In today's rapidly evolving digital age, the quest for financial growth has transcended traditional boundaries. Individuals are increasingly exploring diverse avenues to monetize their time and expertise, with virtual currencies presenting a compelling opportunity. However, the allure of quick returns can mask significant risks, necessitating a balanced approach that marries innovation with prudence. To navigate this landscape effectively, one must adopt strategies that leverage technological advancements while mitigating potential pitfalls. This requires not only a deep understanding of market dynamics but also a commitment to disciplined investment practices that align with both personal goals and global economic trends.

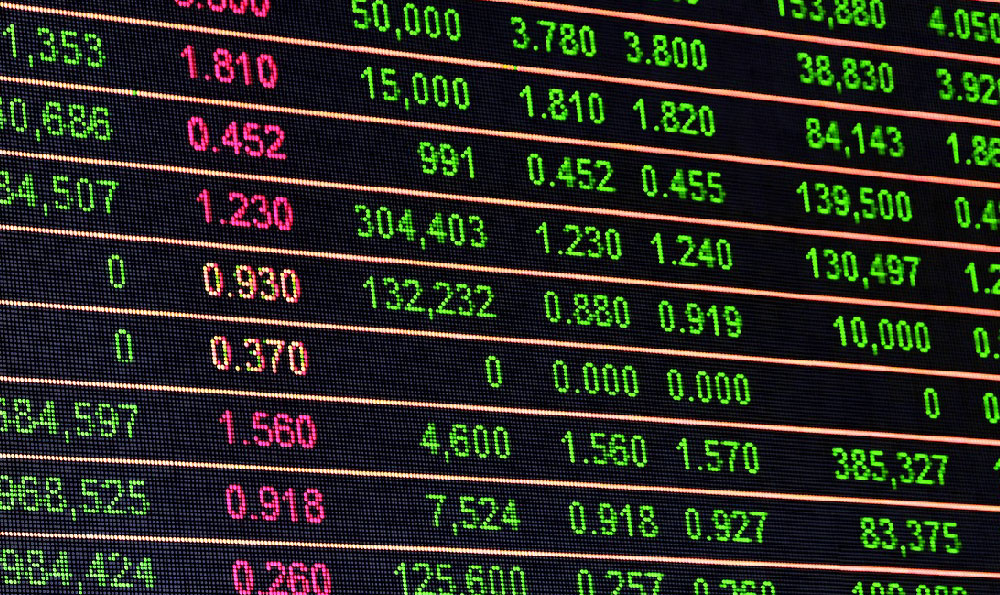

The foundation of any successful investment strategy lies in recognizing the unique characteristics of the virtual currency market. Unlike traditional asset classes, this sector operates 24/7, driven by algorithmic trading, decentralized networks, and global macroeconomic factors. The blockchain technology underpinning these currencies ensures transparency and security, yet volatility remains a defining trait. For instance, Bitcoin's price can fluctuate by hundreds of percent within a single trading session, influenced by news cycles, regulatory announcements, and algorithmic market manipulations. This volatility, while daunting, also presents opportunities for those who can interpret its patterns with precision. By analyzing technical indicators such as moving averages, relative strength index, and volume profiles, investors can identify potential entry and exit points that align with both market sentiment and fundamental value.

Beyond technical analysis, the integration of artificial intelligence has revolutionized the way investors approach the market. Machine learning algorithms can process vast amounts of data, from social media sentiment to on-chain activity, to predict price movements with remarkable accuracy. For example, AI-driven platforms analyze transaction patterns on blockchain networks to assess market demand and supply dynamics, enabling investors to make data-informed decisions. This technological edge allows for the construction of automated trading systems that execute strategies based on predefined criteria, optimizing efficiency and reducing emotional bias. However, the reliance on AI does not eliminate the need for human oversight, as algorithms can sometimes produce false signals during periods of high market turbulence.

The concept of decentralized finance (DeFi) has also emerged as a transformative force, offering alternatives to traditional financial systems. DeFi platforms utilize smart contracts to facilitate lending, borrowing, and trading without intermediaries, often providing higher returns than conventional methods. For instance, yield farming protocols enable users to earn interest on their crypto holdings by staking them in liquidity pools, with annualized returns sometimes exceeding 10%. Despite these advantages, DeFi carries its own set of risks, including smart contract vulnerabilities, liquidity crunches, and regulatory uncertainty. Investors must therefore conduct thorough due diligence, evaluating the security and transparency of DeFi projects before committing funds.

The shadow banking system has not been immune to the influence of virtual currencies, with some platforms offering unregulated lending and borrowing services. While these services can provide attractive returns, they often lack the oversight and safeguards of traditional financial institutions, exposing users to the risk of default or fraud. The rise of stablecoins, designed to maintain a peg to fiat currencies, has introduced a layer of stability to the market, yet their underlying assets and governance mechanisms require careful scrutiny. For example, a stablecoin's reserve holdings must be audited regularly to ensure they meet the required collateral ratios, a process that is often opaque or delayed in practice.

The intersection of virtual currencies and traditional asset classes has created new investment opportunities, such as crypto-linked derivatives and ETFs. These instruments allow investors to gain exposure to the market without directly holding the underlying assets, potentially reducing risk while amplifying returns. However, the complexity of these products requires a nuanced understanding of both markets, with investors needing to assess the underlying assets, funding rates, and regulatory environment before participating. The recent approval of Bitcoin ETFs by the U.S. Securities and Exchange Commission, for example, has introduced a new level of institutional participation in the market, yet the regulatory framework remains in flux.

The global macroeconomic environment also plays a pivotal role in shaping the virtual currency market, with factors such as inflation, interest rates, and geopolitical events influencing price movements. For instance, the Federal Reserve's interest rate decisions can impact the demand for alternative assets, including cryptocurrencies, as investors seek to balance risk and return in a changing economic landscape. This necessitates a holistic approach to investment, where virtual currencies are viewed not in isolation but as part of a diversified portfolio that includes traditional assets and cash reserves.

To capitalize on these opportunities while safeguarding against risks, investors must adopt a multi-faceted strategy that combines technical and fundamental analysis with prudent risk management. This involves setting clear investment goals, diversifying across different asset classes, and employing stop-loss orders to limit downside exposure. The development of algorithmic trading platforms has also provided investors with powerful tools to automate these strategies, allowing for real-time adjustments based on market conditions. By leveraging these technologies, investors can optimize their returns while minimizing the emotional toll associated with manual trading.

The rapid evolution of the virtual currency market necessitates continuous learning and adaptation, with investors needing to stay abreast of technological advancements, regulatory changes, and market trends. This involves monitoring key indicators such as market capitalization, price-to-earnings ratios, and trading volume, as well as engaging with online communities and forums to gain insights from other investors. The integration of virtual currencies into mainstream finance has also led to increased regulatory scrutiny, with governments around the world implementing frameworks to legitimize and oversee the market. This regulatory environment, while still in development, presents a fertile ground for long-term strategic investments.

In conclusion, the virtual currency market offers a unique opportunity to generate income online, but its success hinges on a combination of technical expertise, strategic thinking, and disciplined risk management. By leveraging technological advancements and understanding market dynamics, investors can navigate this complex landscape with confidence. The key to sustained success lies in adopting a holistic approach that balances short-term gains with long-term value, while remaining vigilant against potential pitfalls. As the market continues to evolve, the ability to adapt and innovate will be crucial, ensuring that investors remain at the forefront of this exciting financial frontier.