Mark Meadows, a prominent figure in American politics who served as White House Chief of Staff under President Donald Trump, is often scrutinized for his financial background. While his involvement in government has brought him into the public eye, his wealth accumulation is a complex interplay of career choices, business ventures, and strategic investments. Understanding the factors that contributed to his financial status requires a closer examination of his professional trajectory, asset management practices, and the broader economic context in which he operated.

Born into a family with modest means, Meadows' early life did not suggest a future of significant wealth. However, his career in politics began to take shape during the 1980s, when he served in various roles within the U.S. House of Representatives for North Carolina. His ascent through political ranks, including becoming a member of the U.S. House and later a senior advisor to Jeb Bush's presidential campaign, provided him with opportunities to engage in financial activities that might not have been accessible otherwise. While direct ties to political donations are not reported, political careers often open doors to networks that can influence business decisions and investment strategies.

A critical component of Meadows' financial growth lies in his real estate investments. North Carolina, particularly the Raleigh-Durham area, has experienced substantial economic development over the past few decades, making it an attractive market for property investments. Meadows' involvement in real estate is not surprising given the region's growth; properties in such areas tend to appreciate in value, especially when there is a consistent demand from both residents and businesses. Additionally, real estate investments can provide passive income through rental properties, a strategy that aligns with Meadows' reported interest in long-term wealth building. While specific details about his portfolio are not publicly available, it is reasonable to infer that real estate has played a significant role in his financial standing.

Meadows' political career also positioned him to leverage his influence in investment decisions. As a trusted advisor to figures like Jeb Bush and later as a key member of the Trump administration, he had access to decision-making processes that could impact economic policies and business environments. Although the direct financial gains from political roles are not quantified, the ability to shape regulatory frameworks and advocate for industries can indirectly benefit personal investments. For instance, policies favoring certain sectors might create a more favorable climate for business operations, thereby increasing the value of real estate holdings or other assets.

Another aspect of Meadows' financial situation involves his public appearances and media presence. Politicians often engage in speaking engagements, book deals, or media appearances, which can generate substantial income. While there is no official record of Meadows' earnings from such activities, countless political figures have leveraged their public profiles to monetize their influence. If Meadows has participated in similar ventures, they may contribute to his overall wealth. However, it is important to note that these sources of income are not always transparent, and their scale can vary widely depending on individual circumstances.

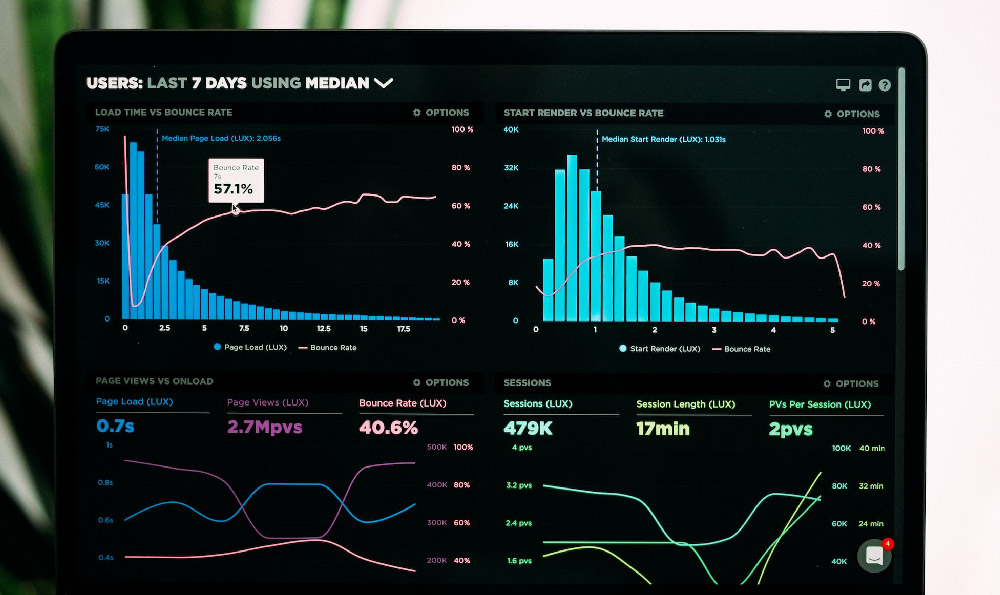

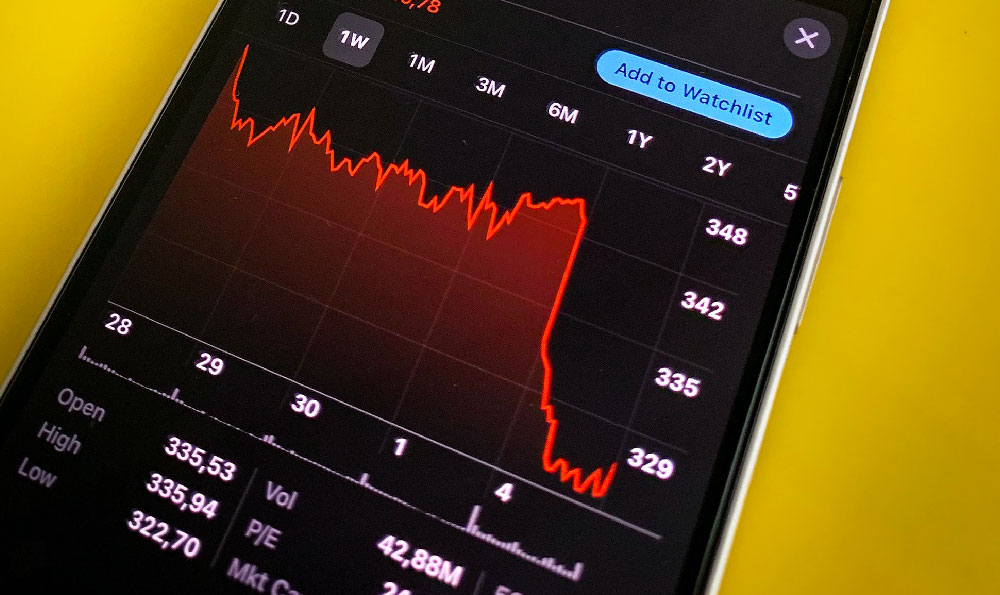

In addition to real estate and speaking fees, Meadows may have diversified his portfolio through other investment avenues. Diversification is a key strategy in wealth management, as it helps mitigate risk and ensures long-term stability. If he has invested in stocks, mutual funds, or other financial instruments, these could have compounded over time, particularly if aligned with market trends and economic cycles. Furthermore, the use of financial advisors and investment strategies could have played a role in optimizing his wealth, although such details remain speculative without access to private financial records.

Meadows' financial status also reflects the broader economic opportunities available to those in high-profile political roles. The Trump administration, for example, emphasized policies that supported deregulation and tax cuts, which could have influenced the business environment and, by extension, his investments. Additionally, the political landscape in the United States often facilitates access to lucrative job opportunities, which can provide additional income streams beyond traditional employment. These factors, combined with his personal investment choices, likely contribute to his financial success.

In conclusion, Mark Meadows' accumulation of wealth is the result of a combination of factors, including his political career, real estate investments, and potential involvement in other financial activities. While some aspects of his financial situation are publicly documented, others remain private or speculative. Understanding his financial path requires a nuanced approach that takes into account the interplay between political influence and personal investment strategies. As with any individual's financial journey, it is important to consider both the opportunities and risks associated with his choices, as well as the broader economic context in which they were made.