Investing in nuclear energy stocks presents a fascinating, albeit complex, opportunity for investors. It's a sector fueled by both growing global energy demands and increasing concerns about climate change, making it a potential beneficiary of a transition towards cleaner power sources. However, navigating this market requires a thorough understanding of the industry, its associated risks, and your own investment goals. Before diving into specific stocks, it's crucial to lay a solid foundation.

First and foremost, educate yourself about the nuclear energy industry. This includes understanding the different reactor technologies, the nuclear fuel cycle (from mining to waste disposal), and the regulatory landscape. Governments worldwide play a significant role in the nuclear industry, influencing everything from safety standards to project approvals and subsidies. Familiarize yourself with the key players in the industry, including reactor manufacturers, fuel suppliers, waste management companies, and utility companies that operate nuclear power plants. Learn about their market share, financial performance, and future projects. This due diligence is paramount. Don’t rely solely on mainstream financial news; delve into industry-specific reports and analysis. Consider subscribing to specialized newsletters or following reputable analysts who focus on the energy sector.

Evaluating the long-term prospects of nuclear energy is essential. Is nuclear power poised for a resurgence, or will it remain a niche energy source? Factors to consider include: the cost competitiveness of nuclear energy compared to other renewable and fossil fuel sources; public perception and acceptance of nuclear power; advancements in reactor technology, such as small modular reactors (SMRs) that offer greater flexibility and safety; and the political and regulatory support for nuclear energy in key markets. Climate change policies and government initiatives aimed at decarbonizing the energy sector can significantly impact the demand for nuclear power. Remember, investment is inherently forward-looking, and your judgment of the future trajectory of this sector will heavily influence your success.

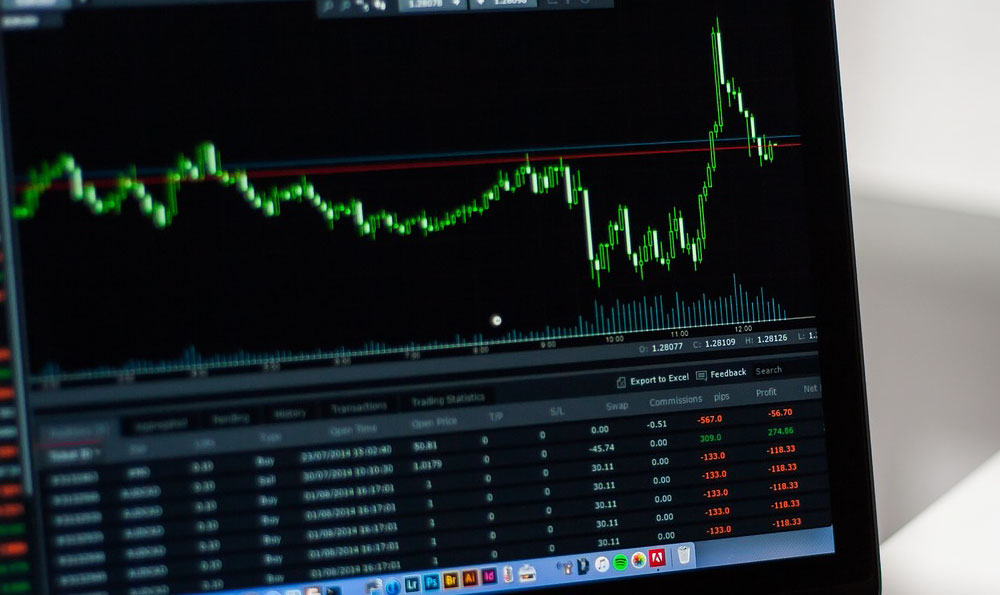

When evaluating individual nuclear energy stocks, scrutinize their financial statements. Look for companies with strong balance sheets, consistent revenue growth, and healthy profit margins. Pay attention to their debt levels and cash flow, as these indicators can reveal their ability to weather economic downturns and fund future projects. Understand the company's competitive advantage and its position within the industry value chain. Does it possess proprietary technology, a strong brand reputation, or a dominant market share? Consider the company's management team and their track record. Experienced and competent leadership is crucial for navigating the complexities of the nuclear energy industry. Moreover, analyze the company’s project pipeline and future growth opportunities. Are they developing new reactors, expanding their fuel supply operations, or venturing into new markets?

Diversification is a cornerstone of sound investment strategy. Don’t put all your eggs in one basket. Instead, consider diversifying your portfolio across different nuclear energy stocks, or even across the broader energy sector. This can help mitigate the risk associated with investing in a single company or technology. You might consider exchange-traded funds (ETFs) that focus on nuclear energy or clean energy. These ETFs provide instant diversification and can be a convenient way to gain exposure to the sector. However, be sure to examine the ETF's holdings and expense ratio before investing.

Investing in nuclear energy stocks is not without its risks. Regulatory hurdles, construction delays, cost overruns, and safety concerns can all negatively impact the performance of these stocks. The nuclear industry is highly regulated, and changes in regulations can significantly affect the profitability of nuclear power plants. Construction delays are common in the nuclear industry, leading to increased costs and delayed revenue generation. Cost overruns can also be a major problem, particularly for new reactor projects. Safety concerns, such as nuclear accidents, can have a devastating impact on the industry and the value of nuclear energy stocks. The stigma surrounding nuclear energy, fueled by historical accidents, remains a challenge. Public opposition to nuclear power plants can hinder project development and expansion.

Before making any investment decisions, carefully assess your own risk tolerance and investment goals. Are you a risk-averse investor seeking steady returns, or are you willing to take on more risk for the potential of higher growth? What is your time horizon? Are you investing for the long term, or are you looking for a quick profit? Nuclear energy investments typically require a long-term perspective, as it can take many years for nuclear power plants to be built and become operational. If you are not comfortable with the risks associated with nuclear energy stocks, or if you have a short time horizon, this may not be the right investment for you.

Consider the ethical implications of investing in nuclear energy. While nuclear power is a low-carbon energy source, it also produces radioactive waste that must be safely stored for thousands of years. Some investors may be uncomfortable with the environmental and social risks associated with nuclear waste disposal. Research the waste management practices of the companies you are considering investing in.

Finally, remember that market conditions can change rapidly. Stay informed about the latest developments in the nuclear energy industry and the broader energy market. Monitor the performance of your investments regularly and be prepared to adjust your portfolio as needed. Don't be afraid to seek professional advice from a financial advisor who specializes in the energy sector. They can help you assess your risk tolerance, develop a personalized investment strategy, and provide ongoing guidance. Investing in nuclear energy stocks requires patience, diligence, and a long-term perspective. By carefully considering the factors outlined above, you can make informed investment decisions and potentially benefit from the growth of this important energy sector.