Investing in the S&P 500 is often touted as a cornerstone of a well-diversified portfolio, and for good reason. It represents a significant slice of the American economy and offers exposure to some of the largest and most successful companies globally. Understanding the process of investing in the S&P 500 and evaluating whether it aligns with your individual financial goals and risk tolerance is crucial before taking the plunge.

The S&P 500 itself is an index, not a directly investable asset. You can't buy "the S&P 500" in the same way you'd purchase shares of Apple or Microsoft. Instead, you invest in instruments that track the performance of the index. The most common and efficient way to do this is through Exchange-Traded Funds (ETFs) and index mutual funds.

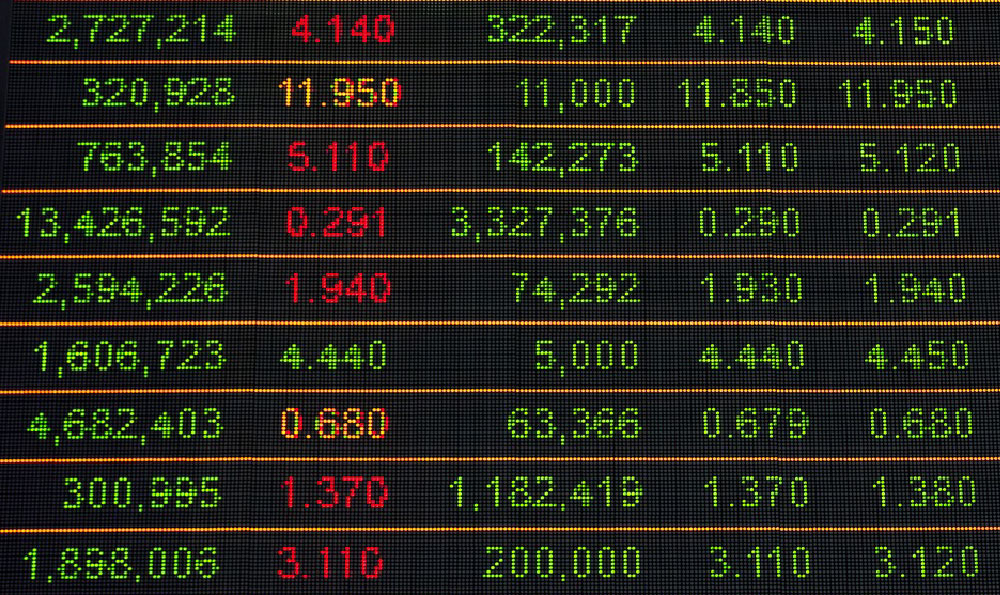

ETFs that track the S&P 500, such as SPY, IVV, and VOO, are designed to mirror the index's composition and performance. They hold shares of the same 500 companies, weighted in proportion to their market capitalization within the index. This replication allows the ETF's price to closely track the overall movement of the S&P 500. ETFs trade like stocks on exchanges, offering liquidity and intraday trading flexibility. They typically have low expense ratios, meaning the annual fee you pay to own the ETF is minimal, often less than 0.1%. This low cost is a significant advantage, as it minimizes the drag on your investment returns over the long term.

Index mutual funds are another avenue for investing in the S&P 500. Similar to ETFs, these funds hold a basket of stocks that represent the index. However, mutual funds are typically purchased and redeemed directly from the fund company at the end of the trading day. They may also have slightly higher expense ratios compared to ETFs, although many low-cost index mutual funds are available. One advantage of mutual funds, particularly within retirement accounts, is the ability to invest in fractional shares, allowing you to contribute specific dollar amounts regularly.

The process of investing is relatively straightforward. First, you need a brokerage account. Numerous online brokers offer access to ETFs and mutual funds. Research and choose a broker that suits your needs in terms of fees, platform usability, research tools, and customer service. Once your account is funded, you can search for S&P 500 tracking ETFs or index mutual funds using their ticker symbols or keywords. Before placing an order, carefully review the fund's prospectus, which outlines its investment objective, strategy, risks, and expenses. After confirming your order, you become a shareholder, indirectly owning a piece of the 500 largest publicly traded companies in the United States.

Dollar-Cost Averaging (DCA) is a popular strategy for investing in the S&P 500. DCA involves investing a fixed dollar amount at regular intervals, regardless of the market's ups and downs. This approach helps to mitigate the risk of investing a large sum at a market peak and allows you to potentially buy more shares when prices are lower. DCA is particularly well-suited for long-term investors who are less concerned with short-term market fluctuations and more focused on building wealth over time.

Whether investing in the S&P 500 is right for you depends on your individual circumstances and financial goals. It's crucial to assess your risk tolerance, investment timeline, and overall portfolio diversification needs.

The S&P 500 is generally considered a moderate-risk investment. While it offers the potential for long-term growth, it's also subject to market volatility. During economic downturns or periods of market uncertainty, the S&P 500 can experience significant declines. Therefore, it's essential to have a long-term investment horizon – typically five years or more – to allow for market fluctuations and potential recovery.

If you have a low risk tolerance or a short investment timeline, investing solely in the S&P 500 may not be the most appropriate strategy. Consider diversifying your portfolio with other asset classes, such as bonds, real estate, or international stocks, to reduce overall risk. A diversified portfolio can help cushion the impact of market volatility and provide a more stable return stream.

For younger investors with a longer time horizon, a higher allocation to the S&P 500 may be suitable, as they have more time to recover from potential market downturns. As you approach retirement or other financial goals, gradually reduce your exposure to the S&P 500 and increase your allocation to more conservative investments to preserve capital.

Another important consideration is diversification within your S&P 500 investment. While the S&P 500 represents a broad range of industries, it's still heavily weighted towards certain sectors, such as technology. To further diversify your portfolio, consider adding investments in small-cap stocks, international stocks, or specific sectors that are underrepresented in the S&P 500.

It's also wise to remember that past performance is not indicative of future results. While the S&P 500 has historically delivered strong returns, there's no guarantee that it will continue to do so in the future. Market conditions can change, and unforeseen events can impact the performance of the index. Therefore, it's essential to stay informed about market trends and economic developments and adjust your investment strategy accordingly.

Investing in the S&P 500 can be a powerful tool for building long-term wealth, but it's not a one-size-fits-all solution. By understanding the process, evaluating your risk tolerance, and considering your individual financial goals, you can make an informed decision about whether it's the right investment for you. Remember to diversify your portfolio, stay informed, and seek professional advice if needed. A well-thought-out investment strategy, coupled with patience and discipline, can help you achieve your financial objectives.