The realm of virtual currency investment is a landscape rife with both immense opportunity and considerable risk. Navigating this complex terrain requires a strategic mind, a keen understanding of market dynamics, and a healthy dose of prudence. Forget fleeting trends and get-rich-quick schemes; sustainable success hinges on a foundation of knowledge, discipline, and a long-term perspective. Let's delve into some key areas to help you potentially thrive in this volatile environment.

First, understanding the underlying technology is paramount. Blockchain, the decentralized ledger technology underpinning most cryptocurrencies, is not just a buzzword. It's the very infrastructure upon which these digital assets are built. Grasping its principles – immutability, transparency, and security – will allow you to discern genuine innovation from hype. Learn about different consensus mechanisms like Proof-of-Work (PoW) and Proof-of-Stake (PoS), as they heavily influence a cryptocurrency's energy consumption, scalability, and overall security. Don't invest blindly in something you don't fundamentally understand. Reputable resources like whitepapers, academic articles, and well-respected industry publications are your allies in this quest for knowledge.

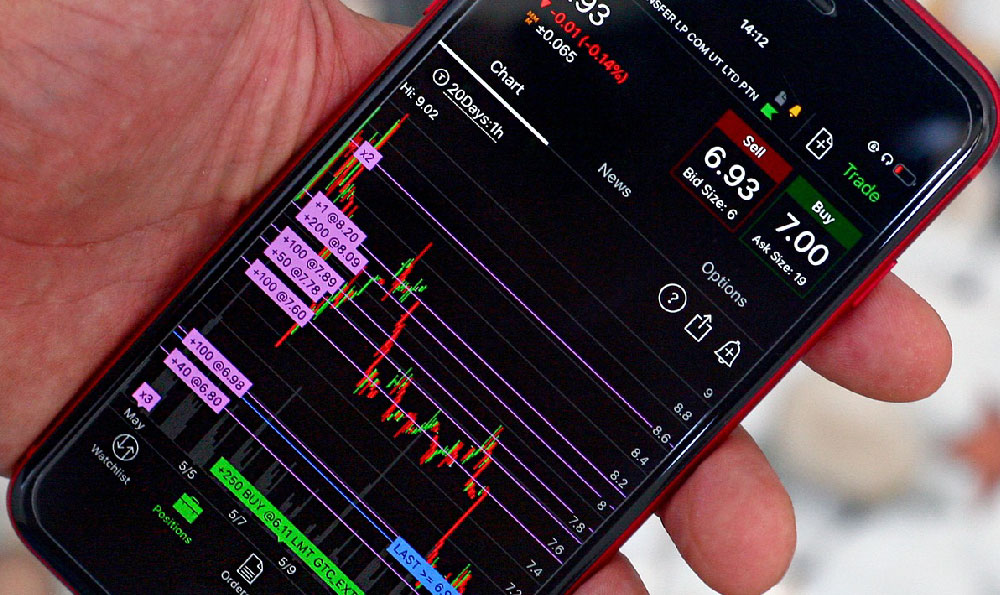

Next, dive deep into market analysis. Technical analysis involves scrutinizing historical price charts, trading volumes, and various technical indicators to identify potential entry and exit points. Learn to interpret candlestick patterns, moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). While technical analysis is not foolproof, it can provide valuable insights into market sentiment and potential price movements. Fundamental analysis, on the other hand, focuses on evaluating the intrinsic value of a cryptocurrency based on factors such as its underlying technology, team, adoption rate, market capitalization, and overall ecosystem. Is the project solving a real-world problem? Does it have a strong community and a dedicated development team? These are crucial questions to consider. A combination of both technical and fundamental analysis will provide a more comprehensive picture of a cryptocurrency's potential.

Diversification is your shield against volatility. Don't put all your eggs in one basket. Spread your investments across a range of cryptocurrencies with different market caps, use cases, and risk profiles. Consider allocating a portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum, which have a proven track record and higher liquidity. You can then allocate a smaller portion to altcoins with promising potential but also higher risk. Regularly rebalance your portfolio to maintain your desired asset allocation. This process involves selling some of your winning assets and buying more of your losing assets to ensure that your portfolio remains aligned with your risk tolerance and investment goals.

Developing a robust risk management strategy is non-negotiable. The cryptocurrency market is notorious for its volatility, and prices can fluctuate dramatically in short periods. Set realistic investment goals and stick to them. Don't chase after quick profits or succumb to FOMO (Fear Of Missing Out). Before investing in any cryptocurrency, determine the amount of money you are willing to lose without significantly impacting your financial well-being. This is your risk tolerance. Implement stop-loss orders to automatically sell your assets if they reach a certain price level, limiting your potential losses. Avoid using excessive leverage, which can magnify both your profits and your losses. Only invest what you can afford to lose.

Security is paramount in the digital world. Use strong, unique passwords for all your cryptocurrency accounts and enable two-factor authentication (2FA) wherever possible. Consider using a hardware wallet, which stores your private keys offline, providing an extra layer of security against hacking and theft. Be wary of phishing scams and never share your private keys with anyone. Regularly back up your wallet and keep your software up to date. Stay informed about the latest security threats and take proactive steps to protect your assets.

Beyond the individual cryptocurrency investments, consider exploring other avenues within the blockchain ecosystem. Decentralized Finance (DeFi) platforms offer opportunities to earn passive income through staking, lending, and yield farming. However, DeFi platforms also come with their own set of risks, including smart contract vulnerabilities and impermanent loss. Thoroughly research any DeFi platform before investing your funds. Non-Fungible Tokens (NFTs) have also gained significant popularity, representing unique digital assets such as artwork, collectibles, and virtual real estate. Investing in NFTs requires careful evaluation of the project, the artist, and the overall market demand.

Staying informed is a continuous process. The cryptocurrency market is constantly evolving, with new projects, technologies, and regulations emerging all the time. Subscribe to reputable news sources, follow industry experts on social media, and attend conferences and webinars to stay up-to-date on the latest developments. Be critical of the information you consume and always do your own research before making any investment decisions. Remember, knowledge is your most valuable asset in the world of cryptocurrency.

Finally, exercise patience and avoid emotional decision-making. The cryptocurrency market can be unpredictable, and there will be times when your investments decline in value. Don't panic sell during market downturns or make impulsive decisions based on fear or greed. Stick to your long-term investment strategy and focus on the fundamentals. Remember that investing in cryptocurrency is a marathon, not a sprint. With a well-thought-out plan, a disciplined approach, and a healthy dose of patience, you can potentially achieve your financial goals in this exciting and dynamic market.