Real estate agents play a vital role in the real estate market, acting as intermediaries between buyers and sellers, and their income and earnings are pivotal indicators of the industry's dynamics. The average salary and earnings per year for real estate agents can vary significantly based on location, experience, and market conditions, making it essential to analyze these figures within broader economic contexts. In the United States, the Bureau of Labor Statistics (BLS) reports that the median annual wage for real estate brokers and sales agents was $54,510 in 2023, though this figure is often skewed by the commission-based nature of the profession. Unlike traditional salaried roles, real estate agents typically earn through a combination of commissions and bonuses, which means their income can fluctuate widely depending on the volume of transactions they facilitate. For instance, an agent may secure a high commission from a single transaction but face lean periods when the market is sluggish, creating an unpredictable revenue stream that complicates straightforward salary comparisons.

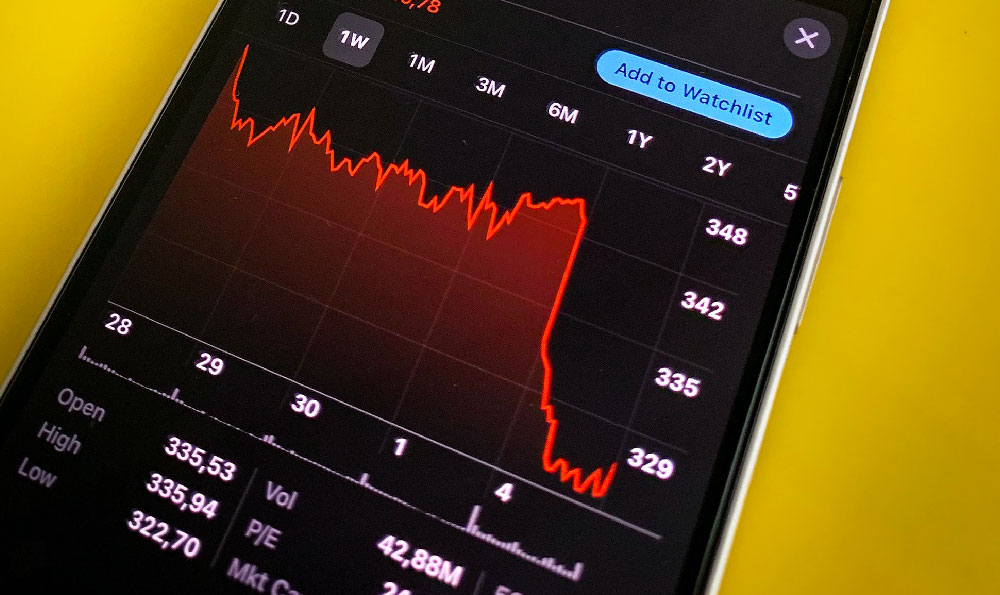

The income structure of real estate agents is influenced by both external and internal factors. Collectively, the real estate market’s performance directly impacts the volume of sales, which in turn affects the number of transactions an agent can close. During periods of economic expansion, when home buying and selling activity increases, agents often experience higher earnings. Conversely, in a downturn, such as the 2020 pandemic-driven market crash, income levels may decrease substantially. This volatility underscores the importance of agents adapting to market cycles, leveraging digital tools to maintain client engagement, and diversifying their services to ensure steady revenue. Beyond market conditions, the commission rate itself varies depending on the brokerage model and the type of transaction. In some cases, agents may earn between 2% to 7% of a property’s sale price, while others receive a split commission with their brokerage or team. This negotiable aspect adds layers of complexity to income projections, as it requires agents to navigate contractual agreements and competitive commission structures.

Geographic location is another critical determinant of earnings, with urban centers often offering higher salaries than rural areas. For example, agents in metropolitan regions like New York, Los Angeles, or Chicago typically command higher fees due to the cost of living and the density of transactions. In contrast, agents in smaller towns or less competitive markets may have lower income potential, even if their commissions are steady. Additionally, the regional real estate market’s health plays a role; areas with a robust housing market and high demand for properties may generate more consistent earnings. However, agents in markets with oversupply or price stagnation may face challenges in securing high-value deals. This regional disparity highlights the need for agents to conduct thorough market research and consider relocating or expanding their practice to areas with growth potential.

The level of experience and specialization also shapes income trajectories. Entry-level agents often earn less than seasoned professionals, as their revenue depends on the volume of sales they complete. Over time, as they gain credibility and develop a client base, their earnings can increase significantly. Specializing in niche markets, such as luxury real estate, commercial properties, or investment properties, may further elevate income levels. For example, agents focusing on high-end properties can charge higher fees and commissions, while those who specialize in commercial real estate may negotiate more lucrative deals. This diversification of services allows agents to target high-margin segments, thereby improving their financial stability.

In addition to market dynamics and individual performance, the choice of brokerage model can impact earnings. Independent agents often have greater autonomy but must bear higher operational costs, including marketing expenses and office rent. On the other hand, agents affiliated with larger firms may benefit from resources and support, but their income could be lower due to commission splits. This trade-off between independence and support systems underscores the importance of aligning one’s business model with long-term financial goals.

Investors and aspiring real estate agents should also consider the broader implications of income trends. The real estate industry’s growth is closely tied to macroeconomic factors, such as interest rates, inflation, and employment rates, all of which can influence transaction volumes and agent earnings. For instance, low interest rates can stimulate home buying activity, indirectly boosting agent incomes. Conversely, rising mortgage rates or economic instability can reduce market participation, affecting revenue. Understanding these macroeconomic linkages enables agents and investors to make informed decisions about market entry, service offerings, and investment strategies.

Ultimately, while the average salary and earnings per year for real estate agents provide a baseline for comparison, they should be viewed as part of a larger narrative. Agents who thrive in this industry often leverage their networks, adapt to technological advancements, and focus on long-term client relationships. For investors, recognizing the income potential of real estate agents can inform decisions about market participation, such as identifying high-income areas for property investments or collaborating with skilled agents to enhance returns. By examining these factors holistically, individuals can better navigate the complexities of the real estate market and optimize their financial outcomes.