Roth IRAs are powerful retirement savings vehicles, particularly attractive for individuals anticipating a higher tax bracket in retirement or those seeking tax-free growth on their investments. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, but qualified withdrawals in retirement, including earnings, are tax-free. This tax advantage makes it a compelling option for long-term cryptocurrency investments, allowing potential gains to compound without the burden of future taxation. However, navigating the world of Roth IRA investing, especially with volatile assets like cryptocurrencies, requires a strategic approach.

Before venturing into crypto within a Roth IRA, understanding the fundamental principles of Roth IRAs is crucial. Eligibility for contributing to a Roth IRA depends on your modified adjusted gross income (MAGI). There are income limits; exceeding them restricts or eliminates your ability to contribute. It is essential to review the IRS guidelines annually to ensure you meet the requirements. Contribution limits also exist, fluctuating year to year. Staying within these limits is critical to avoid penalties. Failure to do so can result in excise taxes on excess contributions. The IRS publishes these limits, and you can typically find them on their website or through financial institutions.

Next, the crucial step involves selecting a custodian that permits cryptocurrency holdings within Roth IRAs. Not all IRA custodians support cryptocurrencies. Traditional brokerage houses often lack the infrastructure to securely hold and manage digital assets. Specialized crypto IRA providers exist that offer custodial services and platforms specifically designed for digital assets. Thoroughly research different custodians, comparing their fees, security measures, and available cryptocurrency options. Look for custodians with robust security protocols, including cold storage for the majority of assets and multi-factor authentication. Consider the custodian's reputation and customer service reviews before making a decision.

Once you've established a Roth IRA with a compatible custodian, you need to fund it. As mentioned, Roth IRA contributions are made with after-tax dollars. You can contribute cash, which you then use to purchase cryptocurrencies within the IRA. You cannot directly transfer cryptocurrency you already own into the Roth IRA without triggering a taxable event. This is a crucial point to understand. Transferring existing crypto holdings would be treated as a sale, incurring capital gains taxes on the appreciated value, and then a separate contribution, potentially exceeding the annual limit. The most common approach is to fund the Roth IRA with cash and then use that cash to purchase cryptocurrency through the custodian's platform.

Investing in cryptocurrencies within a Roth IRA demands a well-defined investment strategy. Cryptocurrency investments are inherently volatile, and diversification is key to mitigating risk. Don't put all your Roth IRA eggs into a single cryptocurrency basket. Spread your investments across different cryptocurrencies with varying market capitalizations and use cases. Consider allocating a portion of your Roth IRA to more established cryptocurrencies like Bitcoin and Ethereum, and then diversifying into smaller-cap altcoins. A good starting point is to determine your risk tolerance. Are you comfortable with high volatility for potentially high returns, or do you prefer a more conservative approach? Your risk tolerance will dictate your asset allocation strategy. Remember, the goal is long-term growth within a tax-advantaged environment.

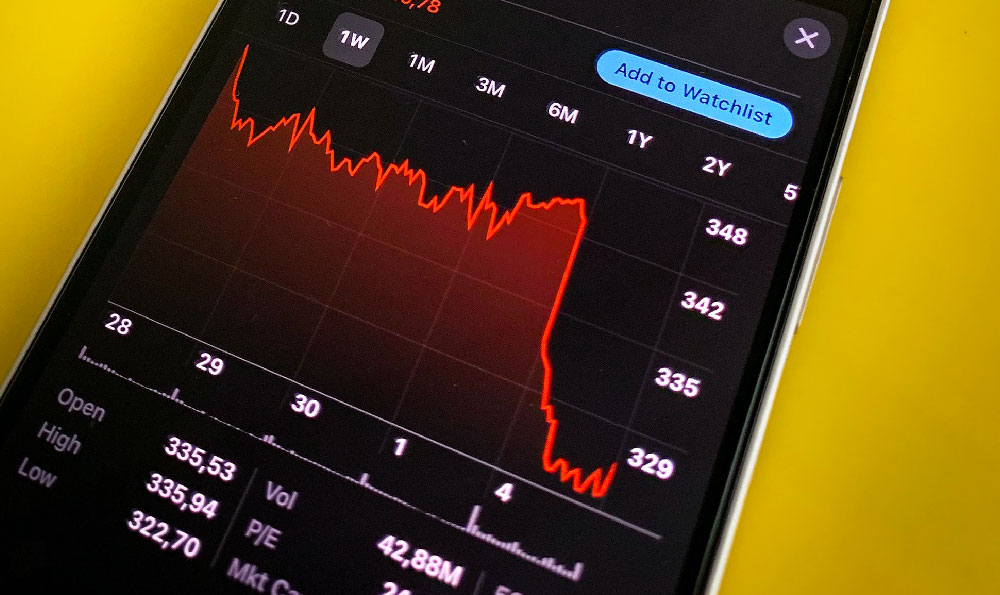

Furthermore, adopt a long-term perspective. Cryptocurrencies are prone to significant price fluctuations. Avoid making impulsive decisions based on short-term market movements. Instead, focus on the long-term potential of the underlying technology and the adoption rate of different cryptocurrencies. Consider using dollar-cost averaging (DCA). DCA involves investing a fixed amount of money at regular intervals, regardless of the price of the asset. This strategy helps to smooth out the impact of volatility and can lead to better average returns over time. For example, instead of investing $6,500 (the 2023 contribution limit for those under 50) all at once, you could invest $541.67 each month.

Risk management is paramount when dealing with cryptocurrencies. Only invest what you can afford to lose. Cryptocurrencies are speculative assets, and their value can drop to zero. Understand the risks involved before investing. Research each cryptocurrency thoroughly before investing. Understand its underlying technology, its use case, and its competitive landscape. Be wary of hype and "get-rich-quick" schemes. Due diligence is essential. Employ stop-loss orders to limit potential losses. A stop-loss order is an instruction to sell a cryptocurrency when it reaches a certain price. This can help to protect your investments from significant drawdowns.

Tax implications within a Roth IRA are different compared to taxable brokerage accounts. The beauty of a Roth IRA is that qualified withdrawals in retirement are tax-free. This includes the earnings generated from your cryptocurrency investments. However, non-qualified withdrawals may be subject to taxes and penalties. Be aware of the Roth IRA withdrawal rules and ensure you understand the implications of taking money out of your account before retirement. It's always wise to consult with a qualified tax advisor to understand the specific tax implications of your Roth IRA investments.

Finally, the cryptocurrency landscape is constantly evolving. Stay informed about the latest developments in the industry. Follow reputable news sources, read whitepapers, and attend industry events. Be aware of regulatory changes that could impact the cryptocurrency market. The regulatory environment for cryptocurrencies is still developing, and changes in regulations could significantly affect the value of your investments. Continual learning and adaptation are essential for successful cryptocurrency investing.

In conclusion, investing in cryptocurrencies within a Roth IRA offers the potential for tax-free growth and significant retirement savings. However, it requires careful planning, a well-defined investment strategy, and a thorough understanding of the risks involved. By choosing a compatible custodian, diversifying your investments, adopting a long-term perspective, managing risk effectively, and staying informed about the cryptocurrency market, you can increase your chances of achieving your financial goals. Remember to always consult with a qualified financial advisor before making any investment decisions.