Bitcoin has emerged as one of the most talked-about assets in modern finance, drawing both fervent believers and cautious skeptics. Its meteoric rise from a niche digital currency to a global market phenomenon has sparked conversations about its potential to generate wealth. While the allure of cryptocurrency is undeniable, understanding how to profit from Bitcoin requires a nuanced approach that balances opportunity with risk. Let's explore the dynamics of this volatile market and the strategies that might shape an investor's journey.

The narrative around Bitcoin's profitability often centers on its limited supply and the growing adoption by institutions and individuals. With only 21 million coins ever to be mined, scarcity has historically driven demand, creating an environment where value could appreciate significantly. This scarcity is further amplified by the fact that Bitcoin operates on a decentralized network, free from the influence of traditional financial intermediaries. Unlike fiat currencies, which can be manipulated by central banks, Bitcoin’s algorithmic design theoretically ensures a stable supply, making it an attractive proposition for those seeking long-term value retention.

For investors willing to navigate the complexities of the crypto space, several avenues present themselves. Long-term holding, often referred to as "HODLing," has become a popular strategy among early adopters who anticipate a future where Bitcoin is widely accepted as a store of value. The concept is reminiscent of gold investing, where the idea is to own a tangible asset that appreciates over time. However, the decentralization that makes Bitcoin unique also introduces challenges, such as the lack of regulatory clarity and the absence of traditional safety nets like FDIC insurance.

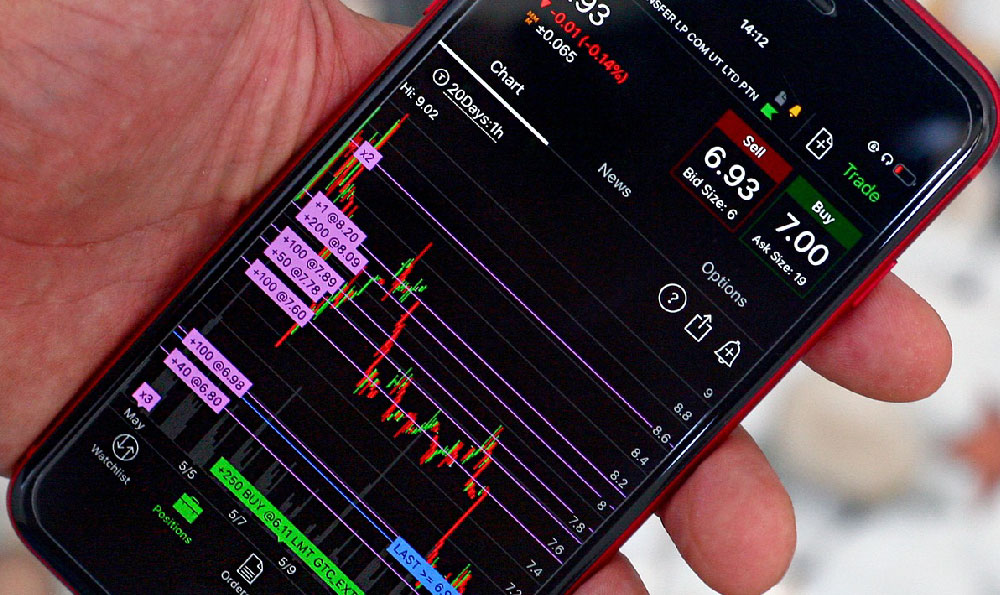

Speculative trading offers another angle for those looking to capitalize on short-term price movements. The cryptocurrency market is known for its high volatility, with prices fluctuating rapidly due to factors like news events, regulatory changes, and technological advancements. This volatility can create both explosive gains and steep losses, requiring traders to employ rigorous risk management techniques. Strategies such as dollar-cost averaging, technical analysis, and both long and short positions may be explored, though the unpredictability of the market often leaves traders in a perpetual state of adaptation.

Mining Bitcoin, though not as accessible as it once was, remains a viable method for individuals with the necessary resources. The computational power required to validate transactions and secure the network has shifted from a more democratic process to an industry dominated by large-scale operations. This evolution has raised concerns about centralization, which could undermine Bitcoin's core principles. However, for those with the technical expertise and financial commitment, mining still offers a direct incentive through block rewards and transaction fees.

The intersection of technology and finance has positioned Bitcoin at the forefront of innovation. Smart contracts, decentralized applications, and the integration of blockchain technology into various industries have expanded its utility beyond mere currency. This diversification could open new pathways for profit, such as participating in Initial Coin Offerings (ICOs) or investing in companies building infrastructure around Bitcoin. As the technology matures, these opportunities are likely to evolve, offering a more layered approach to investing.

Regulatory developments play a pivotal role in shaping Bitcoin's future. Governments and financial institutions are increasingly grappling with how to integrate this asset into existing frameworks. Policies ranging from taxation to licensing could influence market sentiment and liquidity. A supportive regulatory environment may enhance Bitcoin's legitimacy, while restrictive measures could create uncertainty, impacting both institutional and retail investors. Staying informed about these developments is crucial for anyone seeking to profit from Bitcoin.

The psychological aspect of investing in Bitcoin cannot be overlooked. The asset's extreme volatility can lead to emotional decision-making, with investors often caught between optimism and fear. This dynamic is amplified by the media's tendency to highlight dramatic price swings, creating a cycle of hope and anxiety. Developing a strong mindset, including discipline and emotional control, is essential for navigating this unpredictable terrain.

In conclusion, Bitcoin presents a unique opportunity for profit, but it is not without its challenges. The potential for high returns is matched by the need for robust risk management, adaptability, and a deep understanding of the market. Whether through long-term holding, speculative trading, or technological participation, the path to profitability requires careful consideration of both the upside and downside. As the market continues to evolve, investors must remain vigilant, informed, and prepared to embrace the uncertainties that come with this groundbreaking asset.