Virtual coin investment has become a critical component of modern financial portfolios, offering unique opportunities for wealth creation while demanding meticulous risk management. As the digital asset market evolves, understanding its dynamics is essential for both novice and experienced investors. Let's explore the nuanced relationship between market trends, technical indicators, and strategic decision-making in this domain.

Market Trends Shaping Virtual Coin Investments

The cryptocurrency landscape is influenced by a confluence of factors, from macroeconomic shifts to technological innovation. In recent years, the rise of decentralized finance (DeFi) and the adoption of blockchain technology by mainstream institutions have significantly altered investor behavior. Regulatory developments also play a pivotal role; for instance, the approval of Bitcoin ETFs in 2024 has driven institutional interest and increased market liquidity. Additionally, global events such as geopolitical tensions and supply chain disruptions often trigger volatility, highlighting the need for adaptability. Monitoring these trends enables investors to anticipate market movements and position their assets accordingly.

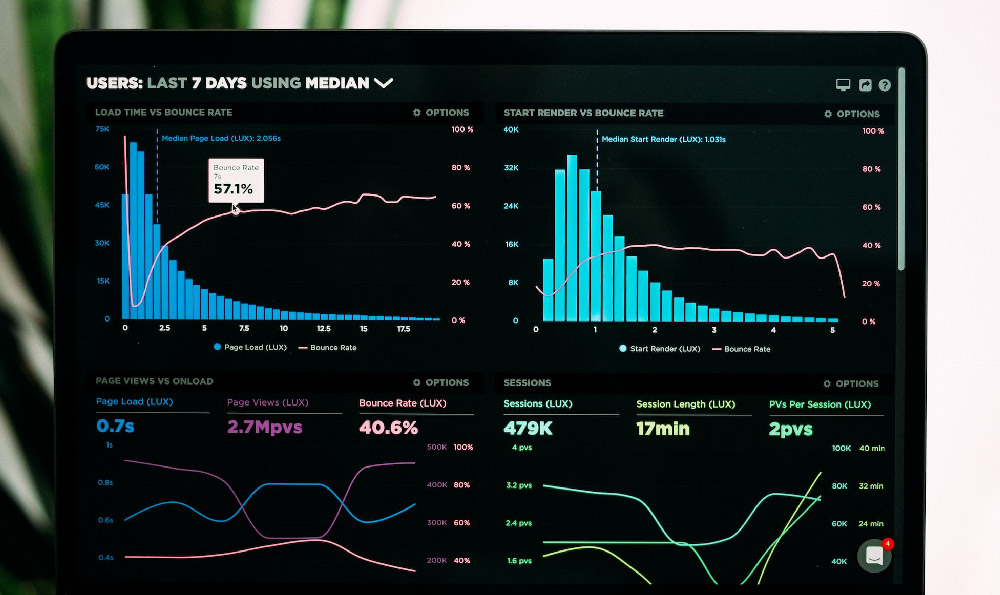

The Role of Technical Analysis in Strategic Decisions

Technical analysis remains a cornerstone for evaluating virtual coin performance. Key metrics like price action, volume, and chart patterns provide insights into market sentiment. For example, a bullish trend line breakout often signals a potential upward movement, while a bearish divergence in the Relative Strength Index (RSI) may foreshadow a downturn. Investors must also consider moving averages—such as the 50-day and 200-day lines—to identify support and resistance levels. However, technical indicators should not be viewed in isolation; their effectiveness is amplified when cross-referenced with fundamental analysis.

Balancing Risk and Reward in Virtual Coin Portfolios

Diversification is a fundamental principle in mitigating risks associated with virtual coin investments. Allocating funds across different asset classes—such as blue-chip cryptocurrencies, altcoins, and stablecoins—can reduce exposure to sudden market corrections. Additionally, implementing a stop-loss strategy ensures that losses are capped if prices retreat from key levels. Position sizing is another critical factor; limiting individual investments to a percentage of the total portfolio prevents overexposure to any single asset. Investors must also remain vigilant about market manipulation tactics, such as pump-and-dump schemes, which often target low-cap cryptocurrencies.

Long-Term vs. Short-Term Investment Approaches

The choice between long-term and short-term strategies hinges on investor goals and risk tolerance. Long-term investors often focus on the intrinsic value of projects, analyzing whitepapers and development roadmaps to identify sustainable growth. This approach aligns with the concept of "buy and hold," which has proven effective for major cryptocurrencies like Bitcoin. Short-term traders, on the other hand, capitalize on market fluctuations, using tools like Fibonacci retracements and candlestick patterns to execute precise trades. However, short-term strategies require disciplined risk management to avoid emotional decision-making.

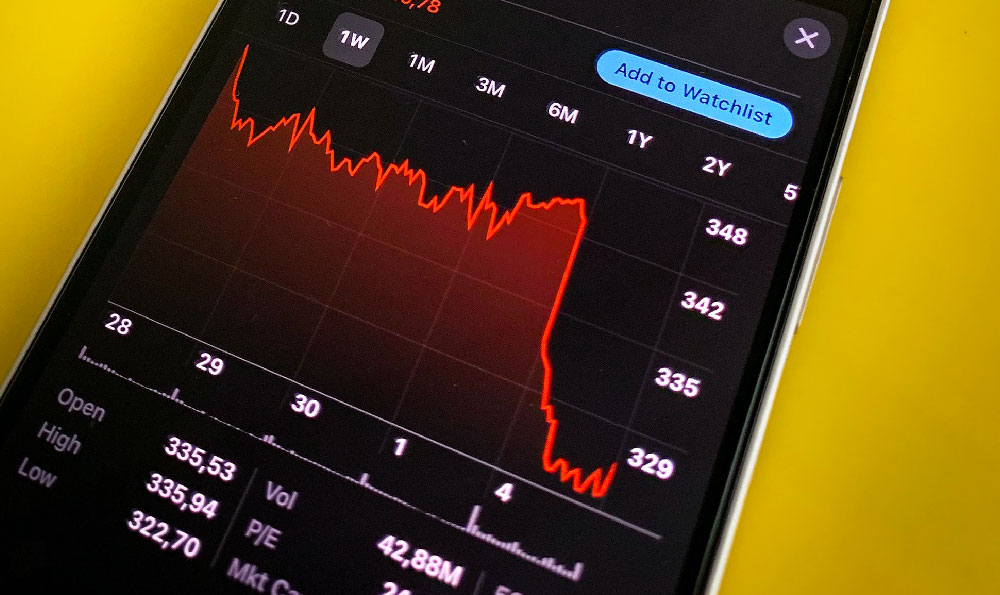

Staying Ahead of Market Volatility

Market volatility is a defining characteristic of virtual coin investments, necessitating a proactive approach. Investors should track macroeconomic indicators, such as inflation rates and interest changes, as these often influence cryptocurrency prices. Social media sentiment and news cycles also contribute to price swings, making real-time monitoring imperative. Strategies like dollar-cost averaging (DCA) can smooth out market fluctuations by investing a fixed amount regularly, while hedging techniques, such as using futures contracts, can protect against sudden price drops.

The Importance of Education and Due Diligence

Success in virtual coin investment is closely tied to continuous learning and thorough research. Understanding the fundamentals of a project, including its team, technology, and use case, is vital for identifying potential value. Investors should also verify the legitimacy of platforms and projects, avoiding scams or fraudulent schemes. Staying informed about regulatory updates ensures compliance and reduces legal risks. Engaging with community discussions and expert analyses provides a broader perspective, fostering well-informed decisions.

Avoiding Common Pitfalls in Virtual Coin Markets

The digital asset market is fraught with risks that demand vigilance. One prevalent trap is overtrading, which erodes profits through high fees and opportunity costs. Investors must resist the urge to chase quick gains, instead focusing on long-term value. Another common mistake is neglecting security measures; ensuring the use of hardware wallets and two-factor authentication (2FA) safeguards against cyber threats. Lastly, emotional decision-making can lead to erratic trades; maintaining a disciplined approach based on data rather than hype is crucial for sustained success.

Adapting to the Future of Finance

As the financial ecosystem continues to evolve, virtual coins will likely play an even more prominent role. Emerging technologies like CBDCs (central bank digital currencies) and the integration of AI in trading algorithms will redefine market dynamics. Investors should remain agile, adjusting their strategies to align with these changes while upholding core principles of risk management. The key to achieving long-term financial growth lies in combining strategic foresight with disciplined execution, ensuring that virtual coin investments are not just speculative but part of a robust, diversified approach.

By integrating these insights into their investment framework, individuals can navigate the complexities of virtual coin markets with confidence. The journey toward financial success requires not only an understanding of market trends and technical indicators but also a commitment to continual education and prudent risk management. As the digital asset landscape matures, those who adopt a strategic mindset will find themselves better positioned to capitalize on opportunities while safeguarding their wealth.