Bail bonds business model operates at the intersection of legal and financial systems, where the primary objective is to facilitate the release of individuals detained in courts by securing their appearance at future proceedings. Unlike traditional bank loans that require collateral and credit checks, bail bonds involve a unique arrangement where a third-party financial intermediary steps in to guarantee payment for the defendant’s bail. This model generates profit through a combination of fees, risk management strategies, and the dynamic nature of the legal justice system. The process begins with the defendant being arrested, which often results in a demand for a cash bail set by the court. If the defendant or their family cannot afford this amount, they turn to bail bond agents who act as guarantors, typically charging a non-refundable fee that constitutes a percentage of the total bail amount. The fee structure, often ranging from 10% to 15%, is a direct source of revenue for the business, but the profitability extends beyond this initial transaction.

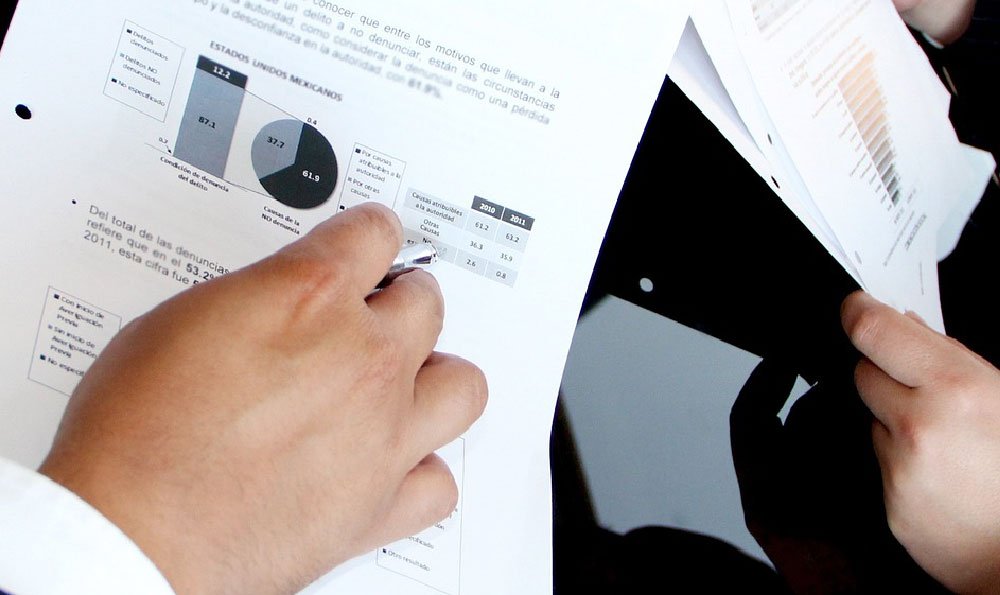

A critical component of the bail bonds model is the risk associated with the defendant’s failure to appear in court. Bail bond agents operate under the assumption that the defendant will attend all scheduled court hearings, but when they fail to do so, the agent becomes liable for repaying the full bail amount to the court. This creates a potential financial liability that necessitates robust risk assessment protocols. The agents analyze various factors, including the defendant’s criminal history, the severity of the charges, the bond amount, and the local legal environment. For instance, a defendant with a prior record of fleeing court appearances poses a higher risk, prompting the agent to charge a higher fee or impose stricter conditions. This risk-based pricing mechanism ensures that the agent’s profit aligns with the level of perceived risk, while also incentivizing defendants to comply with court mandates.

The profitability of bail bonds is further amplified by the liquidity of the business. Unlike long-term investments, bail bonds require the agent to reserve funds for short-term obligations, which can be challenging given the unpredictable nature of the legal process. To mitigate this, agencies often employ a network of co-signers or investors who pool resources to cover the bail amounts. This structure not only spreads the financial risk across multiple parties but also enables the agent to offer bail services even when the individual lacks the necessary capital. The funding from co-signers is typically structured as a loan, with the agent acting as the intermediary between the defendant and the financial backers. This creates a dual revenue stream: the agent earns a fee from the defendant while also receiving interest payments from the investors, ensuring a more stable financial foundation.

Moreover, the bail bonds industry thrives on the demand for immediate access to legal resources. In many jurisdictions, cash bail is mandatory for certain offenses, and the inability to pay can result in prolonged detention. This creates a niche market where bail bond agents provide a critical service by allowing individuals to secure their release quickly. The speed at which the agent can process the bail, often within 24 hours of the arrest, is an essential factor in the business model. This rapid response time is made possible by leveraging pre-established networks, streamlined underwriting processes, and partnerships with local law enforcement. The ability to meet this urgent need differentiates bail bonds agents from competitors and strengthens their position in the market.

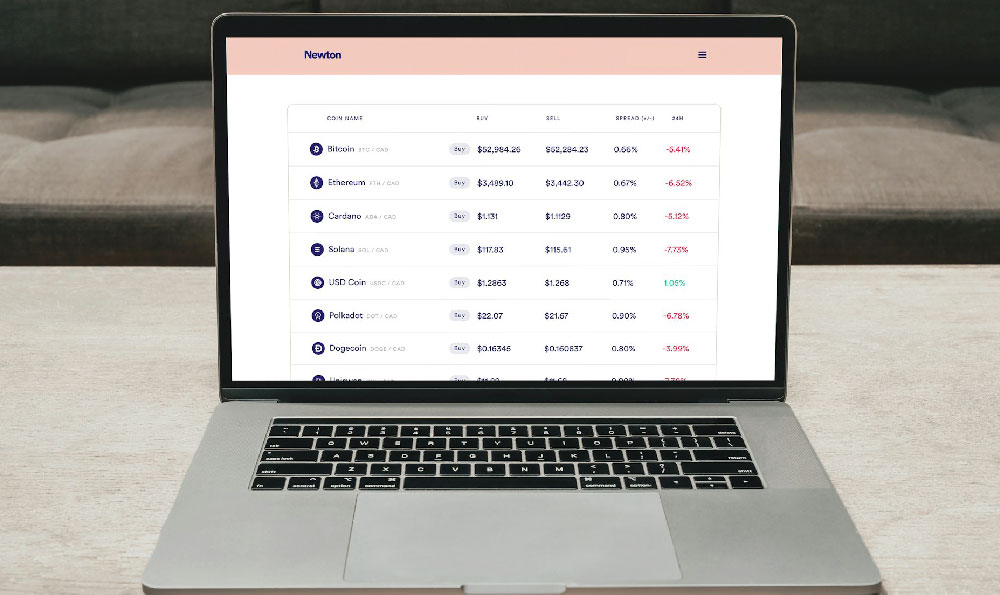

The profitability of the model also depends on operational efficiency. Agencies must maintain a balance between minimizing costs and maximizing fees while ensuring compliance with legal and ethical standards. This involves investing in technology to track court schedules, manage client data, and monitor the performance of bonded defendants. By utilizing digital tools, agencies can reduce administrative expenses, improve accuracy, and enhance customer service, all of which contribute to long-term profitability. Additionally, the presence of regulatory frameworks, such as the Truth in Lending Act (TILA), necessitates transparency in fee structures and payment terms, which can be a challenge for profit maximization. However, these regulations also create a level of trust between the agency and its clients, ensuring a sustainable business environment.

Another dimension of the bail bonds business model is its adaptability to changing legal and economic landscapes. For example, the introduction of electronic pretrial services in some states has reduced the reliance on cash bail, prompting bail bonds agents to diversify their offerings. This might involve expanding into other financial services or providing assistance to defendants with non-cash alternatives. Additionally, the rise of online platforms has enabled agents to reach a broader client base, increasing transaction volumes and revenue potential. These adaptations highlight the resilience of the bail bonds business, which continually evolves to align with regulatory shifts and market demands.

Ultimately, the bail bonds model generates profit through a blend of fixed fees, risk-based pricing, and operational efficiency. The industry’s survival hinges on its ability to navigate legal complexities, manage financial risks, and meet the immediate needs of individuals facing detention. While the business model may appear straightforward, its success is rooted in a multifaceted approach that balances financial gain with the ethical responsibility of ensuring justice. The profitability of this niche market underscores the importance of understanding the interplay between legal processes and financial strategies, revealing how a unique service can thrive in an intricate system.