Okay, I understand. Here's an article based on the title "Real Estate Riches: How Can You Earn & Is It Right For You?" written according to your specifications:

Real estate, often touted as a pathway to wealth and financial independence, holds a certain allure for investors of all levels. The promise of passive income, asset appreciation, and the tangible nature of owning property makes it an appealing option. However, navigating the real estate landscape requires careful consideration, strategic planning, and a realistic understanding of both the potential rewards and the inherent risks. Before diving headfirst into property investment, it's crucial to examine the different avenues available for earning money and determine if this investment vehicle aligns with your individual circumstances and financial goals.

One of the most common and straightforward ways to generate income from real estate is through rental properties. The core concept is simple: purchase a property and rent it out to tenants. The rental income should, ideally, cover the mortgage payment, property taxes, insurance, and maintenance expenses, leaving you with a positive cash flow. However, successful rental property investment requires diligent tenant screening, proactive property management, and a thorough understanding of local landlord-tenant laws. Vacancy periods, unexpected repairs, and difficult tenants can quickly erode profits. Analyzing the local rental market, understanding occupancy rates, and calculating potential return on investment (ROI) are essential steps before acquiring a rental property. Furthermore, consider the time commitment involved in managing a rental, or the cost of hiring a property manager.

Flipping houses offers a more active and potentially lucrative path to real estate riches. This involves purchasing undervalued properties, renovating or improving them, and then selling them for a profit. Successful flipping demands a keen eye for identifying properties with potential, accurate cost estimation for renovations, and efficient project management skills. The timeline is critical; the longer a property sits on the market, the more it costs in holding expenses, which can significantly impact profitability. Market research is crucial, as is understanding local building codes and permit requirements. Flipping can be highly rewarding, but it also carries significant risk, particularly if renovation costs overrun estimates or the market cools down unexpectedly.

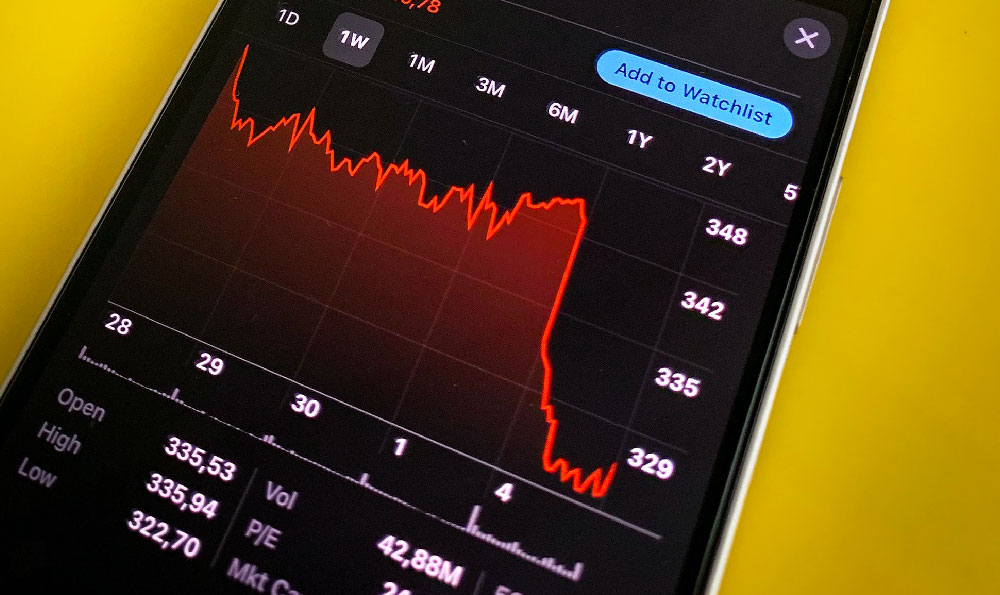

Real Estate Investment Trusts (REITs) provide a more accessible entry point for investors who want exposure to real estate without the responsibilities of direct property ownership. REITs are companies that own or finance income-producing real estate across various sectors, such as commercial properties, residential buildings, and industrial complexes. By purchasing shares in a REIT, investors can earn dividends based on the income generated by the underlying properties. REITs offer diversification and liquidity, as shares can be easily bought and sold on stock exchanges. While REITs can provide a steady stream of income, their performance is influenced by market fluctuations and interest rate changes. Thorough research into the specific REIT's portfolio, management team, and financial health is vital before investing.

Another avenue to explore is wholesaling, which involves finding properties below market value and then assigning the contract to another buyer for a fee. Wholesalers essentially act as intermediaries, connecting motivated sellers with potential investors. Wholesaling requires strong networking skills, marketing abilities, and a good understanding of real estate contracts. The wholesaler doesn't actually purchase the property but rather controls the right to purchase it and then sells that right to someone else. This strategy demands minimal capital but relies heavily on identifying deals and finding buyers quickly. Ethical considerations are paramount in wholesaling, as transparency and fair dealing are essential for building a reputable business.

Crowdfunding platforms have emerged as a relatively new way to invest in real estate. These platforms connect investors with real estate developers or property owners seeking funding for projects. Investors can pool their capital to finance various real estate ventures, earning returns based on the project's success. Crowdfunding offers access to larger and more diverse real estate opportunities with relatively lower investment minimums. However, it's important to carefully evaluate the platform's due diligence process, the project's viability, and the risks involved before committing funds.

Ultimately, the suitability of real estate investment depends on several factors, including your financial situation, risk tolerance, time commitment, and investment goals. Ask yourself these crucial questions:

- What is your risk tolerance? Real estate investments can be illiquid and subject to market fluctuations. Are you comfortable with the possibility of losing money?

- What is your time commitment? Direct property ownership requires significant time and effort for property management, tenant screening, and repairs. Are you willing to dedicate the necessary time, or are you prepared to hire professionals to handle these tasks?

- What are your financial goals? Are you seeking passive income, long-term capital appreciation, or short-term profits? Different real estate strategies align with different financial goals.

- What is your financial situation? Do you have sufficient capital for a down payment, closing costs, and ongoing expenses? Can you comfortably handle unexpected repairs or vacancy periods?

- Do you have the necessary skills and knowledge? Successful real estate investing requires a solid understanding of market analysis, property valuation, negotiation, and property management.

Investing in real estate can be a rewarding endeavor, but it's essential to approach it with a clear understanding of the potential risks and rewards. Conduct thorough research, seek professional advice, and carefully assess your own circumstances before making any investment decisions. There is no guaranteed path to "real estate riches", but with careful planning and due diligence, it can be a valuable component of a diversified investment portfolio. Consider the ethical implications of your investment choices, ensuring you are contributing to the well-being of communities and respecting the rights of tenants. Remember that sustained success in real estate requires continuous learning, adaptability, and a commitment to providing value to both investors and tenants alike.