Okay, here's an article on Blockchain Investment, focusing on how and where to begin, tailored for someone seeking expert advice:

Embarking on the realm of blockchain investment can feel akin to navigating uncharted waters. The potential for substantial returns is undeniable, but so too is the inherent risk. Success hinges on a well-informed strategy, a keen understanding of market dynamics, and a commitment to continuous learning. This exploration aims to equip you with the foundational knowledge needed to confidently begin your journey into blockchain investment.

Before diving into specific investment vehicles, it's paramount to grasp the underlying technology: blockchain. At its core, a blockchain is a decentralized, immutable ledger that records transactions across a network of computers. This distributed nature eliminates the need for a central authority, fostering transparency and security. Understanding concepts like consensus mechanisms (Proof-of-Work, Proof-of-Stake, etc.), smart contracts, and decentralized applications (dApps) is crucial. Numerous online resources, including reputable websites, academic papers, and introductory courses, can significantly bolster your understanding. A solid theoretical foundation will enable you to differentiate between promising projects and fleeting hype.

Once you possess a basic understanding of the technology, it's time to explore the diverse landscape of blockchain investments. Cryptocurrency is the most recognizable, encompassing Bitcoin, Ethereum, and countless altcoins. However, blockchain investment extends beyond purely digital currencies. Consider companies that are leveraging blockchain technology to improve supply chain management, enhance data security, or revolutionize financial services. Investing in these companies, either through publicly traded stocks or private equity opportunities, offers indirect exposure to the blockchain ecosystem without the direct volatility associated with cryptocurrencies.

Choosing the right investment vehicle is a critical decision that should align with your risk tolerance, investment horizon, and financial goals. If you're risk-averse, allocating a small portion of your portfolio to established cryptocurrencies like Bitcoin or Ethereum might be a suitable starting point. For those with a higher risk appetite, exploring promising altcoins or investing in blockchain-related startups could offer greater potential returns, but also carries a significantly higher risk of loss.

Regardless of your risk profile, diversification is key. Avoid putting all your eggs in one basket. Spreading your investments across different cryptocurrencies, blockchain companies, and asset classes can mitigate risk and increase your chances of overall success. Remember that the blockchain space is highly volatile, and even the most promising projects can experience significant downturns.

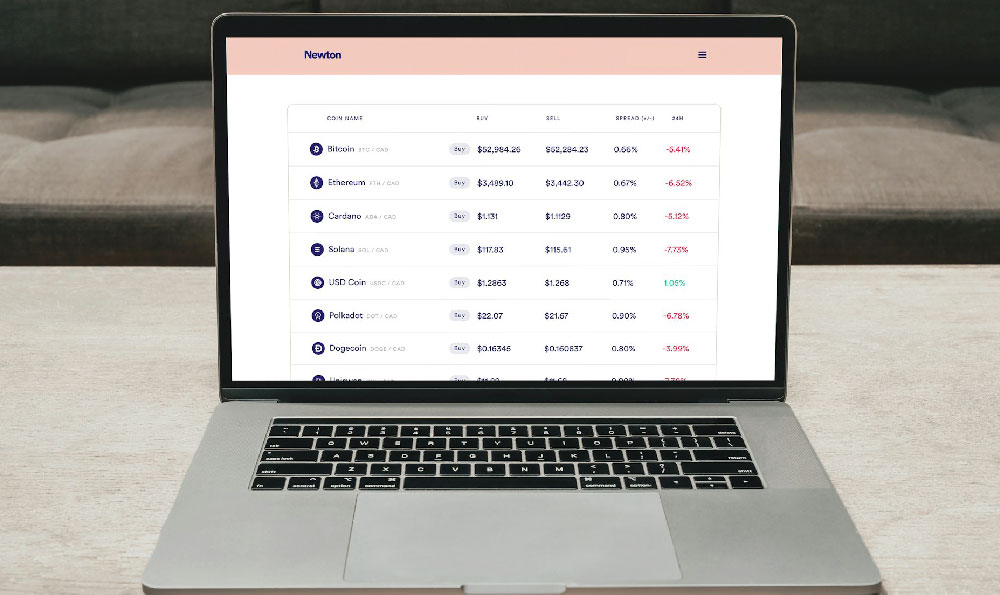

Where to actually begin your investment journey involves several steps. Firstly, select a reputable cryptocurrency exchange. Look for platforms with strong security measures, a wide range of supported cryptocurrencies, and reasonable transaction fees. Coinbase, Binance, Kraken, and Gemini are popular choices, but it's essential to research and compare different exchanges before making a decision. Carefully review the platform's terms of service, security protocols, and customer support options.

Once you've chosen an exchange, you'll need to create an account and complete the necessary Know Your Customer (KYC) verification process. This usually involves providing personal information, such as your name, address, and identification documents. KYC regulations are in place to prevent fraud and money laundering, and they are a necessary step for accessing most reputable exchanges.

After your account is verified, you can deposit funds using a variety of methods, including bank transfers, credit cards, and other cryptocurrencies. Be mindful of any deposit or withdrawal fees that may apply. Once your funds are deposited, you can begin trading cryptocurrencies.

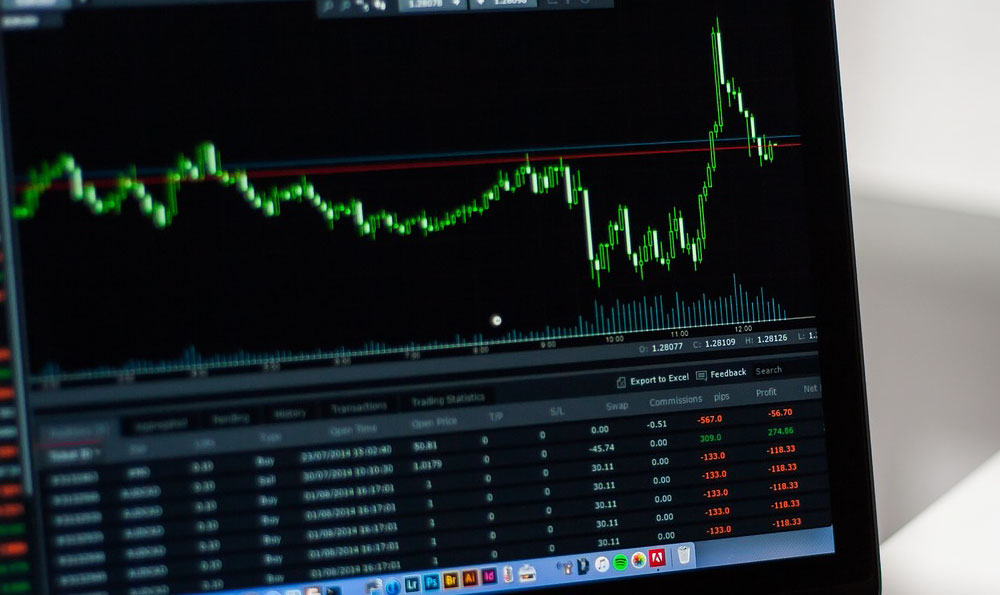

Before making any trades, it's crucial to conduct thorough research on the specific cryptocurrencies you're interested in. Understand the project's goals, its underlying technology, its team, its market capitalization, and its potential competitors. Read whitepapers, analyze market charts, and follow reputable news sources to stay informed about the latest developments.

Employing risk management techniques is paramount to safeguarding your capital. Set stop-loss orders to limit potential losses, take profits when your investment reaches a desired level, and avoid emotional trading. The cryptocurrency market is known for its volatility, and it's easy to get caught up in the hype or fear. Stick to your pre-defined investment strategy and avoid making impulsive decisions based on short-term market fluctuations.

Beyond direct cryptocurrency investments, consider exploring other avenues within the blockchain space. Decentralized finance (DeFi) offers opportunities to earn interest on your cryptocurrency holdings through lending, staking, and yield farming. However, DeFi platforms also carry significant risks, including smart contract vulnerabilities and impermanent loss. Thoroughly research any DeFi protocol before investing and understand the associated risks.

Non-fungible tokens (NFTs) represent another emerging area within the blockchain ecosystem. NFTs are unique digital assets that can represent ownership of various items, such as artwork, collectibles, and virtual land. The NFT market has experienced significant growth in recent years, but it's also characterized by high volatility and speculative bubbles. Exercise caution when investing in NFTs and only invest what you can afford to lose.

Finally, remain vigilant against scams and fraudulent schemes. The blockchain space is rife with scams, including pump-and-dump schemes, phishing attacks, and fake ICOs (Initial Coin Offerings). Be wary of projects that promise unrealistic returns or that pressure you to invest quickly. Always do your own research and never invest in something you don't fully understand. Verify the legitimacy of any project before investing and be cautious of unsolicited investment advice.

Investing in blockchain technologies presents a unique opportunity for financial growth, but it requires a measured approach. By educating yourself, diversifying your portfolio, employing risk management techniques, and staying informed about the latest developments, you can navigate the complexities of the blockchain space and position yourself for long-term success. Remember that investing involves risk, and there are no guarantees of profit. Always invest responsibly and only invest what you can afford to lose.