical execution, ensuring that every decision aligns with both creative aspirations and financial objectives.