Keepbit, like many real-time trade gateways in the cryptocurrency space, presents itself as a solution for traders seeking speed, efficiency, and access to a wider range of markets. Deciding whether Keepbit is the “right” choice hinges on a thorough evaluation of its features, fees, security protocols, and, perhaps most crucially, a comparison with its alternatives. The decision-making process should be informed by your individual trading style, risk tolerance, and specific needs.

The allure of real-time trade gateways lies in their ability to execute orders almost instantaneously, often leveraging sophisticated algorithms and direct connections to exchanges. This speed advantage can be crucial in volatile markets where even slight delays can impact profitability. Before committing to Keepbit, a prospective user should meticulously analyze the latency offered. This means understanding the typical execution speed, and also whether the execution speed stays the same during peak trading hours when network congestion can slow down transactions. Keepbit's website and documentation should ideally provide this information, though independent reviews and user feedback can offer a more realistic perspective.

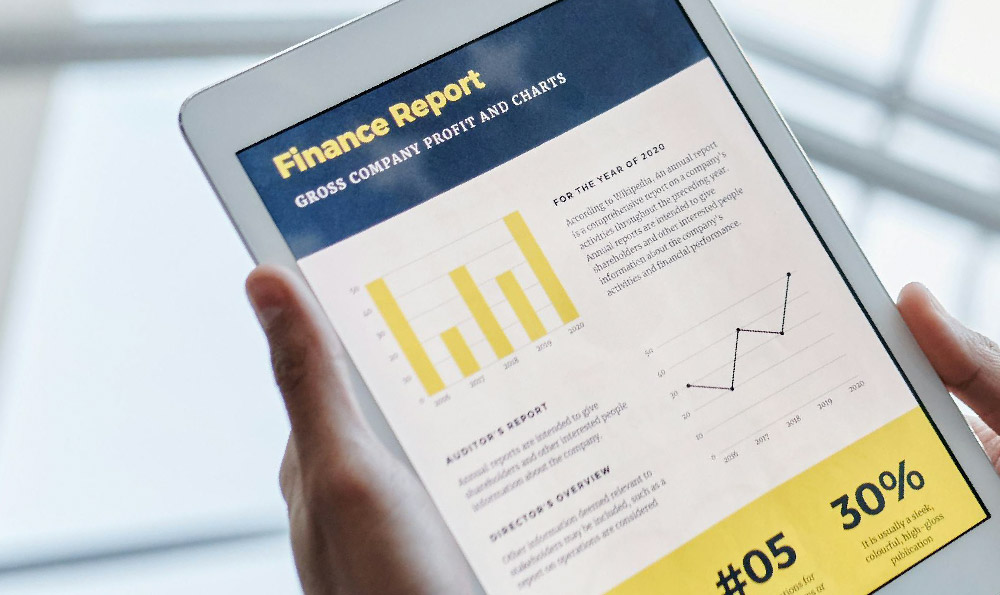

Fees are another critical factor. Real-time trade gateways typically charge a commission or subscription fee for their services. A seemingly small fee can quickly erode profits, particularly for high-frequency traders or those making numerous small trades. Comparing Keepbit's fee structure with those of its competitors is essential. Some gateways offer tiered pricing based on trading volume, while others have a flat fee structure. Carefully calculate the total cost of using Keepbit based on your expected trading activity. Hidden fees are also a common pitfall; always read the fine print to understand potential charges for withdrawals, deposits, or inactivity.

Security is paramount in the cryptocurrency realm. Given that real-time trade gateways handle sensitive financial information and facilitate transactions, their security infrastructure must be robust and reliable. Investigate Keepbit's security measures. Does it employ multi-factor authentication? Are funds held in cold storage? Has the platform undergone security audits by reputable firms? Look for evidence of security breaches or vulnerabilities in the past. A track record of strong security practices is a significant indicator of a platform's commitment to protecting user funds. Keepbit must also fully comply with all the relevant regulations and laws related to AML/KYC requirements.

Now, let's delve into the alternatives. The market is populated with various platforms catering to different trading needs. A direct comparison is essential.

-

Established Cryptocurrency Exchanges: Major exchanges like Binance, Coinbase Pro, Kraken, and Gemini offer their own trading interfaces and APIs for automated trading. While not strictly "real-time trade gateways" in the purest sense, they provide direct access to a wide range of cryptocurrencies and trading pairs, often with competitive fees and robust security measures. Their biggest advantage is their liquidity and high trading volume. Evaluating the API documentation and available trading tools for these exchanges is crucial for determining their suitability for automated trading.

-

Professional Trading Platforms (e.g., MetaTrader 4/5 with Crypto Brokers): MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular platforms used by traders of all levels. While originally designed for forex trading, they are now supported by many cryptocurrency brokers. These platforms provide advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs). However, using MT4/5 for cryptocurrency trading involves trusting a broker, which introduces counterparty risk. Carefully vet the broker's reputation, regulatory compliance, and financial stability before entrusting them with your funds. Check the spread and commission offered by the crypto broker and make sure that they are acceptable.

-

Other Specialized Trading Gateways: Numerous other specialized trading gateways cater to specific niches within the cryptocurrency market. Some focus on arbitrage trading, while others specialize in providing access to decentralized exchanges (DEXs). Researching these alternatives can reveal platforms that better align with your specific trading strategy. Examples might include solutions that aggregate liquidity from multiple exchanges or offer advanced order types not available on standard exchanges.

-

DIY Approach with Custom API Integrations: For technically proficient traders, building a custom trading platform using exchange APIs offers the ultimate control and flexibility. This approach requires significant programming skills and a deep understanding of exchange protocols. While it allows for complete customization, it also entails a substantial time commitment and the responsibility for maintaining the platform's security and stability.

Ultimately, the “right” choice depends on your specific circumstances. Keepbit might be a suitable option if it offers the speed, features, and security measures you require at a competitive price. However, thoroughly comparing it with the alternatives mentioned above is crucial. Before making a decision, consider:

- Your trading volume and frequency: High-volume traders may benefit from tiered pricing structures, while low-volume traders may prefer platforms with lower fixed fees.

- The cryptocurrencies you want to trade: Ensure that the platform offers access to the specific cryptocurrencies and trading pairs you are interested in.

- Your technical expertise: If you are comfortable with programming, a DIY approach might be feasible. Otherwise, a user-friendly platform with good customer support is essential.

- Your risk tolerance: Choose a platform with robust security measures and a proven track record of protecting user funds. Diversify your holdings across multiple exchanges and platforms to mitigate risk.

Finally, remember that cryptocurrency investing is inherently risky. Never invest more than you can afford to lose, and always conduct thorough research before making any investment decisions. No trading platform can guarantee profits, and even the most sophisticated strategies can be subject to market volatility. Continuous learning and adaptation are essential for success in the ever-evolving cryptocurrency landscape.