Unlocking Financial Freedom: Navigating American Income Streams

The pursuit of financial stability and prosperity is a universal aspiration, deeply ingrained in the American Dream. Understanding the diverse landscape of income sources in the United States is crucial for individuals seeking to improve their financial standing and build a secure future. Beyond the traditional 9-to-5 job, a plethora of opportunities exist, each with its own advantages and challenges. Let's delve into the prominent income streams that Americans utilize to generate wealth and achieve their financial goals.

The Cornerstone: Traditional Employment

For the majority of Americans, traditional employment remains the primary source of income. This encompasses a wide range of occupations, from entry-level positions to executive roles, across various industries. The appeal of traditional employment lies in its stability, predictability, and often, the provision of benefits such as health insurance, retirement plans, and paid time off. However, traditional employment can also present limitations in terms of earning potential and work-life balance. Salaries are typically fixed, and career advancement may be contingent on factors beyond individual performance.

Embracing Entrepreneurship: The Self-Employment Route

Self-employment, encompassing freelancing, independent contracting, and business ownership, offers an alternative path to income generation. The allure of self-employment lies in the autonomy it provides, allowing individuals to set their own hours, pursue their passions, and potentially earn significantly more than in a traditional job. The digital age has further fueled the growth of self-employment, with online platforms connecting freelancers and contractors with clients worldwide. However, self-employment also entails a higher degree of risk and responsibility. Individuals are responsible for managing their own finances, marketing their services, and securing clients. Income can be unpredictable, and benefits are typically not provided.

The Rise of the Gig Economy: Short-Term Opportunities

The gig economy has emerged as a significant force in the American workforce, offering short-term, project-based work opportunities. This includes driving for ride-sharing services, delivering food, and completing tasks on online platforms. The gig economy provides flexibility and accessibility, allowing individuals to supplement their income or pursue full-time work on a flexible schedule. However, gig workers often lack the benefits and protections afforded to traditional employees, such as minimum wage laws and unemployment insurance. Income can also be highly variable and dependent on factors such as demand and competition.

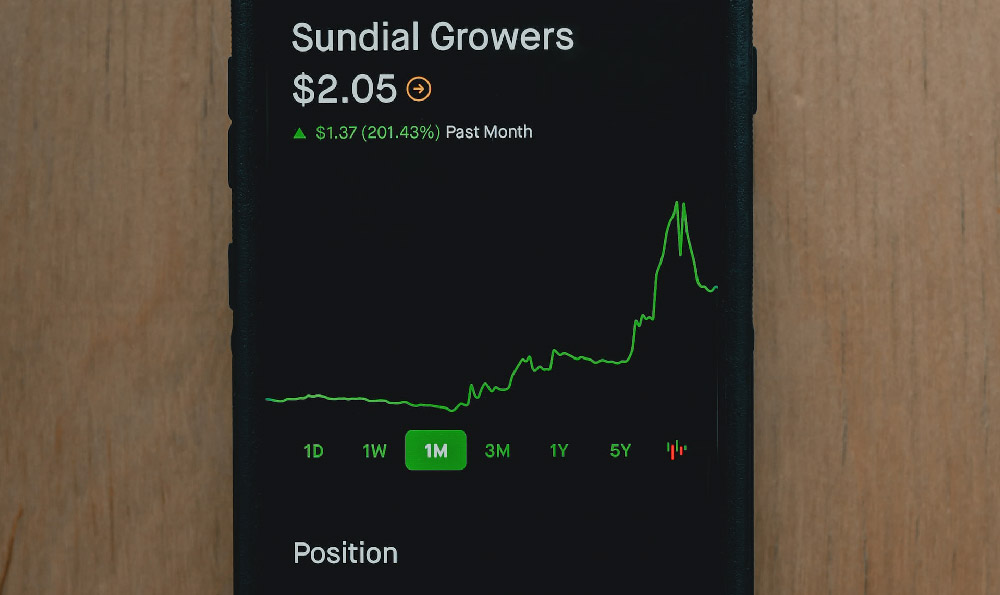

Investing for the Future: Passive Income Streams

Passive income, generated with minimal ongoing effort, is a coveted source of income for many Americans. This can include rental income from real estate, dividends from stocks, royalties from intellectual property, and earnings from online businesses. The beauty of passive income lies in its ability to generate wealth while freeing up time for other pursuits. However, generating passive income typically requires an initial investment of time, money, or effort. Real estate, for example, requires a significant capital outlay and ongoing maintenance. Stocks carry investment risk, and online businesses require time and effort to build.

Navigating the Complexities of Government Benefits

Government benefits, such as Social Security, unemployment insurance, and disability benefits, provide a safety net for Americans in need. These benefits are funded by taxes and are designed to provide income support during periods of unemployment, disability, or retirement. While government benefits can be a valuable source of income, they are often subject to eligibility requirements and may not provide a sufficient level of income to meet all needs.

Strategic Financial Planning: A Holistic Approach

Regardless of the income sources chosen, strategic financial planning is essential for achieving long-term financial security. This includes setting financial goals, creating a budget, managing debt, saving for retirement, and investing wisely. A financial advisor can provide valuable guidance and support in developing a personalized financial plan.

Mastering the Art of Budgeting

Budgeting is the cornerstone of sound financial management. It involves tracking income and expenses, identifying areas where spending can be reduced, and allocating funds towards savings and investments. A well-crafted budget provides clarity and control over finances, enabling individuals to make informed decisions and achieve their financial goals.

Conquering Debt: A Pathway to Financial Freedom

Debt can be a significant obstacle to financial success. High-interest debt, such as credit card debt, can quickly erode income and make it difficult to save and invest. Developing a debt repayment strategy, such as the debt snowball or debt avalanche method, can help individuals eliminate debt and free up cash flow.

Saving Wisely: Building a Financial Foundation

Saving is crucial for building a financial foundation and achieving long-term financial security. Setting up automatic transfers to savings accounts can make saving effortless. Consider contributing to retirement accounts, such as 401(k)s and IRAs, to take advantage of tax benefits and build a nest egg for the future.

Investing Strategically: Growing Your Wealth

Investing is a powerful tool for growing wealth over time. However, it is important to invest wisely and diversify investments to minimize risk. Consider consulting with a financial advisor to develop an investment strategy that aligns with your risk tolerance and financial goals. Explore various investment options, including stocks, bonds, mutual funds, and real estate.

In conclusion, the American income landscape is diverse and multifaceted, offering a range of opportunities for individuals to generate wealth and achieve financial security. By understanding the various income sources available, developing a strategic financial plan, and making informed decisions, Americans can unlock their financial potential and build a brighter future.